SAN FRANCISCO — Oregon may have to give a cash infusion to a struggling alternative energy program with $229 million of debt outstanding to pay debt service backed with the state’s general obligation pledge.

The State Debt Policy Advisory Commission said in a report earlier this month that a state GO bond program for alternative energy projects may soon need state support to make bond payments.

The review found the Oregon Department of Energy may need between $2 million and $5 million a year from the general fund to cover GO bond payments starting in fiscal 2015 through fiscal 2019 because of delinquent loans.

The program “only has $2 million in net assets, so there is far less room for error going forward,” James Sinks, spokesman for the treasurer’s office, said in an email. He added that the program’s cash will be drawn down as it makes debt service payments on delinquent and defaulted loans.

The bond program was designed to be self-sustaining, but because the bonds are backed by the state GO pledge, Oregon’s general fund will be on the hook to help make up the debt service shortfall.

The small-scale energy loan program was established in 1980 to provide low-interest loans to individuals, companies, state agencies, local governments and nonprofits for energy efficiency and renewable energy projects.

Its reserves for covering loan losses have declined due to a rise in large, delinquent loans. An $18 million write-off and default on a loan to an ethanol facility in 2009 helped spur the decline.

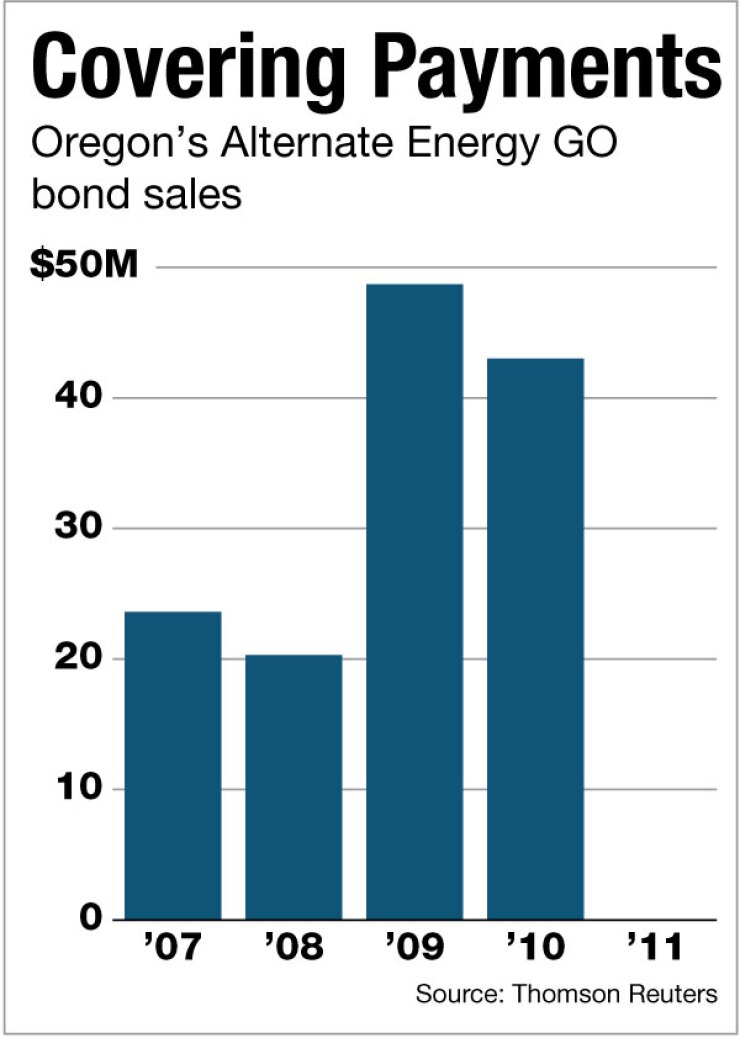

The alternative energy program has issued $574 million of loans as of the end of last year, with $205 million outstanding. The state has $229 million of bonds outstanding, issued from 1998 through 2011, to support the program. Since the start of the program, 3.53% of all loans have been written off.

The commission said the governor and lawmakers should step up their monitoring and controls of the state energy loan program.

The panel, chaired by Treasurer Ted Wheeler, also reported that declines in projected general fund revenue will likely lead Oregon to temporarily exceed its target of 5% of general fund revenue dedicated to annual debt service by the end of fiscal 2013. As a result, the commission recommended that the legislature and governor refrain from issuing any new general fund-supported debt for the rest of the state’s two-year budget cycle.

Oregon’s outstanding long-term GO appropriation and revenue bond debt was $11.3 billion as of June 30, 2011, down slightly from fiscal 2010. The state’s GOs are rated AA-plus by Standard & Poor’s and Fitch Ratings, and Aa1 by Moody’s Investors Service.