Gov. Lincoln Chafee has fired the first shot in the latest battle over pension overhaul in Rhode Island.

The message from Chafee and several Rhode Island mayors Thursday was loud and clear: cities and towns need relief.

“The time of urgency has arrived,” said Chafee, flanked by several mayors in Pawtucket, as he introduced a legislative package intended to give local communities more power to cut pension benefits.

His legislation parallels last year’s successful push to overhaul public-employee pensions statewide.

As he did last year, Chafee can expect union pushback and lawmaker skepticism.

“Game on,” said workout specialist William Brandt, president and chief executive of Development Specialists Inc. and chairman of the Illinois Finance Authority.

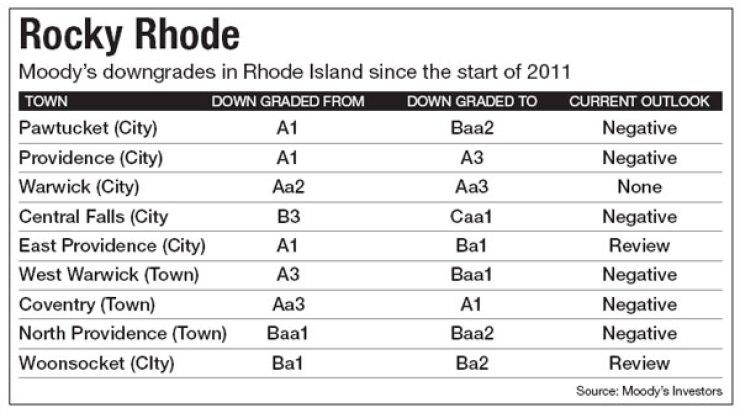

Chafee’s most recent move came amid a tumultuous week in the nation’s smallest state. Fitch Ratings dropped the general obligation bond rating of capital city Providence three notches to BBB from A, and cash-strapped Woonsocket weighed closing schools in April. Moody’s Investors Service Friday placed Woonsocket’s already speculative Ba2 rating on watch for downgrade.

In bankrupt Central Falls, state-appointed receiver Robert Flanders called for a charter review commission with an eye on replacing an elected mayor with an appointed city manager.

Eight Rhode Island communities received downgrades last year from Moody’s. One of them, East Providence, is under the oversight of a budget review commission, the second tier of the three-step state intervention process, one step short of receivership.

Chafee, an independent and former Republican, wants to create a “highly distressed community” designation to allow cities with critically underfunded retirement plans to suspend cost-of-living pension increases, or COLAs.

To qualify as highly distressed, a city would have to be in the lowest 20% statewide in all four of the following criteria: percent of tax levy to full value of property; per-capita income; percent of personal income to full value of property; and per capita full value of property.

Providence, Pawtucket, Woonsocket and West Warwick would now qualify as such, according to Chafee. These communities would get relief from mandates and binding arbitration, and could freeze annual salary increases for teachers and alter medical benefits.

Chafee also proposed a new cap on pensions for employees who retire with a work-related disability and called for local pension plans not to exceed state plans in generosity.

The Democratic-controlled state Legislature must approve the package. Its leaders, Senate President M. Teresa Paiva Weed and House Speaker Gordon Fox, said cautiously in a statement late Thursday that they look forward to scrutiny and debate over the matter.

The mayors, however, were resolute: They say they need help.

“Finding the best way forward is a responsibility for each municipality to shoulder in its own way. But we can’t do it alone,” said Pawtucket Mayor Donald Grebien.

From 2006 to 2010, he said, Rhode Island cut more than $190 million in local support. During that time, according to Grebien, Pawtucket alone lost $21 million in state aid.

Natalie Cohen, a senior analyst at Wells Fargo Securities, agreed that localities are vulnerable. “If you’re the local level you take it on the chin in this kind of environment,” she said.

