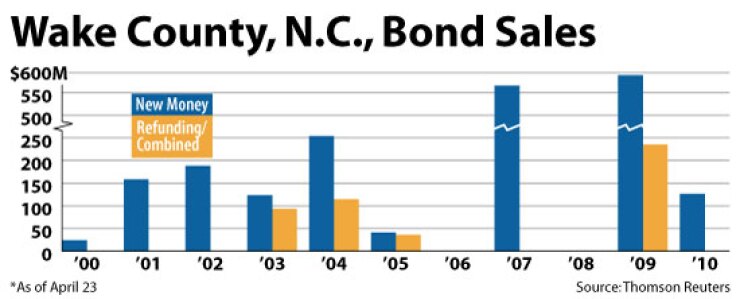

WASHINGTON — Wake County, N.C., on Wednesday is expected to competitively price $421.7 million of general obligation refunding bonds, its largest refunding deal on record.

The Series 2010C bonds are expected to mature between 2013 and 2026. The county, the state’s third-largest issuer, plans to use the proceeds to refund bonds issued in 2003, 2004, 2005, 2007, and 2009 for a minimum 3% savings rate.

It expects to save between $13 million and $16 million from the transaction, according to county debt manager Nicole Kreiser.

Winston Salem, N.C.-based Womble Carlyle Sandridge & Rice PLLC is bond counsel. Birmingham, Ala.-based Waters and Co. is financial adviser.

Wake County is rated triple-A by Moody’s Investors Service, Standard & Poor’s, and Fitch Ratings. The county has outstanding $1.79 billion of GO debt and $303 million of limited obligation bonds.

In 2006, county voters approved a $970 billion bond program for schools. About two-thirds of that debt was sold in 2007 and 2009 and $238.5 million remains to be issued, Kreiser said. Part of this week’s deal will be to refund bonds issued for schools in 2007 and 2009.

In March, the county sold $86.3 million of tax-exempt GO bonds for county school and community college projects. Jefferies & Co. won the bid at a 2.5% true interest cost.

That same month, Wake County also sold $39.5 million of recovery zone economic development bonds to Bank of America Merrill Lynch at a true interest cost of 5.1%, with the proceeds going toward school projects.

County officials in May expect to sell $34.9 million of qualified school construction bonds, its first such deal, Kreiser said. Wake County’s student population is expected to moderate through the end of the decade, but will remain strong, according to Moody’s.

Wake is one of four North Carolina counties that are rated Aaa by Moody’s out of 68 in the state. Moody’s is scheduled to migrate its rated issuers in North Carolina to the global rating system on Monday.

This will have no effect on Wake County, but other counties may see their ratings shift higher, said Alicia Stephens, Moody’s lead analyst for Wake.

The county distinguished itself from other triple-A counties in fiscal 2010 by balancing its budget without tapping reserve funds.

This ability “was unique, particularly in the context of a recession,” Stephens said. The county’s fiscal 2011 budget has not been finalized, but county managers have indicated they will avoid a need for reserve funds again next year, she said.

The county’s sales tax collection, which is its second-largest revenue source, has reported shortfalls and poses a challenge to the county as the recession lingers, Stephens said.

Wake’s property tax collections, its largest revenue stream, have stayed more stable through the recession. Home values in the county did not experience the boom-and-bust cycle that hit other metropolitan areas, she said.

Wake County encompasses the state capital in Raleigh and had one of the fastest-growing populations among counties in 2007 and 2008, according to the U.S. Census. Its per-capita income was higher than North Carolina’s and the U.S. average through 2007.