Through Wednesday, the municipal bond market held to the script drafted for early January 2012.

Loosely, it read as follows: high investor demand, little issuance, large muni bond mutual fund inflows, and a rally that pushes yields to record lows. Given the script, Thursday’s session marked a sudden departure, and for some, a welcome break.

By Wednesday’s close, muni yields had outperformed those of Treasuries by rallying four to five basis points on the intermediate and long ends of the curve throughout the holiday-shortened week. Meanwhile, equivalent Treasury yields backed up three to four basis points.

On Thursday, munis in the secondary sold off and prices tanked, giving up all of the week’s gains. The triple-A 10-year muni yield rose seven basis points on the day’s session to 1.74%, according to the Municipal Market Data scale, while the 30-year jumped 10 basis points to 3.25%.

Those yields are still incredibly low by any standard.

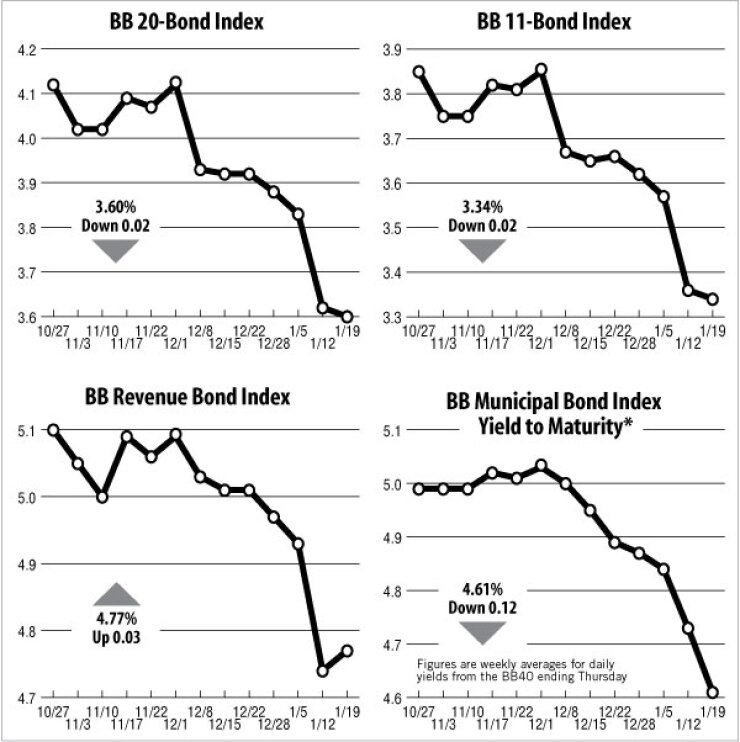

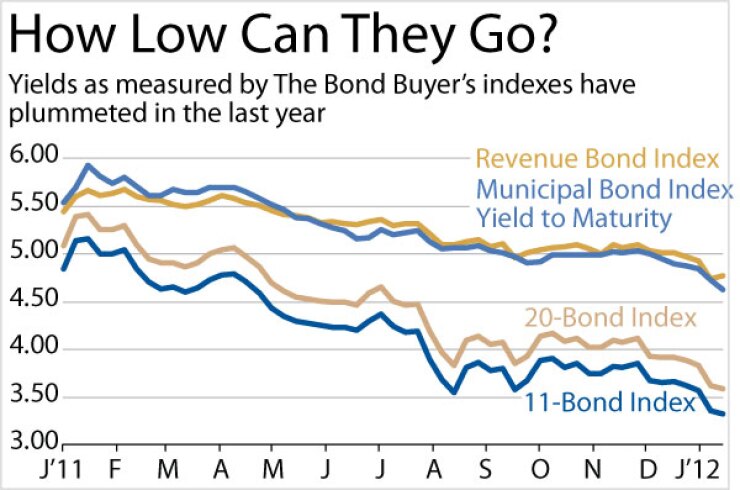

Despite the day’s sell-off, the 11- and 20-bond indexes remained at levels that haven’t seen in almost 45 years. The Bond Buyer’s 20-bond general obligation index of 20-year GO yields declined two basis points this week to 3.60%, its lowest level since April 13, 1967, when it was 3.54%.

The 11-bond GO index of higher-grade 20-year GO yields also dropped two basis points this week, to 3.34%. That marks its lowest level since Feb. 9, 1967, when it was 3.33%.

The yield on the Treasury’s 10-year note rose six basis points this week to 1.99%, but remained below its 2.00% level from two weeks ago. The yield on the 30-year Treasury gained eight basis points this week to 3.05%. But it remained below its 3.06% level from two weeks ago.

On Thursday morning, Chris Ryon, a co-portfolio manager at Thornburg Investment Management, noticed some early data indicating that the market was heading for a turn. He also saw an uptick in selling activity. “It’s good that the market rebalances and gets back to equilibrium,” Ryon said of the pause in the rally.

Muni yields have been rallying since Jan. 3. And before Thursday’s session, 10- and 30-year yields saw record-breaking days over the prior six trading sessions.

The ingredients were in place for such a rally, said John Mousseau, a portfolio manager with Cumberland Advisors. By November, muni bond fund flows had decisively turned a corner to strong inflows, ratios measuring muni yields compared to Treasuries jumped into extremely cheap territory, and finally the credit story — of rising municipal tax receipts — continued to improve noticeably.

“So, you’ve set the fire with those factors, and now you just need the match,” Mousseau said. “And the match is all the reinvestment money you have at year end.”

The revenue bond index, which measures 30-year revenue bond yields, increased three basis points this week to 4.77%. But it remained below its 4.93% level from two weeks ago.

The Bond Buyer’s one-year note index, which is based on one-year GO note yields, declined one basis point this week to an all-time low of 0.24%. The index began in July 1989.

The weekly average yield to maturity of The Bond Buyer muni bond index, which is based on 40 long-term bond prices, declined 12 basis points this week to 4.61%. That is the lowest weekly average for the yield to maturity since the week ended May 10, 2007, when it was 4.60%.