All of The Bond Buyer’s weekly yield indexes on long-term debt declined this week, as municipals firmed up in nearly every session.

“The market has had a decent tone to it,” said Evan Rourke, portfolio manager at Eaton Vance. “The Treasury market has perked up a bit, which has helped us out a little. The new-issue supply has been relatively light this week, and what did come was mostly the health-care types, the higher-yield portion of the curve.

“There’s a pretty decent calendar next week, which has kept some people on the sidelines,” Rourke said. “But there are people saying that there isn’t much coming past that, and now is a good time to be putting money to work.”

Leading the new-issue market this week, Bank of America Merrill Lynch priced $723.2 million of school facilities construction bonds for the New Jersey Economic Development Authority. Also this week, Morgan Stanley priced $643.1 million of power revenue bonds for the Puerto Rico Electric Power Authority, upsized from the originally planned $275 million.

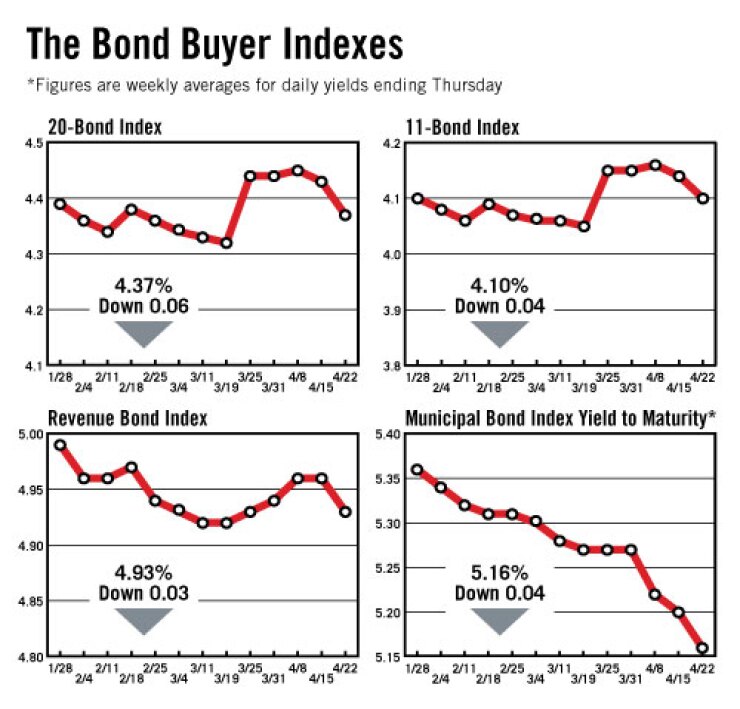

The Bond Buyer 20-bond index of 20-year general obligation bond yields dropped six basis points this week to 4.37%. This is the lowest the index has been since March 18, when it was 4.32%.

The 11-bond index of higher-grade 20-year GO yields declined four basis points this week to 4.10%. It is now at its lowest level since March 18, when it was 4.05%.

The revenue bond index, which measures 30-year revenue bond yields, dropped three basis points this week to 4.93%. It is now at its lowest point since March 25, when it was also 4.93%.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, rose six basis points this week to 0.54%, which is its highest level since Nov. 24, when it was 0.56%.

The yield on the 10-year Treasury note declined five basis points this week to 3.79%, which is the lowest it has been since March 18, when it was 3.67%.

The yield on the 30-year Treasury bond fell seven basis points this week to 4.65%. It is the lowest yield for the 30-year bond since March 18, when it was 4.59%.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term municipal bond prices finished at 5.16%, down four basis points from last week’s 5.20%.