Most of The Bond Buyer's weekly yield indexes increased this week, despite tax-exempt yields declining slightly in the majority of the week's sessions and the market carrying an overall firmer tone.

"The muni market has shown some slight improvement," said Evan Rourke, portfolio manager at Eaton Vance. "We did have the quarter-end, so I think that kind of put a little damper on things. Really, the week was kind of muted because of quarter-end. I think people have gotten used to life in the post-arb world, if you will, so there's less trading stress right on that quarter-end.

"I think it was kind of a muted week, but I think there's plenty of cash out there for next week," Rourke continued. "My impression was that some people were sitting on some cash balances that they would put to work, they just weren't in a rush. I think there's potential there for munis to perform well next week."

Activity in the new-issue market was light during the holiday-shortened week. The largest deal to come to market was a $235.7 million Orange County, Calif., issue on behalf of John Wayne Airport, priced Tuesday by Citi. Also, Merrill Lynch & Co. priced $219.3 million of revenue bonds for Miami-Dade County to be used for a new stadium for Major League Baseball's Florida Marlins, and the Pennsylvania Higher Educational Facilities Authority competitively sold $123.6 million of revenue bonds to Merrill with a true interest cost of 4.37%.

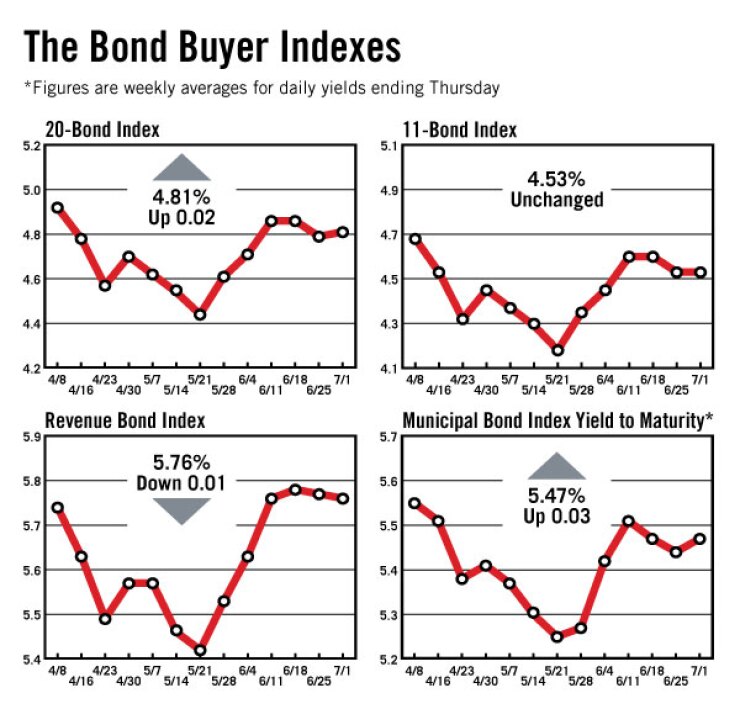

The Bond Buyer 20-bond index of 20-year general obligation bond yields rose two basis points this week to 4.81%. However, it remained below its 4.86% level from two weeks ago.

The 11-bond index of higher-grade 20-year GO yields was unchanged this week at 4.53%.

The revenue bond index, which measures 30-year revenue bond yields, declined one basis point this week to 5.76%. That's the lowest it has been since June 11, when it was also 5.76%.

The 10-year U.S. Treasury note yield was unchanged this week at 3.54%.

The 30-year Treasury bond yield rose one basis point this week to 4.34%, but remained well below its 4.63% level from two weeks ago.

The Bond Buyer's one-year note index, which is based on one-year tax-exempt note yields, rose seven basis points this week to 0.74%. That's the highest level for the index since May 20, when it was also 0.74%.

The weekly average yield to maturity on The Bond Buyer 40-bond municipal bond index, which is based on 40 long-term municipal bond prices, rose three basis points this week to 5.47%. That matched the 5.47% level from two weeks ago.