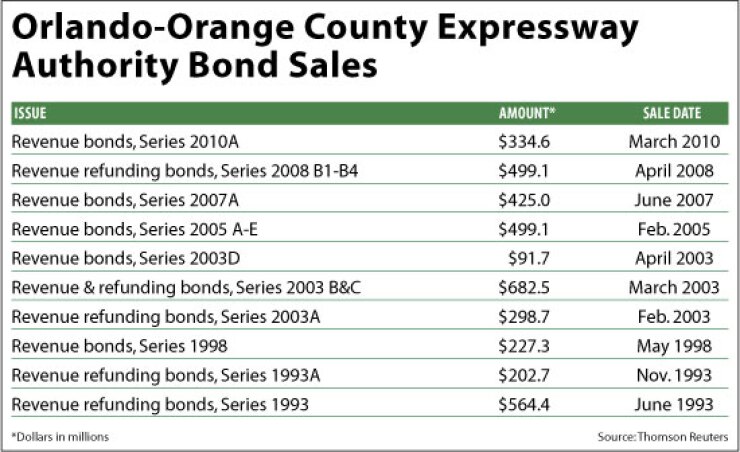

BRADENTON, Fla. — The Orlando-Orange County Expressway Authority in central Florida today hopes to begin retail pricing of a two-pronged transaction — including up to $250 million of fixed-rate refunding revenue bonds and a restructuring of $250 million of variable-rate bonds with the termination of associated swaps.

While the refunding component is for debt-service savings, the potential restructuring to fixed-rate bonds is part of a strategy to reduce the authority’s exposure to variable-rate obligations.

However, the restructuring is highly dependent on market conditions, which were not favorable late last week, chief financial officer Nita Crowder said yesterday.

If the transaction is successful, the OCCEA’s percentage of hedged variable-rate debt compared to traditional fixed rate in its $2.4 billion debt portfolio would decline to 31% from 41%.

The deal, culminating with institutional pricing tomorrow, is expected to be structured as $192 million — but could be as much as $250 million — of Series 2010B refunding bonds that will refinance all or a portion of the authority’s currently callable 1998 bonds and pay issuance costs, which may include bond insurance.

The present-value savings of the refunding is estimated at 5%, or $10 million. The final maturity is expected to be 2029.

A secondary goal of the transaction is “reducing exposure to variable-rate debt,” Crowder said.

The authority hopes market conditions this week enable it to restructure its variable-rate 2008B1 and 2008B2 series as fixed rate bonds within existing maturities, but the restructuring will only occur if the combined transaction has a net-present value of $5.5 million or less.

When market conditions were assessed late last week, Crowder said the economics of the restructuring did not comply with the price-tag limitation authorized by the OCCEA’s board.

“The key is to hit the $5.5 million cost,” Crowder said. “The focus of this financing is to keep debt service at existing levels through 2028, to capture savings in the 1998 bonds, and reduce the authority’s exposure to variable-rate debt.”

If the restructuring is accomplished, the variable-rate bonds would be replaced with fixed rates with final maturity in 2040. Bond insurance is being considered.

To provide flexibility if market conditions this week are not conducive to meeting the cap on cost, Crowder said the restructuring element could take place within 15 days of pricing the refunding bonds.

Fitch Ratings and Standard & Poor’s have assigned long-term ratings of A to the refunding revenue bonds.

Both agencies affirmed their underlying A ratings on $2.4 billion of outstanding revenue bonds. They both assigned stable outlooks.

The OOCEA is one of four active expressway authorities in Florida.

First Southwest Co. is the financial adviser.

Bank of America Merrill Lynch is book-runner. Others in the syndicate are Citi, Barclays Capital, Goldman, Sachs & Co., JPMorgan, Loop Capital Markets LLC, Morgan Stanley, Raymond James & Associates Inc., RBC Capital Markets, and Wells Fargo Securities.

Broad and Cassel PA and Ruye H. Hawkins PA are co-bond counsel on the offering. Greenburg Traurig PA and KnoxSeaton are co-disclosure counsel. Foley & Lardner LLP is underwriters’ counsel.