DALLAS — The Texas Permanent School Fund bond guarantee program will again be available to back debt issued by school districts starting next year, the Texas Education Agency announced.

The Internal Revenue Service notified the TEA on Wednesday that revised rules will allow the PSF to insure double the amount of bonds it could previously based on the value of the fund. Before, the PSF could guarantee a total amount of bonds amounting to 2.5 times the fund's value. The new rules double that to five times the fund's worth.

"This IRS ruling increases our capacity to back school district bonds by hundreds of millions of dollars," said education commissioner Robert Scott. "It will help school districts to build new buildings for generations to come. It will also help school districts keep tax rates down because this will save them money."

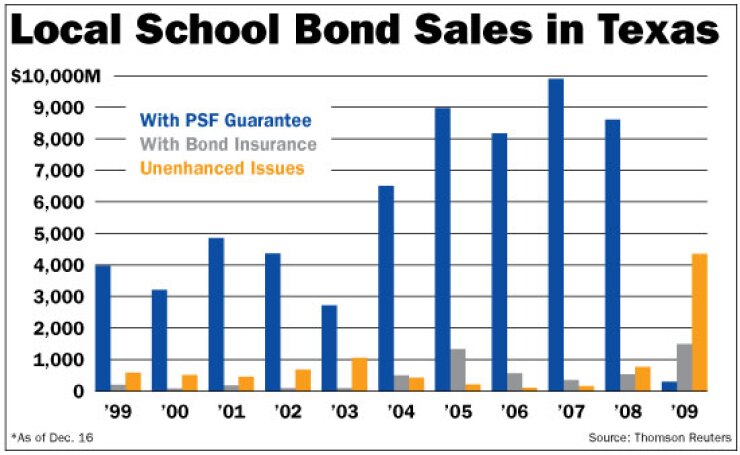

The TEA halted applications for PSF backing in 2008 and the fund was officially closed to new borrowers last March due to capacity constraints as the value of its investments fell sharply in line with the financial markets and the recession.

Without PSF backing or other forms of insurance, school districts were forced to issue debt using their own underlying credit, attempt to obtain bond insurance, or postpone issues. Districts in the double-A category typically found sufficient investment interest to make issues affordable. Those in the lower categories typically postponed large issues.

The PSF's value has rebounded to $23 billion, which includes assets managed by the state Board of Education and the TEA, as well as the General Land Office. Thus, the dollar value of bonds the fund can back will grow to roughly $115 billion from the previous $58 million. Since its creation in 1983, the fund has guaranteed more than $83 billion of school debt.

"I think this may also create refunding opportunities for existing bonds," school consultant and former superintendent Joe Smith told administrators via his Web site TexasISD.com. "Expect your financial advisers to contact you soon."

Texas began asking for the expanded coverage before the recession hit in December 2007. In November 2007 and again in February 2008, Gov. Rick Perry sent a letter to then-U.S. Treasury Secretary Henry Paulson urging the IRS to increase its guarantee limitation to match the limit in Texas state law.

Perry and lawmakers who voted to raise the limit in the 2007 legislative session said the previous ceiling would cause taxpayers to pay millions of dollars more than they should in financing costs. Members of the Texas congressional delegation this year also urged the IRS to raise the limit.

"The IRS' decision to grant our request will now allow the state to back more voter-approved school district bonds, providing lower cost financing to secure adequate facilities for the schoolchildren of Texas, and easing the burden on local property taxpayers," Perry said.

To permit the guarantee of school bonds by the PSF program, the TEA must reopen the application process for Texas school districts.

While the return of the insurer will help districts plan their issuance for 2010, those who just missed the opportunity were questioning their timing.

"I said, 'Dang, that probably would have helped,' " said Robert Criswell, chief financial officer of the Paradise Independent School District near Fort Worth. Criswell's district yesterday priced $7.6 million of refunding bonds through negotiation with Piper Jaffray & Co. and First Public LLC.

Relying on its A-plus rating from Standard & Poor's, Paradise ISD paid a top yield of 4.2% on bonds maturing in 2026. While Criswell said he was pleased with the rates, he feels certain he would have postponed the deal had he known the PSF was coming back soon.

"School districts in Texas need all the help they can get," he said.