The rating agencies may be poised to give California bondholders a breather. The bond market is not.

In a report earlier this week, Brenda Certo-Barnes, an analyst with New York-based credit research firm Savader Asset Advisors LLC, said the rating agencies are probably finished downgrading California for now.

This would be welcome news for the Golden State. Standard & Poor’s, Moody’s Investors Service, and Fitch Ratings have slashed California’s credit rating a combined total of seven times since the beginning of 2009.

California is the lowest-rated of the states, and is not far from junk. Standard & Poor’s dropped the credit to A-minus last month, while last July the state received double downgrades to Baa1 by Moody’s and BBB by Fitch.

Certo-Barnes cautioned against feeling safer just because the state’s ratings may remain where they are for foreseeable future. The truth is California’s bonds can take investors on a dangerous path regardless of what the rating agencies say, she wrote.

While Certo-Barnes does not worry about California defaulting on its debt, she wrote that a continuing decay in the state’s finances could pummel its bonds further.

California’s $63.9 billion of general obligation debt does not need the excuse of a rating downgrade to tumble in value.

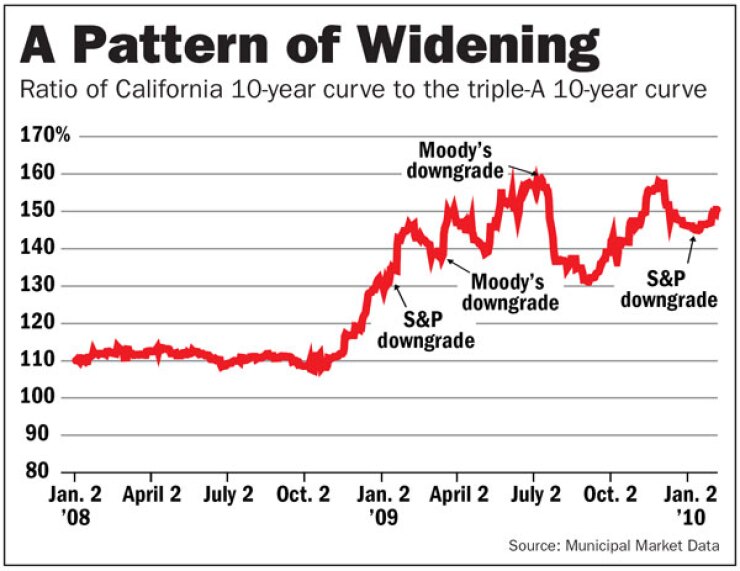

The yield on its 10-year GOs was only 43 basis points more than the generic 10-year triple-A scale at the beginning of 2008, according to Municipal Market Data.

That spread had spiked almost a percentage point before Standard & Poor’s downgraded the state in February 2009.

Certo-Barnes pointed out the spread between California’s 30-year GOs over the triple-A scale swelled nearly 65 basis points from late August 2009 to mid-January 2010 without the impetus of a downgrade.

The shame about California, she wrote, is that it has abundant resources to repay its debts.

With one of the largest economic bases in the world, the state expects its residents to report personal income of almost $1.6 trillion this year, with $456 billion in taxable sales. Income and sales taxes contribute two-thirds of the state’s revenue.

Certo-Barnes wrote that California has “substantial resources” to repay the $6.35 billion in interest and principal due on its bonds this year— about 5.5% of its revenue.

The state’s political system prevents it from tapping these resources or controlling expenses enough to craft a structurally sound budget, she wrote.

The requirement for a two-thirds super-majority to pass a budget constantly leads to budgetary gridlock, and Proposition 13 requires any measure enacted to increase property tax revenue to be approved by a super-majority as well.

The result is the “state has little financial flexibility and few good options remaining,” Certo-Barnes wrote.

The state is struggling to close a budget gap of $6.6 billion in fiscal 2010, and a $12.3 billion deficit in Gov. Arnold Schwarzenegger’s $82.9 billion general spending plan for fiscal 2011.

Personal income, sales, and corporate taxes are all expected to be lower than they were five years ago.

“Even absent a downgrade in the state’s bond rating, bond values — which have weakened significantly over the past year — may realize additional declines if deterioration in financial or economic attributes point to an incremental worsening in the state’s credit profile,” she wrote.

The taxable bond market is just as discriminating against California as the tax-exempt municipal market.

In April, both California and the University of Virginia floated 30-year taxable bonds under the Build America Bonds program.At the time, California’s bonds yielded 27 basis points more than the University of Virginia’s. It now yields 120 basis points more.

Certo-Barnes wrote there is no guarantee the yield will not go up even more.

“Bondholders should keep in mind that even without a formal rating downgrade, their interests may be negatively affected by reports of economic or financial weakening,” she wrote.