DALLAS — Amid Arizona’s deep economic decline, Phoenix is considering shelving $250 million of capital improvement projects that would have been financed by general obligation bonds.

With an eye toward preserving its AAA rating from Standard & Poor’s and avoiding a downgrade on its Aa1 from Moody’s Investors Service, the city’s finance staff is proposing to defer the projects to avoid using general revenue for debt service.

At the same time, officials are considering raising its secondary property tax rate after 2012 to maintain good debt-coverage ratios.

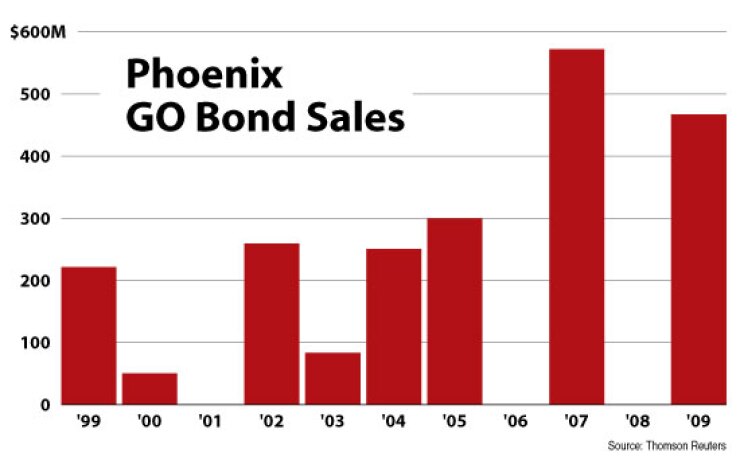

As of 2009, Phoenix had $1.35 billion of GOs outstanding. Without a tax increase, the city would have to use about $85 million in general fund money for debt service by 2017, finance staffers indicated. An additional $15 million would be needed the following year.

At its May 11 meeting, the City Council will review a list of street, storm sewer, and other projects worth $250 million that could be delayed.

While Standard & Poor’s maintains a stable outlook on Phoenix’s GOs, Moody’s has the city on negative outlook. Fitch Ratings does not rate the city’s GOs.

The city can levy property taxes at two levels, with the first going toward operations and the second supporting debt service for infrastructure. Phoenix’s combined property tax rate of $1.82 per $100 of assessed valuation has not changed in 14 years.

The city could establish a floating secondary tax that would not increase the overall taxes that property owners pay, city staffers said. That’s because the sharp drop in property values means that the overall tax payments are also lowered, even with a higher tax rate. Each year, the council could vote to raise or lower the rate based on debt service needs.

Property values, as reflected in assessments sent out in February, dropped for the third straight year in Maricopa County, whose county seat is Phoenix. Residential property values fell an average of 15.2% in 2009, according to the Maricopa County Assessor’s Office. Values fell 23% in 2008, following a 13% drop in 2007.

The median value of homes in the county fell last year to $131,700 from $155,300 the previous year. The assessments sent in February were actually based on 2008 values, so the assessments could drop further. The lag time between appraisal and assessment is about 18 months in Arizona, so local governments may not have hit bottom in terms of property-tax revenue.

Other cities in Maricopa County and throughout Arizona have been tightening their belts amid the funding shortage as well.

The Tempe City Council last week began identifying projects to postpone amid a 35% drop in secondary property tax revenue over three years. Home values in Tempe declined 13.4% in 2009.

In Tucson, county seat of Pima County, the city staff is asking the City Council to consider raising the sales tax by 0.5% to cover operating costs. The tax increase would provide about $33 million per year, enough to avoid losing another 500 jobs, according to city manager Mike Letcher.

Local governments are being hit hard by the state’s revenue crisis, and matters could worsen if voters do not approve a temporary one-cent tax increase next month to cover state operating expenses, local officials said.

Local sales taxes have dropped sharply in recent years as shared revenue distributed through the state has declined nearly 40% in the last two years.

If the proposed three-year sales tax increase fails next month, the state plans to shift the cost of maintaining state prison inmates to the counties and require them to cover about $8 million in salaries for Superior Court judges.

Fearing the consequences if voters reject the temporary sales tax increase in May, the League of Arizona Cities and Towns is pushing hard for the measure.

“Without the additional money to fund state operations, education and public safety programs could be in serious jeopardy,” said Chandler Mayor Boyd Dunn, president of the league. “Cities and towns are voluntarily doing our part to help the state with its budget difficulties by giving up nearly $600 million in potential revenue over the three-year life of the tax.”