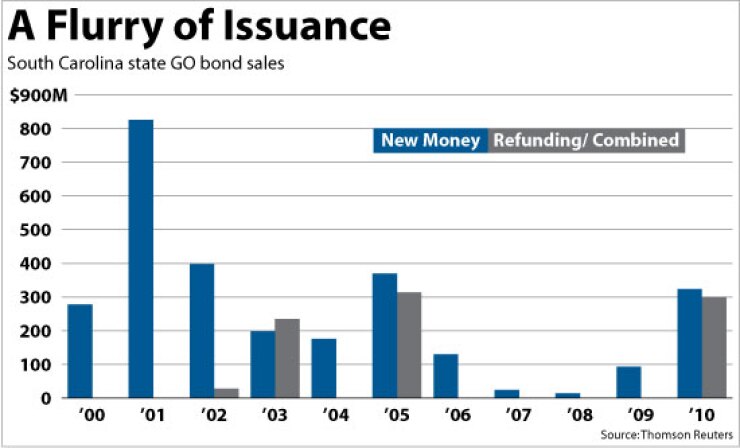

WASHINGTON — South Carolina expects to competitively issue $342.7 million of refunding bonds and $126.2 million of general obligation bonds for four higher education institutions this week.

The refunding bonds, scheduled to price Wednesday, include $197.2 million of GO school facilities bonds and $126.3 million of GO capital improvement bonds that are to refund bonds issued from 2000 through 2002.

The state also will issue $19.3 million to refund bonds sold for the University of South Carolina in 2001.

The new-money GO bonds will be priced on Thursday. The state will issue $66.2 million for Clemson University, $15 million for Midlands Technical College, $18.9 million for the University of South Carolina, and $26 million for the USC Medical University for capital projects.

The deals come as South Carolina’s budget conditions are improving. Fiscal 2011 revenues are coming in stronger than expected, providing some relief for state officials after fiscal 2010, when revenues were revised down four times. In November, the state revised its revenue forecast up by $229.6 million.

For the current fiscal year, individual income taxes are expected to increase 1.6% and sales taxes are estimated to grow by 1.6%, according to South Carolina’s Board of Economic Advisers. Additionally, the state has fully replenished its rainy-day fund in fiscal 2011, bringing it up to 3% of revenues.

However, an estimated revenue gap of $878.8 million looms for fiscal 2012 as federal stimulus funds disappear.

Curtis Loftis, the new state treasurer who took office Jan. 13, said the stronger revenue returns are likely to shrink the size of the budget deficit once fiscal 2012 begins on July 1. Additionally, he said lawmakers acknowledge that further spending cuts need to be made.

“The General Assembly is very serious about spending cuts this year,” Loftis said in an interview Friday. “I’ve never seen them this serious.”

Cuts will likely be made to health and welfare services, he said.

The new-money and refunding bonds are rated Aaa by Moody’s Investors Service and AA-plus by Standard & Poor’s.

Parker Poe Adams & Bernstein LLP is bond counsel for the school refunding bonds and three of the new-money bond issues. The McNair Law Firm PA is bond counsel for the capital improvement bonds. Haynsworth Sinkler Boyd PA is the bond counsel for the bonds to be issued for the University of South Carolina. Pope Zeigler LLC is disclosure counsel for all the bonds.

South Carolina’s economy, heavily reliant on manufacturing employment, is slowing pulling out of the recession, according to the rating agencies.

But the state’s unemployment rate, 10.7% in December, was above the 9.4% national rate for that month. IHS Global Insight Inc., an economic forecasting company, said South Carolina’s employment will increase 1.1% in 2011.

The unemployment rate remains high because the state’s population boomed during the past decade. The state’s total labor force increased 6.6% from 2004 to 2009 while the national work force was up 3.9% over that period.

One concern of the rating agencies is the state’s unfunded pension liabilities. South Carolina’s retirement plans were only 69% funded as of July 1, 2009, based on the most recent data available.

Loftis said he will be traveling the state to raise awareness for pension reform.

“Our pension plans are not where we like them,” Loftis said. “Pension reform is my No. 1 priority” this year, he said.

Commenting on state bankruptcy concerns, Loftis said it “is a terrible idea” for Congress to consider legislation that would allow states to declare bankruptcy.