In the municipal bond market, 2010 will be remembered as the year of the BAB. Thanks to a rush to issue Build America Bonds before the stimulus program expired on Dec. 31, volume in the final quarter was $132.5 billion, about one-third higher than the amounts issued in the previous three quarters.

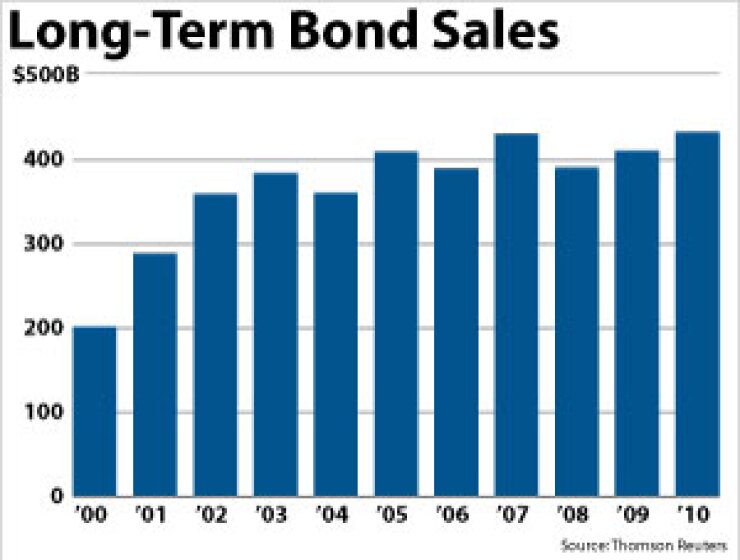

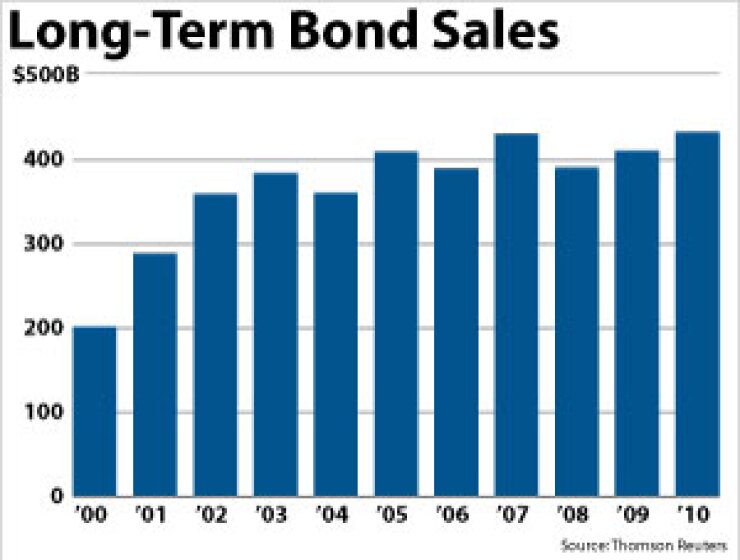

This occurred in a year when state and local governments borrowed more money than any other year on record, according to Thomson Reuters. Total long-term issuance expanded 5.4% to $431.89 billion last year, beating the previous record from 2007 when volume totaled $429.9 billion.

“BABs were certainly the biggest story of 2010,” said Chris Mier, strategist at Loop Capital Markets. “It was the first full year of this new product that appealed to a whole new market area and it had a dramatic impact on the long end of the tax-exempt curve.”

Total issuance from October to December beat the previous fourth-quarter record of $121.92 billion set in 2006. The final quarter of 2010 also represents the second-largest quarter ever, behind the second quarter of 2008 when $146.26 billion was sold.

Taxable issuance accounted for $151.9 billion last year, or more than 35% of all borrowing.

BABs made up $117.3 billion, representing 77% of the taxable total and 27% of all market volume.

Tax-exempt issuance, by contrast, was $274.2 billion in 2010 — the lowest since 2001 and a 15.2% reduction from 2009.

The figures are based on competitive, negotiated, and privately placed sales of municipal bonds maturing in at least 13 months.

New issuance in December jumped 14.1% from the same period a year before to $41.2 billion. Taxable issuance contributed 48% to that total.

The expiration of the BAB program “carried ripple effects into the municipal market,” according to Justin Hoogendoorn, managing director at BMO Capital Markets.

Hoogendoorn noted that as the surge of supply hit the market, municipal prices experienced the worst quarterly performance in 16 years. Thirty-year yields jumped 98 basis points and 10-year yields climbed 78 basis points, placing munis at one of the cheapest yield levels in the past two years.

“Part of this yield adjustment is certainly attributable to rising Treasury yields,” he added. “Yet without the BABs program, how close are municipal bonds to fair valuations?”

New-money issuance last year moved up 6.8% to $279.2 billion, while refunding volume jumped 13.4% to $98 billion.

With BABs no longer siphoning off tax-exempt issuance and helping to keep a cap on yields, issuers may have less incentive to refund debt in 2011.

Chris Holmes, an analyst from JPMorgan who predicts total volume this year will total $345 billion, said issuance of refunding bonds could fall by more than one half due to rising borrowing rates and negative arbitrage.

“Yields are higher, and ratios — in terms of relative value versus Treasuries — are going to be a lot cheaper, as we’re seeing on the long end of the curve right now,” Holmes said. “That’s going to make a lot of refunding not that attractive.”

By state, the biggest issuer of municipal debt was California. However, issuance from the Golden State actually fell 15.7%, to $61 billion.

New York, the second-most voluminous state, issued $40.4 billion of new debt, or 8% less than one year before.

Illinois, the fourth-largest issuer last year, borrowed $26 billion, or 74% more than in 2009.

The bond insurance industry, which in 2010 was solely represented by Assured Guaranty Ltd., guaranteed 1,701 issues totaling $26.96 billion.

That represents 6.2% of the entire market, or 9.8% of tax-exempt issuance. Compared to 2009, the market for bond insurance fell by 23.8%.

Given the recent downgrades of Assured and its former rival, MBIA Inc., Holmes said there is no sign that wrapping bonds will rebound in 2011. The business has been in free fall since the financial crisis erupted in mortgage-backed securities.

“Over the next couple of years, the bond insurance market, to me, is not going anywhere,” he said. “The five-year or 10-year horizon is a different story, but in the near term I don’t think too much is going to change.”

As the bond insurance market struggles to find new entrants, state-guarantee programs such as the Texas Permanent School Fund are being more widely used than ever. These “Other Guarantees,” as Thomson Reuters calls them, increased 195% to $24 billion in 2010.

Looking ahead, total issuance in 2011 is expected to be fall well below last year’s record level, but forecasts range widely.

Analysts from Citi estimate that 2011 issuance will total $340 billion, while forecasters from Bank of America Merrill Lynch foresee as much as $420 billion.

Hoogendoorn estimates that, unless the BAB program is reintroduced, taxable volume will fall to less than $40 billion, or about 10% of total issuance this year.

“Adjusting the model for lower taxable issuance expectations moves munis to rich modeled valuations,” he said. “Should mutual fund flows improve and low January supply expectations prove correct, it may be a good time to take advantage of municipal bonds at high absolute yields relative to the past couple of years.”