The Dormitory Authority of the State of New York’s upcoming $1.3 billion personal-income tax bond deal will be the state’s largest ever municipal issue with a minority firm serving as book-runner, DASNY announced yesterday.

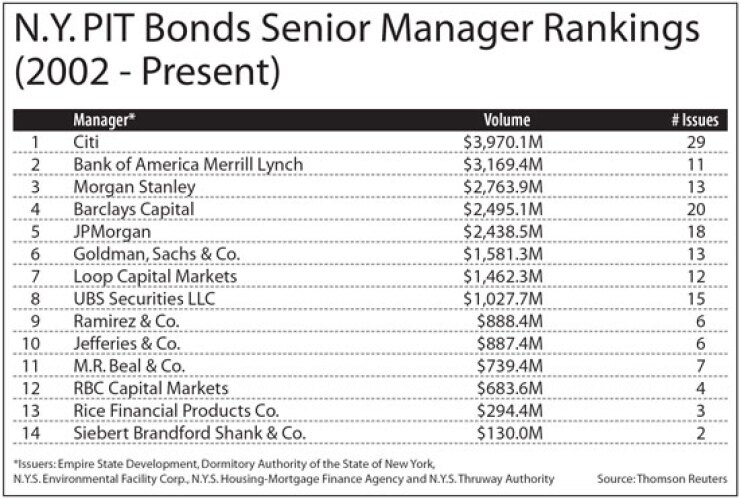

Minority-owned firm M.R. Beal & Co. will serve a book-running senior manager on the deal, which is expected to price toward the end of month.

“New York has turned a new page,” DASNY executive director Paul Williams Jr. said. “We are clearly demonstrating to all firms, but especially to [minority and women-owned] firms out there that inclusiveness is going to be the key going forward, based upon a firm’s demonstrated ability to get the job done.”

Harris Beach PLLC is bond counsel and Sidley Austin LLP will provide special tax advice on portions of the deal. The issuance is expected to be a combination of tax-exempts and taxable Build America Bonds.

M.R. Beal, which has been a member of DASNY’s senior management team for over a decade, was chosen the same way as any other firm is chosen, according to Williams.

“We were looking at M.R. Beal from the standpoint of their past performance with us and with others and their market reputation,” he said.

Underwriting by minority and women-owned firms on state-backed debt increased to 23.9% in 2009 from 4% the year before. The greater participation follows guideline changes in how underwriting syndicates are selected by issuers of state-backed debt that were adopted in 2008 and 2009. Those guidelines were adopted based on the recommendations of a task force created by Gov. David Paterson in 2008 and chaired by Williams.

It not clear whether the state will have a budget in place when the deal goes to market. Yesterday the Legislature was deliberating an emergency spending bill as the state entered its third month without a budget since the fiscal year began on April 1.

Paterson said his office will draw up a plan to lay off state workers after failing to wring concessions from unions and a court ruling striking down worker furloughs.

“We didn’t want to lay off anyone — this is a last resort,” Paterson said at a news conference in Manhattan. “We have not in six months been able to come to an agreement of what was previously agreed upon that we would get $250 million of workforce reductions from the state employees.”

Layoffs would not happen under Paterson’s watch, however. An agreement with labor unions to create a less generous pension plan for new state workers prevents layoffs until Jan. 1. With Paterson not standing for election, the plan would be left to be implemented by a successor.

How many layoffs would be in the plan would depend in part on how many workers took an early retirement plan, said Division of Budget spokesman Erik Kriss. The state has delayed payments to school districts that were due yesterday until later in the month. Kriss could not provide the amount being delayed but previous estimates were pegged at $1 billion.

Despite budget troubles that include a $9.2 billion budget gap, New York’s double-A bond ratings have held.

“We’re continuing to look at the state’s liquidity, revenue performance, what the trends in forecast are,” said Standard & Poor’s analyst Robin Prunty. “Were most focused on what the budget solution is.”

Standard & Poor’s rates the PIT bonds AAA with a stable outlook. Fitch Ratings rates PIT debt AA with stable outlook. Moody’s Investors Service does not rate recent New York PIT deals.