BRADENTON, Fla. — Orange County, Fla., on Tuesday plans to take bids for $116.8 million of taxable and tax-exempt sales tax refunding bonds.

Proceeds will be used to refund all of the outstanding Series 1999 and Series 2002B sales tax bonds.

The 2012 bonds will be sold in two series without extension of maturities.

The bonds are secured by a pledge and lien on Orange County’s portion of a local government half-cent sales tax.

About $18.8 million of Series A taxable bonds are expected to achieve an estimated present-value savings of $1.5 million, or 5.5%.

They will have maturities from 2013 to 2018, and are not subject to redemption prior to maturity.

The Series B bonds consisting of $97.9 million of tax-exempt bonds are estimated to achieve $5.2 million or 5% of present-value savings.

Bidders can combine two or more maturities into term bonds.

The tax-exempt piece will have large-block size maturities from 2025 to 2032, a feature that should appeal to many investors, according to David Moore, a managing director at Public Financial Management Inc., the county’s financial advisor.

The bonds are rated AA-plus by Fitch Ratings, Aa3 by Moody’s Investors Service and AA by Standard & Poor’s.

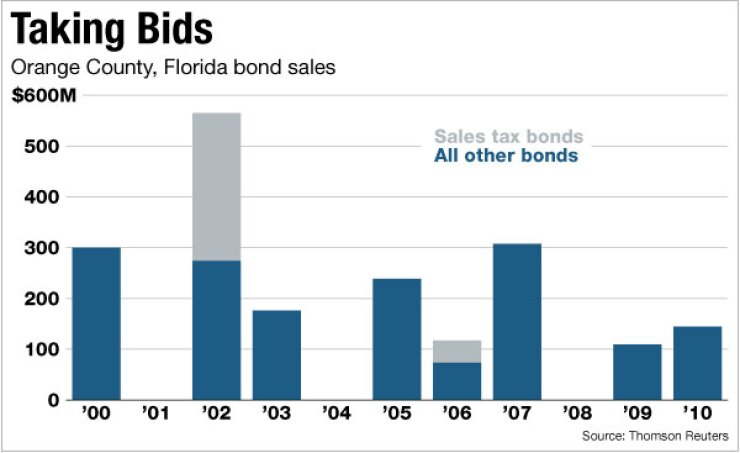

Orange County, home to mega-theme parks like Walt Disney World and Sea World, has not been in the bond market since 2010 and last sold sales tax bonds in 2006, according to Thomson Reuters.

Moore said investor should take note of the county’s “vibrant” economy, which is supported “by the fact that sales tax revenue collections have grown each year since 2009 while many other communities have seen flat or decreasing collections.”

The bonds have a debt-service coverage ratio of more than 4.75 times, he said.

If market conditions are favorable, the county plans to be back in the market this fall to currently refund its 2002A sales tax revenue refunding bonds.

Orange County, in central Florida, has a population of 1.1 million people.

The county seat is Orlando.

Though the tourism and leisure sectors are major components of the local economy, the area has a growing health care and education sector that includes high-wage medical research and biotechnology, according to Fitch analyst Barbara Ruth Rosenberg.

Employment in the region is improving.

“The county maintains ample general fund and other tax-supported reserves, even after planned drawdowns to fund capital needs,” Rosenberg said. “A low and stable tax rate provides the county with significant revenue-raising capabilities.”

PFM is financial advisor for two Florida school districts that also will be in the market this week.

The Palm Beach County School Board on Tuesday will price $20 million of refunding certificates of participation with Morgan Stanley as the sole book-runner.

Estimated present-value savings is $1 million or 4.75%.

The Palm Beach COPs are rated AA-minus by Fitch and Aa3 by Moody’s.

Standard & Poor’s rating was not available at press time.

On Wednesday, the Broward County School Board plans to sell $269 million of refunding COPs with Bank of America Merrill as the book-runner of the six-member syndicate.

The refunding is estimated to capture savings of $13 million or 4.5%.

Broward’s COPs are rated A-plus by Fitch and Aa3 by Moody’s. Standard & Poor’s rating was not available.

Other underwriters on the Broward deal are Citi, JPMorgan, Morgan Stanley, Raymond James & Associates Inc. and Rice Financial Products Co.