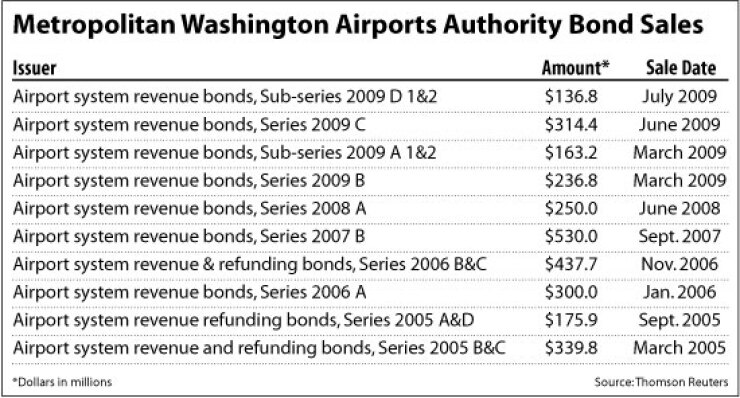

The Metropolitan Washington Airports Authority today will launch the sale of as much as $853 million of bonds - including about $360 million of taxable Build America Bonds - to fund construction of a new Metrorail line that will connect riders with the Dulles International Airport.

The project, initially envisioned 12 years ago, will add 11 new stations and 23.1 miles of rail that will extend the Metro system deep into the northern Virginia suburbs.

Construction is expected to cost $5.26 billion that will be financed with federal, state, and local funds, plus $2.9 billion of debt to be issued over four years. The revenue bonds are backed by tolls that will be increased over 10 years on the Dulles Toll Road, which runs adjacent to the new rail line.

The bonds are expected to be structured in four series. The Series A first-senior bonds are rated A2 by Moody's Investors Service and A by Standard & Poor's. The Series B, C, and D second-senior bonds are rated Baa1 by Moody's and BBB-plus by Standard & Poor's. Both agencies have stable outlooks on the credit.

The MWAA continues to weigh insurance options for the bonds and has been in contact with insurers, said Andrew T. Rountree, the authority's deputy chief financial officer. He declined to elaborate, saying price discussions are ongoing.

Mary Francoeur, a managing director for Assured Guaranty Corp., said the company expects to insure a portion of the deal. Details on the dollar amount will be finalized at pricing.

The sale begins today with a retail order period for Series A, B, and C. Any remaining bonds will be offered to institutional investors on Tuesday. The Series D bonds are expected to be issued as Build America Bonds and will be sold on Wednesday.

Bonds supported by toll revenue historically have been issued based on overly optimistic traffic and revenue projections for new toll roads, rating analysts said. But the Dulles Toll Road benefits from a 25-year record of traffic patterns, said Laura A. Macdonald, the primary credit analyst for the deal at Standard & Poor's.

With a start-up toll road, "you don't know what the base level of demand will be," she said. "Historically, there has been a lot more variation from the traffic and revenue forecasts because you're not sure what that base level of demand is."

The Dulles corridor has "very good demographics in terms of income levels" that could support the planned toll increases, Macdonald said.

Still, the revenue will be collected along just 13 miles of highway and the debt will be highly leveraged. By 2016, the bonds will have a debt-to-forecast revenue of 20-to-1, according to Standard & Poor's.

The A-rated $176 million of Series A bonds are first senior lien and have a senior claim on toll revenues. They will have serial maturities in 24 to 35 years. The only payment made ahead of the bonds will be for operation and maintenance expenses. No additional debt will be issued at this first senior-lien level.

The remaining debt will be issued as second senior-lien bonds and will be subordinate to the Series A bonds.

The $123 million of Series B bonds will be issued as capital appreciation bonds. The interest compounds semiannually beginning April 1, 2010, and investors will be paid the interest at maturity. The bonds have serial maturities between two to 27 years.

The $195 million of Series C bonds will be issued as convertible capital appreciation bonds. The bonds will not pay interest until Oct. 1, 2016, although the interest will be compounding beginning on April 1 next year. The bonds will pay semiannual interest beginning April 1, 2017. The bonds have serial maturities from 29 to 32 years.

The $359.5 million of Series D bonds are expected to be issued as BABs unless it is decided that market conditions are not favorable for such an offering. These would be the first triple-B bonds issued under the BAB program for a deal of $1 million in size or more, according to Thomson Reuters. They will have serial maturities of 32 to 37 years.

Revenue must provide 2-to-1 maximum annual debt service coverage for the series A bonds. The first- and second-lien bonds must have an annual debt service coverage of 1.35 times. Additional debt cannot be issued until the airport authority's chief financial officer certifies that revenues meet the debt service coverage requirements.

"We're targeting [reserve] levels in excess of our required rate covenant," Rountree said.

The MWAA expects to increase tolls beginning in 2010 to fund the bonds. Currently, two-axle drivers pay 75 cents at the main plaza toll and 50 cents at a toll ramp. The tolls generated $64 million in revenue in 2009, according to the authority.

Toll rates are expected to increase 25 cents beginning next year. The rates are expected to increase until 2019 when drivers will pay $3.25 at the main plaza toll and $1.75 at ramp tolls. The MWAA officials expect to generate $216 million in revenue in 2019.

Construction on the Metrorail extension began in March following $900 million in funding from the Federal Transportation Authority. Phase 1 of the project includes five new stations, four in the community of Tysons Corner and one in the city of Reston. Construction is expected to be completed by 2014. The new rail section will function as a new and separate Metrorail line, the Silver Line, operating between Wiehle Avenue in Reston and the Stadium-Armory station in the District of Columbia.

Phase 2 of the project will connect the rail to Dulles Airport and includes six new stations. Construction is expected to be finished by 2017.

The authority expects to receive an $824 million loan from the Department of Transportation in 2013 under the Transportation Infrastructure Finance and Innovation Act. This loan will be subordinate to the other series of debt.

Citi and Morgan Stanley will lead the 14-member underwriting team. Barclays Capital, BB&T Capital Markets, Davenport & Co., Estrada Hinojosa & Co. JPMorgan, Loop Capital Markets LLC, Merrill Lynch & Co. Mesirow Financial, Morgan Keegan & Co., Rice Financial Products Co., Siebert Brandford Shank & Co., and Wachovia Bank NA will be co-underwriters.

Orrick Herrington & Sutcliffe LLP will be bond counsel and Nixon Peabody LLP will represent the underwriters.

Mercator Advisors LLC will be the financial adviser. Frasca & Associates LLC, a New York-based consulting firm, has served as a pricing adviser. Horsham, Pa.-based Wilbur Smith Associates conducted the traffic and revenue estimates.