Providence wanted to discontinue health insurance payments and move coverage for retirees aged 65 and older to the federal Medicare program, but a court injunction has barred the city from doing so. Providence, looking to save $8 million through the move, intends to appeal.

“Cities and towns must make tough, structural changes to strengthen our entire state,” Mayor Angel Taveras said.

Rhode Island late last year passed the Rhode Island Retirement Security Act, which creates a hybrid plan for state employees that merges conventional public defined-benefit pension plans with 401(k)-style plans, among other changes. But unfunded pension liabilities is still a concern at the local level.

Cohen said that only recently has the plight of local pension plans appeared on the radar.

“In Rhode Island and elsewhere, most of the emphasis has been on the state plans,” she said. “They’re bigger and more prominent. But there are also more than 3,000 locally managed plans across the country. Some are fine, but others are really underfunded, and Providence is in that category.”

Brandt expects a middle ground in Rhode Island, probably after a bruising fight.

“The days of an easy cave-in are finally over. In the end, neither labor nor the state will be able to impose its will. Chafee is seen as a pretty fair guy. The end result will be neither his nor labor’s plan,” Brandt said. “These are political questions, even though some people in our industry like to think they’re only economic questions.”

Fitch, announcing its downgrade of Providence, cited the city’s inability to alter pension-related commitments. “The city has growing and severely underfunded pension and other post-retirement benefit [OPEB] liabilities,” the rating agency said.

The state capital passed a fiscal 2012 budget that eliminated a $110 million structural deficit, but certain budget items have not materialized, leaving the city with an estimated $22 million hole, about 3.6% of its general and school fund budget.

“After three years of operating deficits, the city’s cash position is very weak and the current budget gap presents cash-flow problems during the final two months of the fiscal year,” according to Fitch.

Standard & Poor’s assigns an underlying BBB-plus rating to Providence general obligation bonds, with a negative outlook. Moody’s assigns an A3 rating.

Taveras also wants more payments in lieu of taxes, or PILOTS, from tax-exempt institutions, notably Brown University of the Ivy League.

While smaller Johnson & Wales University said last month it would triple its PILOTS to $6.4 million, the city is still looking for more money out of Brown and three hospitals.

Chafee, meanwhile, will continue his push for state-level help.

“Only when we have fixed the structure and workings of state and municipal governments in Rhode Island will we revitalize our economy and create the jobs and opportunities we need,” he said.

All three of the major credit rating agencies rate Rhode Island’s general obligation bonds double-A.

In Central Falls, Flanders last week ordered a nine-member commission of citizen volunteers to propose amendments to the city charter. Recommendations could include changes in the organizational structure of city government, most notably the replacement of the mayor’s position.

Flanders, shortly after his appointment and armed with enabling state legislation, stripped Mayor Charles Moreau and the City Council of their operational powers, reducing their roles to advisors and slicing their salaries.

Speaking to the Associated Press last week, Moreau said eliminating the mayor’s position was “fundamentally wrong” and he would fight the move.

“There is life after receivership,” Flanders said. “It is important to know what kinds of changes, if any, people would like to see in their government so that the city remains on solid financial footing during the decades to come.”

The one-square-mile city, which has a population of 19,000, faces unfunded pension and benefits obligations of $80 million. Brandt said Rhode Island’s smallness, with a less diverse population and economy, has triggered some outside-the-box thinking.

“They’ve been engaging in more draconian moves,” he said. “The Central Falls receiver can say 'Look, let’s bag the mayor and get a city manager in here.’ ”

According to Brandt, the learning curve for governments is leveling off.

“I’ve surveyed the situation for some time and governments are getting their acts together,” he said. “Are they all the best ideas? No, but at least you have discussion over some of the proposals, some of which you wince at, others you want to consider.”

Cohen acknowledged that a turnaround in Rhode Island will be difficult.

“There have to be tough negotiations on all sides,” she said. “The way you end it, you recognize what the issues are and you tackle them one by one.”