BRADENTON, Fla. — Atlanta is looking for companies interested in setting up operations in its commercial tax allocation districts.

The city next week begins seeking applications from those interested in developing business ventures in four commercial TADs that utilize tax increment financing.

The so-called CTADs were established four years ago to generate public-private partnerships aimed at revitalizing the targeted areas, but implementation for project financing was delayed, in part because of the recession.

The primary focus of CTADs is on larger commercial, industrial, and mixed-use developments with total project sizes of $5 million and greater.

Officials with the Atlanta Development Authority, which oversees many of the city's redevelopment programs, including TADs, say they are seeing renewed business interest in the commercial corridors.

Tax increment financing bonds will be used if ventures are large enough that it makes economic sense to issue debt. Many of the projects are expected to be small and will be financed on a pay-as-you-go basis.

"We're coming out of the recession and the developers we're talking to all seem to know about a project that they would bring on line," said Wyman Winston, senior manager of the CTAD program.

Prospective developers believe now is a good time to assemble financing to complete projects by 2011 and 2012, he added.

Winston and others at the ADA have already been making information available through

The agency on Wednesday will post a request for proposals at

Tax allocation districts offering TIF have been a successful tool for Atlanta. The city has 10 TADs, including the commercial districts.

The districts are used to channel incremental taxes toward improvements in distressed or underdeveloped areas where development would not otherwise occur. They do so by using the increased property or sales taxes that new development generates to finance qualified costs related to the development, according to the Council of Development Finance Agencies.

When a TIF district is created, a baseline year for tax collections is established. Thereafter, taxing authorities continue to receive the same amount of tax collections as they did in the baseline year.

Any tax collections above the amount established in the baseline year go to the TIF district and are usually generated by new development and other improvements. Those revenues can be used to back bonds that pay for infrastructure improvements and other qualified costs.

Six of Atlanta's TADs were implemented between 1992 and 2005 and now include a mix of residential, retail, and park redevelopment features. They are the Westside, Atlantic Station, Princeton Lakes, Perry-Bolton, Eastside, and Beltline TADs. Atlanta has issued approximately $500 million of TIF bonds for some of those districts since 2001.

While TIF project financing is about to begin in the four commercial TADs, all were established in 2006, which is the baseline year. They are the Campbellton Road, Hollowell/Martin Luther King Jr. Drive, Metropolitan Parkway, and Stadium Area CTADs.

"A lot of success around downtown revitalization is attributable to the TADs," said Cheryl Strickland, director of TAD programs.

Over the past 10 years, the city's compounded assessed-property value growth rate was 8%, while the growth rate within the TADs was 30%.

The districts have helped lure development to areas of downtown previously thought of as somewhat passé, Strickland said, citing the scale of Atlantic Station, which is the redevelopment of a 138-acre former brownfield site for which $250 million of bonds have been issued.

The Atlantic TAD is approximately 40% completed and already has lured considerable vertical developments and new retail into mid-town, including the Southeast's first Ikea store, she said.

Later this year will come the inaugural sale of TIF bonds for the northwest Atlanta Perry-Bolton TAD, totalling approximately $50 million. The anchor project is a mixed-income redevelopment community.

For now, the ADA is focused on moving forward with project financing in the four commercial corridors where it hopes redevelopment will foster new business in underserved areas and drive job growth, Winston said.

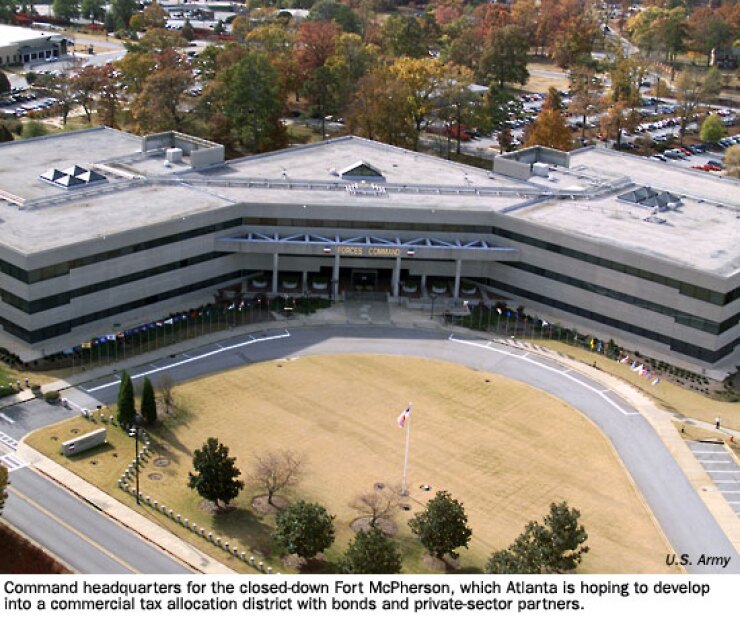

Prospective applicants have shown interest in the Campbellton Road CTAD, which includes the 485-acre Fort McPherson, a U.S. Army base in southwest Atlanta that was closed under the Base Realignment and Closure Act of 2005.

In addition to TIF financing, the McPherson Implementing Local Redevelopment Authority also has the power to issue revenue bonds. The authority is a state agency that is implementing a reuse plan for the base; details are available at www.mcphersonredevelopment.com.

Another area of interest is the Stadium Neighborhoods, which focuses on the redevelopment of 370 acres of parking lots and vacant land around Turner Field where baseball's Atlanta Braves play.

Plans call for building parking decks to free up new open space for businesses to locate near downtown and to foster new development that might otherwise locate outside of the city.

The 886-acre Hollowell/ML King CTAD is in the city's west and northwest sectors. The goal of the district is to encourage private investment by offering financing incentives that will induce major new development and help ameliorate the current conditions contributing to disinvestment and marginal use.

The Metropolitan Parkway CTAD is made up of 1,023 acres in the southwest quadrant of Atlanta, which has suffered from the general lack of new development over the past three decades.

Plans for the area include development of parks and plazas to support building a sustainable community through the development of primarily commercial infill and mixed-use projects.

Information about Atlanta's TADs and other redevelopment tools are available at