The Massachusetts Water Pollution Abatement Trust on Tuesday held a retail period for $242 million of state revolving fund bonds.

The trust, established in 1989 under the federal Clean Water Act and which the Massachusetts treasurer’s office oversees, issues bonds to provide subsidized financing to municipalities statewide for its water pollution abatement and drinking water projects.

Sale proceeds will finance or refinance costs of certain projects for governmental units or other eligible borrowers.

The negotiated sale included $146 million of Subseries 16B bonds. Final maturity of the bonds will be in 2042. Another $96 million was offered as Series 2012B refunding bonds.

On Thursday the trust will offer $119.8 million of bonds through competitive bid.

According to a Treasury spokeswoman, the trust received $58.9 million in orders on Tuesday, about 40% of the total amount of bonds offered to retail investors.

Sources of repayment, Treasury officials say, include loan repayments, commonwealth assistance payments, the pool program reserve fund and the deficiency fund.

Jefferies & Co. is the senior manager. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo PC is bond counsel and Edwards Wildman Palmer LLP is program counsel. Nixon Peabody LLP is representing the underwriters.

All three major rating agencies assign a triple-A to the tax-exempt bonds.

Fitch Ratings said collateralization primarily from pledged reserves allows the state revolving fund program to withstand defaults during any four-year period of the bonds’ life.

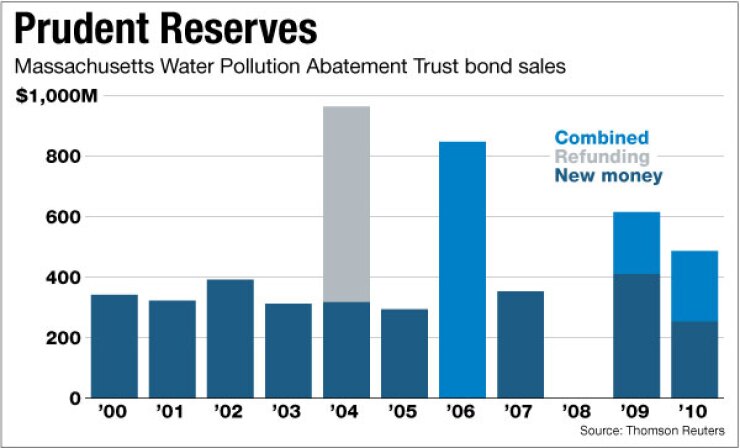

Fitch also praised the trust for prudent reserve investment practices, and added that cross-collateralization of clean water and drinking water funds, in which a surplus in one can cover shortfalls in another, further enhances bondholder security.

In addition, Fitch said the program’s reserves, which are roughly $1.2 billion, or 37% of outstanding bonds, along with the principal portion of the pledged direct loans — about $115 million — provide “strong levels of tolerance” to loan repayment defaults.

Moody’s Investors Service cited a diverse pool of underlying borrowers with sound credit, and an intercept program. Moody’s, however, warned about the trust’s exposure to counterparty risk, with its reserve investments held in guaranteed investment contracts.

Several of the trust’s larger GIC counterparties, including Assured Guaranty Municipal Corp. and Natixis Funding Corp., are on review for downgrade.

The trust operates under the direction of Treasurer Steven Grossman and executive director Susan Perez, who took over in April. Perez has worked for the trust since September 2009 as the chief compliance officer, and worked simultaneously as internal auditor for the treasurer’s office.