The volume of long-term municipal bonds in May heavily outweighed that of the same month in 2011, continuing an upward trend from last year’s reduced numbers.

Last month saw $33.38 billion in new issuance on 1,320 issues. That’s an increase of 56% from the same period in 2011, when the market saw $21.39 billion on 985 deals.

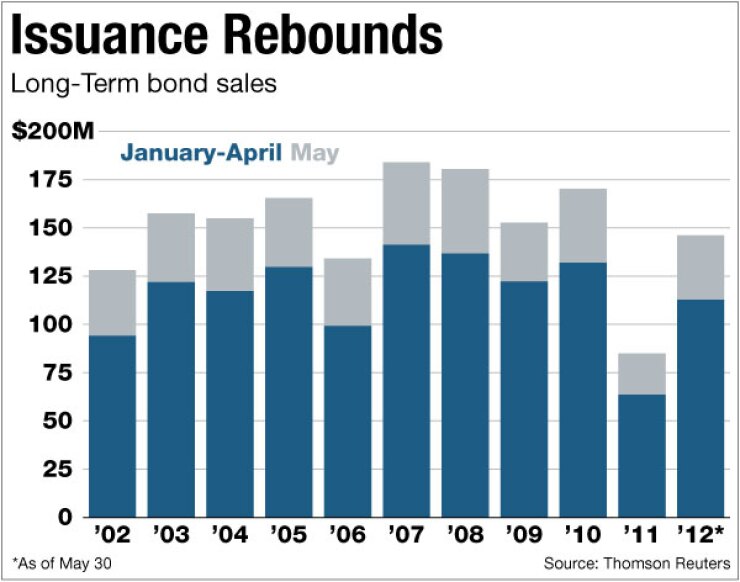

The market also has seen a 72% increase in total long-term volume over the first five months of 2011, according to Thomson Reuters numbers. That breaks down to $146.1 billion on 5,522 issues, against $85 billion on 3,665 deals.

Refundings levels have been strong all year. They represented $13.92 billion on 547 issues in May. That compares to $5.63 billion on 269 deals in May 2011, an increase of 147%.

For the year to date, refunding deals were up 155%, with $63.51 billion from 2,882 issues, a jump from $24.92 billion via 1,116 deals over the first five months of 2011.

The perpetuation of historically low yields and strong demand continues to make refundings a popular option for issuers, according to Bill Walsh, president of New Jersey-based wealth manager Hennion & Walsh.

“As long as both of those factors are there, you’re going to see these refundings,” he said. “The end-of-the-world mentality has waned. So, issuers are comfortable bringing [refunding] deals.”

The refundings should continue, said Paul Montaquila, vice president of fixed income for San Francisco-based Bank of the West.

“There’s no reason to believe these numbers don’t continue, and we see an enormous amount of refinancings in the second half of the year,” he said. “Couple that with the fact that we’re out of the woods, as far as negativity goes, and where else are you going to go? You may be creating a really good platform for munis for the second half of this year.”

New-money deals are still up for the month and the year to date, but not by much. For May, new-money issues climbed 21%; they rose 14% for the year to date.

Within the market’s larger issuing sectors, housing, utilities and general purpose bonds saw the biggest increases. Housing racked up $1.45 billion on 37 issues in May, compared with $504 million on 27 issues in the same period, or a 187% rise.

Utility bond issuance increased 165% in May compared with the same period a year ago. That translates into $5.45 billion on 190 deals, up from $2.06 billion on 118 deals last May.

General purpose bonds in May totaled $9.49 billion on 388 deals. That’s up considerably from the $5.25 billion on 264 issues over the same period one year earlier, an 81% increase.

For the year to date, the muni market’s largest sectors — education, utilities, transportation and general purpose — saw increases over the same period in 2011 of 59%, 152%, 79% and 77%, respectively.

Tax-exempt paper also increased last month by 65%. Issuance jumped to $30.79 billion on 1,207 deals, against $18.66 billion on 876 deals in May 2011.

On the other hand, taxable volume slipped 8% in May and has fallen 27% year-to-date.

Last month, just $2.02 billion made it to market, compared with almost $2.20 billion a year ago.

Negotiated deals dwarfed competitive deals by more than three times last month, even though both categories saw solid increases in volume over the period.

Negotiated deals rose to $25.71 billion on 801 deals last month, compared with $15.93 billion in May 2011.

Competitive issues managed $7.58 billion on 512 deals in May, versus $4.37 billion on 371 deals a year earlier.

Revenue and general obligation bonds also saw increases in May of around 55%. For revenue bonds, that translates into $20.06 billion on 445 issues, against $12.77 billion on 311 deals.

GOs, meanwhile, saw $13.32 billion on 875 issues in May, compared with $8.62 billion on 674 deals a year ago.

Among municipalities, the largest issuers to see gains were state governments, cities and towns, and local authorities.

Comparing May 2012 with the same period one year earlier, state government bond issuance rose 127%, cities and towns climbed 169%, and local authorities increased 58%.

Issuers in California ranked first among states with the highest amount of bonds floated in 2012 so far. The Golden State, ranked second through the first five months of 2011, saw issuance rise 160%.

California issued $19.27 billion on 289 deals from January through May, compared with $7.41 billion on 295 issues over the same period last year. If the state could just balance its books, it would issue more than $40 billion, Bank of the West’s Montaquila said.

“Historically, when the state issues a GO, it can be $1-to-$2 billion in [revenue anticipation notes], and up to $8-to-$10 billion in GOs,” he said. “Ideally, that’s what the state would like to do. But by law, they can’t issue without a balanced budget.”

Issuers from New York swapped places with their California brethren.

The second-ranked Empire State saw issuance year-to-date rise 73%, to $15.94 billion on 396 issues from $9.24 billion on 206 deals over the same period a year ago.

Issuers from Texas leapfrogged Illinois for third place in deals floated year-to-date from the same periods one year earlier.

The Lone Star State issued $13.18 billion on 545 deals for the first five months of 2012, a near 100% increase. That compares with almost $6.60 billion on 335 issues a year ago.

Illinois issuers’ volume remained pretty much flat year-over-year through the first five months. The state issued $6.98 billion on 255 deals in the first five months of 2012, against $6.95 billion on 186 deals over the same period in 2011.

Puerto Rico rounded out the top five through the first five months of 2012 over the same period a year earlier, when it ranked 16th.

It issued $6.48 billion on six deals through May this year, compared with $1.74 billion on six deals over the same period in 2011 — a 273% increase.

Just one deal of more than $1 billion reached the primary market in May as Illinois issued about $1.8 billion of GOs on the first day of the month.

The state boasted two of the five biggest deals by issuers hailing from within its borders.

A New York City deal followed Illinois with almost $950 million of GOs. Louisiana took third place with an $803 million issue of street and highway refunding bonds.