The Bond Buyer's weekly yield indexes declined this week as municipal yields marched steadily downward, setting new record lows in 10-year munis on a daily basis.

The Municipal Market Data triple-A yield scale yielded a record low 2.43% last Thursday, and went on to set new marks each session thereafter. The yield stood at a record 2.30% as of Thursday's close.

"You can attribute the rally to cash flow in the market," said Evan Rourke, portfolio manager at Eaton Vance. "There's the reinvestment funds in the market, and the new-issue calendar has been steady, but not overwhelming."

He said new money keeps coming into the market and relative-value ratios are attractive. The absence of inflation also has weighed on yields.

"Absolute yield levels aren't exactly compelling, but you're talking about 100% of Treasuries for high-grade munis," Rourke said. "When you have a 4% yield in 10 years, the core rate of inflation was 2.5%, so your real rate of return was 1.5%. Now, you're getting 2.3% but a core inflation rate of 0.9%, so you're still making 1.4%."

Rourke described the situation as "a psychological shift."

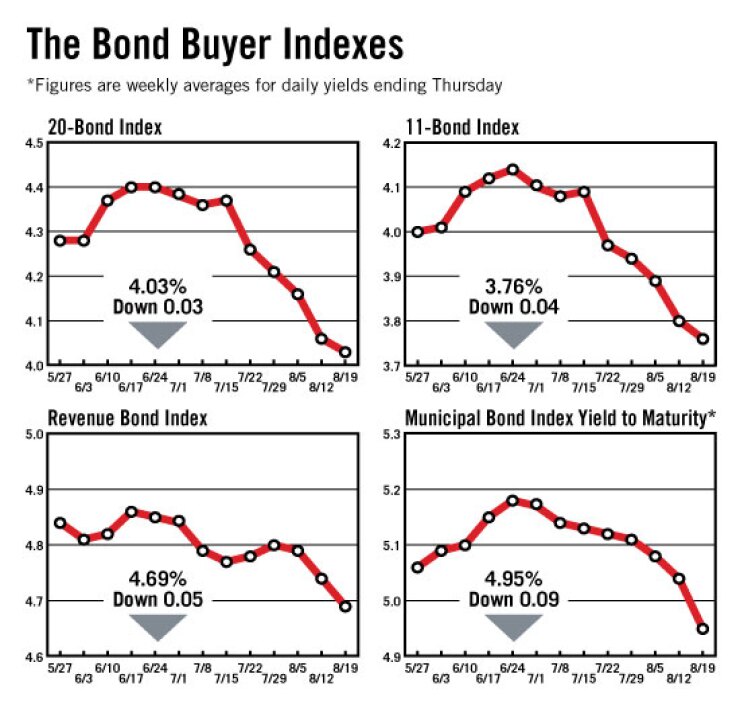

The Bond Buyer 20-bond index of 20-year general obligation bond yields declined three basis points this week to 4.03%. That is the lowest for the index since Oct. 1, 2009, when it was 3.94%.

The 11-bond index of higher-grade 20-year GO yields dropped four basis points this week to 3.76%, which is the lowest level for the index since Oct. 1, 2009, when it was 3.69%.

The revenue bond index, which measures 30-year revenue bond yields, declined five basis points this week to 4.69%. This is its lowest level since Oct. 8, 2009, when it was also 4.69%.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, dropped one basis point to 0.45%, which is its lowest level since March 31, when it was 0.43%.

The yield on the 10-year Treasury note declined 17 basis points this week to 2.58%. This is the lowest the yield has been since Jan. 22, 2009, when it was also 2.58%.

The yield on the 30-year Treasury bond fell 28 basis points to 3.67%, which is its lowest level since April 8, 2009, when it was also 3.67%.

The weekly average yield to maturity on The Bond Buyer's 40-bond municipal bond index, which is based on 40 long-term municipal bond prices, finished at 4.95%, down nine basis points from last week.

That is the lowest weekly average since the week that ended April 17, 2008, when it was also 4.95%.