DALLAS - Oklahoma State University will acquire privately owned on-campus student housing with the proceeds from this week's negotiated sales of about $200 million of debt.

The debt, issued by the Oklahoma Agricultural and Mechanical Colleges Board of Regents, includes $62 million of tax-exempt revenue bonds and $139.9 million of taxable bond anticipation notes.

The revenue bonds were priced yesterday, with the notes going to market today. Standard & Poor's rated the bonds AA-minus and the notes SP-1-plus. Fitch Ratings provided a AA-minus for both tranches.

Goldman, Sachs & Co. is underwriter on the Bans.

The underwriting team on the revenue bonds includes Morgan Stanley, BOSC Inc., Capital West Securities Inc., Edward Jones, Merrill Lynch & Co., and Wells Fargo Brokerage Services LLC.

First Southwest Co. is financial adviser to the university. Public Finance Law Group PLLC is bond counsel.

OSU will use the proceeds to acquire student housing units on the main campus in Stillwater. The university currently leases and manages the residential units.

With the acquisition financed with proceeds from this week's sales, OSU will own all on-campus student housing.

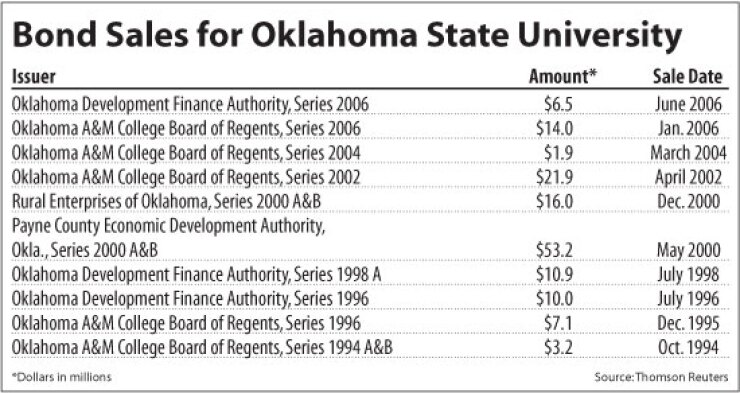

The housing, which includes residence halls and married student apartments, was funded with $161.3 million of variable-rate demand student housing bonds issued in 2002 and $59.9 million in 2005, both by the Payne County Economic Development Authority. The agency also issued bonds for OSU student housing in 1999 and 2000.

Dexia Bank currently holds the $211 million of outstanding variable-rate bonds from the 2002 and 2005 sales as bank bonds as a result of failed remarketings, according to Steve Whitworth, associate controller for OSU.

"Once the bonds went to the bank, the weekly rate went from 4.3% to the ballpark of 6.5% to 8%," he said.

Whitworth said he was pleased with the preliminary results of yesterday's bond sale. Preliminary pricing saw bonds due in 2039 offering a yield of 5.08%.

"It's going real well," he said. "We have more orders than bonds available, with some maturities being more popular than others."

The Internal Revenue Service is in the process of examining the tax exemption of the 2002 student housing revenue bonds. OSU is issuing the Ban proceeds as interim taxable financing while the IRS examination continues.

The temporary notes are secured by proceeds from long-term fixed-rate revenue bonds that the regents will issue no later than Aug. 1, 2011. The university already has obtained permission from the state for the revenue bonds.

OSU currently has $501 million of outstanding debt. Because the Payne County student housing bonds are considered off-balance OSU debt, the outstanding debt will not change with this week's sales.

Current debt includes $95.6 million of outstanding revenue bonds and $175 million of capital lease obligations.

OSU said it expects to issue $72 million of revenue bonds in 2010 for various capital projects and another $38 million in fiscal 2011 to acquire portions of the football stadium that the university currently does not own.