SAN FRANCISCO — As California emerges from its debt doldrums this month with expected sales of $8 billion of short- and long-term debt, investors are eager for the fresh yield the state will add to a stagnant market.

California has scheduled a $5.4 billion revenue anticipation note sale for Sept. 15 and up to $2.6 billion of general obligation bonds — $1.3 billion of new money and $1.3 billion of refunding, depending on market conditions — for Sept. 20.

The state last sold GO bonds in November.

The forecast for the issuance is as sunny as a typical California weather forecast. The lack of new-issue supply has helped drive yields to record lows in the municipal market, making it much more attractive for large deals.

“I don’t think [California] will have any trouble,” said Tom Spalding, a fund manager at Nuveen Asset Management. “The market right now is fairly starved for any type of yield. And certainly as long as the pricing is adequate, I think they could plough through $2.7 billion-plus this month into early October.”

The benchmark 10-year municipal bond yield fell to a record low of 2.09% on Wednesday. It has fallen 15 basis points since Sept. 1, according to Thomson Reuters.

The 30-year bond yield fell two basis points to 3.68%, its lowest level since Sept. 29. The two-year yield held at 0.30% for a 20th consecutive session, holding at its lowest level in more than 40 years.

A trader in Los Angeles agreed California should have no problem selling its paper in a difficult market that hasn’t presented many opportunities, especially outside the state.

“If you believe we are going to be in this low interest-rate environment for an extended period of time, then you can get some things sold,” the trader said. “It is tough at these levels unless you can make a compelling case for ratios to Treasuries.”

Ahead of the deal, Moody’s Investors Service affirmed its A1 rating on California GOs and Fitch Ratings affirmed its A-minus rating. Standard & Poor’s most recently rated California A-minus.

With those single-A level ratings, California’s upcoming deals are expected to offer higher yields than most other state debt sales.

Between June 14 and Wednesday, the average spread between California five-year GOs and the Municipal Market Data triple-A curve was 60 basis points, while 10-year state GOs averaged an 89 basis point spread and 30-year bonds averaged a 98 basis point spread.

California’s “financial strength has deteriorated in the past three years and a weak economic recovery may mean that financial weakness is likely to continue,” Moody’s analyst Emily Raimes said in a report released Thursday affirming the agency’s rating.

“That said,” she added, “long-term economic prospects are good, and long-term liabilities are moderate compared to many other states.”

The revenue anticipation notes will mature on June 26.

Fitch rates the Rans F1, Moody’s tags them MIG-1 and Standard & Poor’s assigned them a SP-1-plus.

Standard & Poor’s analyst Gabriel Petek in a report last week said California has the ability to repay the notes even with a variety of negative scenarios.

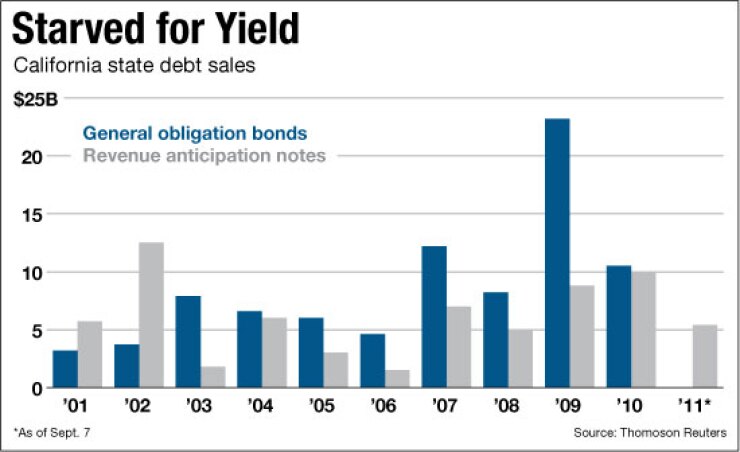

The state’s deals come amid a steep drop in muni market issuance compared to last year.

New borrowings in August tumbled to $21 billion, a 29% decline from the $29.7 billion issued a year earlier and 42% down from 2009, according to Thomson Reuters.

Year-to-date tax-exempt issuance has fallen 21% to $139 billion compared to the same time last year.

California Treasurer Bill Lockyer has tentatively scheduled another general obligation sale before the end of the year.

“Our planned issuances are still up in the air,” Lockyer spokesman Tom Dresslar said.

Dresslar said official estimates for future debt sales will be clearer after the treasurer’s office releases its annual debt affordability study on Oct. 1.

California, typically the largest issuer in the country, has refrained from issuing any GO debt so far this year, bypassing its usual multibillion dollar spring sale as it revaluated financing needs in the face of a multibillion-dollar budget deficit.

Working under a mandate by Gov. Jerry Brown to reduce the state’s “wall of debt,” his Department of Finance has been polling departments and agencies to find out how much cash from previous bond issues they have on hand to spend on projects, as an alternative to issuing new debt.

More than $11 billion of cash from bond sales has accumulated in department accounts, costing taxpayers more than $700 million a year in debt service for projects that have yet to be completed, according to the governor’s May Revise budget.

Last year, the state sold $4.5 billion of GO debt in the fall. It did not offer new-money GOs this past spring for the first time since at least 1988. Last year, the state issued $6 billion of GO debt in the first half of the year and $10.5 billion for all of 2010 — way down from 2009 when it set a municipal market record of $23 billion.

The treasurer’s office picked Bank of America Merrill Lynch and Stone & Youngberg LLC as joint senior managers for the Sept. 20 GO deal. Goldman Sachs & Co. and JPMorgan were tapped to be joint lead managers for the second GO offering. Wells Fargo Bank and Barclays Capital Inc. have been selected as joint senior managers for the Ran sale.

KNN Public Finance, Montague DeRose and Associates and Public Resources Advisory Group are the state’s financial advisors. Orrick, Herrington & Sutcliffe LLP will serve as bond counsel.