The Bond Buyer's weekly yield indexes declined this week, as the municipal market grew firmer in each of the week's sessions.

George Strickland, portfolio manager at Thornburg Investment Management, said most of the gains have been on the long end of the curve.

"We've hit ratios of about 100% of Treasuries through 10 years, and kind of recovered a lot of the lost ground that we had in December, and now I would expect munis would be much more correlated with what happens in the Treasury market," he said. "I think at least the immediate rally has pretty well run its course."

Strickland said this week's rally was mostly due to "technicals" and "fairly low supply."

"I've been a bit surprised we haven't seen more supply," he said. "I think you might start seeing some high single-digit [weekly volume in the billions] in the weeks ahead instead of numbers in the low single digits. The market has absorbed the supply, though. If the calendar stays light, maybe we can stay around these levels. If it builds, then we might see some slippage."

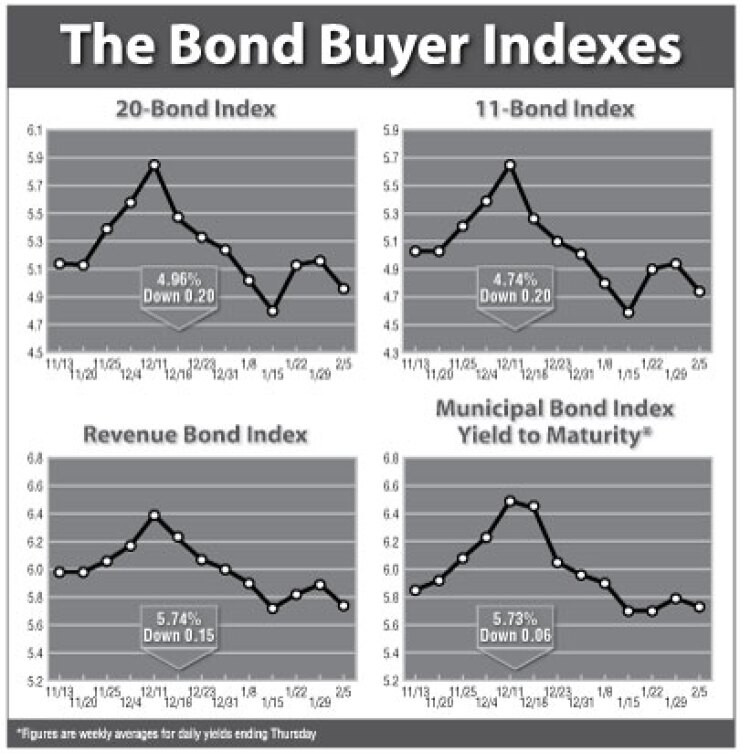

The Bond Buyer 20-bond index of general obligation yields and the 11-bond index of higher-grade 20-year GO yields both declined 20 basis points this week, to 4.96% and 4.74%, respectively. These are the lowest levels for the indexes since Jan. 15, when they were 4.80% and 4.59%, respectively.

The revenue bond index, which measures 30-year revenue bond yields, declined 15 basis points this week to 5.74%. This is the lowest the index has been since Jan. 15, when it was 5.72%.

The 10-year U.S. Treasury note's yield rose seven basis points this week to 2.90%. The 10-year note's yield has increased in six of the past seven weeks, rising a total of 85 basis points from its most recent low of 2.05% on Dec. 18, 2008, and is now at its highest level since Nov. 25, 2008, when it was 3.09%.

The 30-year U.S. Treasury bond's yield rose six basis points this week to 3.63%. It also has risen in six of the past seven weeks, gaining a total of 110 basis points from its most recent low of 2.53% on Dec. 18, 2008, and is now at its highest level since Nov. 20, 2008, when it was 3.65%.

The Bond Buyer one-year note index, which measures one-year tax-exempt note yields, declined 16 basis points this week to 0.77% - the same level it reached two weeks ago on Jan. 21.

The weekly average yield to maturity on The Bond Buyer 40-bond municipal bond index finished at 5.73%, down six basis points from last week's 5.79%.