BRADENTON, Fla. - The Miami-Dade County School Board next week is expected to price $537.6 million of certificates of participation in Florida's largest single COP deal by a public school district.

The single fixed-rate series offering with 25-year maturities will be sold on Tuesday to retail investors and on Wednesday to institutional investors, according to district treasurer Silvia Rojas.

Goldman, Sachs & Co. will head up a syndicate of underwriters selling the COPs, which will be insured by Assured Guaranty Corp. The syndicate is composed of Citi, JPMorgan, Morgan Stanley, M.R. Beal & Co., Ramirez & Co., Siebert Brandford Shank & Co., and UBS Securities LLC.

Proceeds will be used for seven new schools, four school additions, three school conversions, one school partial replacement, and for remodeling and renovations.

Because of market disruptions the past few months, the school board had considered selling a portion of the new debt as variable rate, but Rojas said stabilizing interest rates prompted the district to go with an all fixed-rate deal.

"We're glad the market has settled somewhat and we look forward to some good [investor] participation next week," she said.

Ratings of A3 and A were assigned by Moody's Investors Service and Standard & Poor's, respectively.

De Lara Associates and Public Resources Advisory Group Inc. are co-financial advisers on the transaction. Greenberg Traurig PA and KnoxSeaton are special co-tax counsel. Nabors, Giblin & Nickerson PA is underwriters' counsel. Liebler, Gonzalez & Portuondo PA is disclosure counsel.

The deal will be structured with interest-only payments in the first five years to lower the district's lease payments due to budget constraints, Rojas said.

Those constraints include a constitutional tax reform amendment Florida voters approved in January placing a 10% cap on the annual increase of property assessments on all properties other than those owned by primary homeowners, which effectively reduces the assessable value available to school districts as well as other local governments.

Additionally, all of Florida's 67 school districts are facing cuts in state funding in fiscal 2009 because the state is experiencing declining revenues caused by falling sales and real estate taxes. Florida has no state income tax. The Legislature cut the millage rate available to school districts in fiscal 2009 for capital expenses to 1.75 mills from two mills, ordering school districts to use the 0.25 mill difference to support operating costs that would otherwise have been paid by the state. Although that is a one-year reduction, it could be extended.

The budget constraints limiting debt service capacity have forced Miami-Dade to also cut back on its plans for future sales.

"We originally were going to issue $500 million next year, right now it will be approximately $300 million," Rojas said. "We're reviewing the whole capital program at this point."

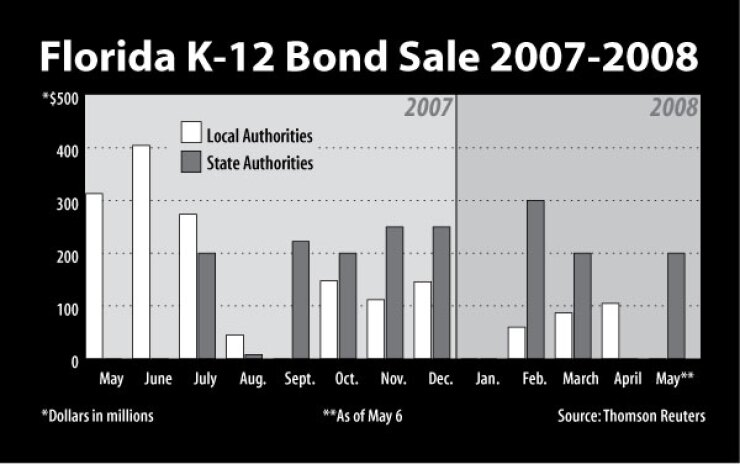

Miami-Dade is only one of a handful of Florida school districts in the bond market so far this year. To date, there have been six debt issuances for local schools for a total volume of $251.5 million, according to Thomson Reuters data.

By this same time last year, at least 14 school districts had sold more than $2.34 billion of debt in 27 issuances.

"COP issuance is down from last year," Moody's analyst John Incorvaia said. "It appears it could be from a combination of issues, but mostly insurer downgrades, uncertainty related to property tax reform, and legislative actions."

Incorvaia pointed out that school districts could be facing budgetary uncertainty for the foreseeable future. In addition to the Legislature's millage rate cut, which could be extended, Florida voters this November will be asked to consider a constitutional amendment that would enact sweeping changes in the way public schools are funded.

Just last week, the Florida Taxation and Budget Reform Commission approved a constitutional amendment that - if approved by voters - would eliminate property taxes funding public schools and replace those revenues with other sources, such as a one-cent increase in the state sales tax.

If approved, the amendment would authorize, but not require, the Legislature to increase the sales tax. It also suggests other sources of revenue, including eliminating some sales tax exemptions.

In addition to the dramatic change in public school funding, the amendment would lower the amount annual assessments can increase on commercial property and non-homesteaded property to 5% from the current 10%. However, the lower assessment would not apply to school districts which would be allowed to continue assessing up to two mills for capital expenditures unless otherwise restricted by the Legislature.

Along with tax reform and state budget cuts, property values are declining as the state's depressed economy continues suffering from national recessionary pressures, sinking real estate sales, and increasing foreclosures and bankruptcies.

Florida had the fourth-highest foreclosure rate in the country during the first quarter of 2008, RealtyTrac reported last week. Foreclosure filings were reported on 87,893 properties during the first quarter, a 178% increase over the same period in 2007.

The U.S. Bankruptcy Court's Southern District of Florida reported this week that there were 73% more business and personal bankruptcies in April compared with a year ago. The Southern District covers Palm Beach, Broward, Miami-Dade, Highlands, Indian River, Martin, Monroe, Okeechobee and St. Lucie counties.

In another school-related financing, Florida's Division of Bond Finance on Tuesday competitively sold $200 million of lottery revenue bonds on behalf of the Florida State Board of Education in its second deal of the year. The proceeds will be distributed to various school districts to build new schools.

The lottery revenue bonds were sold to Merrill Lynch & Co. with a true interest cost of 4.51%. The bonds mature from 2009 through 2027, with yields ranging from 2.83% in 2010 to 4.79% in 2026, all with 5% coupons.

The bonds were rated A2 by Moody's, A by Fitch Ratings, and AAA by Standard & Poor's.