DALLAS - After years of litigation and controversy over a bond-funded bridge to Mexico that seemed to go nowhere, the Brownsville Navigation District is expected to settle accounts with its own attorneys today.

The tab for representing the district in its battles with Dannenbaum Engineering is $302,561, said BND chairman Martin Arambula. The law firm Susman Godfrey had a choice of compensation at an hourly rate or at 40% of the $2.9 million settlement owed by the district to Dannebaum, Arambula said.

"They chose to go with the hourly rate, which is a lot more affordable," Arambula said. "We have more than enough money set aside for legal fees."

In its meeting today, the board is expected to approve the payment to the law firm.

Meanwhile, Dannenbaum continues to work on engineering of the American half of the bridge in return for the $2.9 million settlement. In the original dispute, the BND claimed that Dannebaum had failed to perform the work required under contract.

Former BND board chairman and attorney Peter Zavaletta also filed a lawsuit as an individual, claiming that Dannenbaum, a well-respected Texas engineering firm, had done little work on the bridge in exchange for $15.4 million in payments from a $21 million bond issue approved by voters in 1991.

Dannenbaum sued BND in February 2005, beating BND to court by filing in Houston, several hundred miles north of Brownsville. In its suit, Dannenbaum sought an additional $822,365. BND countersued in Brownsville in March, later losing a challenge to the Houston court's jurisdiction. The settlement in February 2007 required BND to pay Dannenbaum $2.9 million for work that has not yet begun.

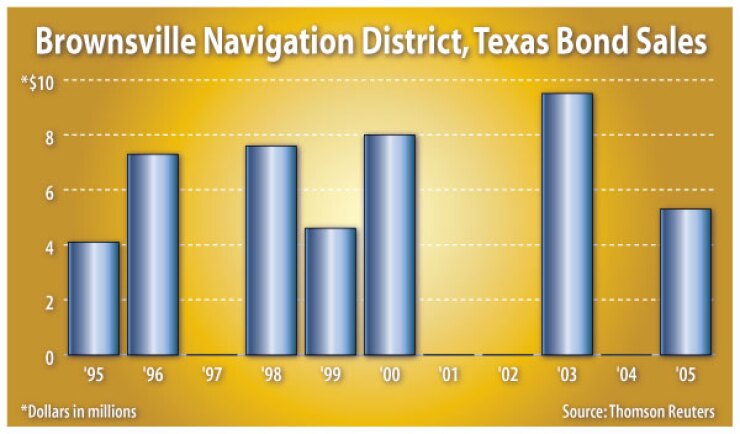

Meanwhile, BND continues to pay debt service on the bonds that mature in 2023.

The bridge, itself, remains in limbo, awaiting action on the Mexican side of the Rio Grande.

"It's in the hands of the secretary of state on the Mexican side," Arambula said. "Hopefully, we'll hear from them in the next few months."

The bridge, connecting Brownsville to Matamoros, is expected to cost $60 million, divided between the BND and the Mexican government.

Brownsville, the southernmost city in Texas, is connected to Matamoros by three bridges currently. The new bridge was intended to ease commerce between the U.S. and Mexico.

James Dannenbaum, president of the company that bears his name and a University of Texas regent, last year denied accusations that the firm misled or cheated the district.

He said in an interview last year that his company was called in to rescue the project six years after the bonds were approved.

"They hired another firm that got nowhere, and we were hired to see what we could do with it," Dannenbaum said.

The original contract went to Halliburton subsidiary Brown & Root, which was paid $424,505 before the company was fired and replaced by Dannenbaum in 1997. Dannebaum had hired state Sen. Eddie Lucio for consulting work, and Lucio introduced Dannebaum to the BND board.

Danenbaum's original contract for $2 million grew through a series of supplemental contracts to $15.4 million.

To make the project work, Mexico had to agree to finance its half of the bridge. But the road on the Mexican side was unpaved, Dannenbaum said, "and the Mexican government said it had no interest in connecting [the bridge] to a mud road."

To make the project viable, Dannenbaum said he introduced planners to people in Mexico who could develop paved roads and rail corridors that would link the bridge to a container port on the west coast of Mexico.

Of the $15.4 million paid to Dannenbaum, about $10 million went to Mexican subcontractors according to navigation district documents.

Despite the $21 million boondoggle, the navigation district retained an A rating on its GO debt with a stable outlook from Standard & Poor's. Moody's Investors Service rates the GO debt A2. Fitch Ratings does not provide underlying ratings on the district.