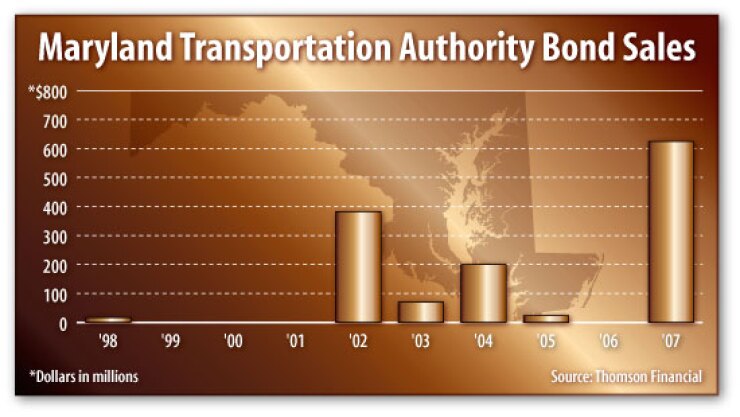

WASHINGTON - The Maryland Transportation Authority, which operates a network of toll roads, will issue about $570 million of fixed-rate, tax-exempt revenue bonds in a competitive transaction Wednesday.

The sale comes as yields on municipal bonds have dropped from peaks reached in recent days. MdTA finance director Alison Williams believes that the demand for the authority's debt issue will offset upward pressure on yields.

Standard & Poor's and Fitch Ratings assigned the bonds, which are backed by toll revenue, a AA-minus rating with a stable outlook. Moody's Investor Service rated the deal Aa3 with a stable outlook.

"There has been a flight to quality," Williams said in an interview last week. "Because there is so much uncertainty in the market, and so many downgrades, that goes in our favor."

The yield on a triple-A, 30-year general obligation bond, an industry benchmark, was 4.84% on Thursday, down from the 5.14% reached on the previous Friday, according to Thomson Municipal Market Monitor.

Williams declined to speculate what the yield would be on the issue. The MdTA last issued revenue bonds in September - $300 million of the debt that carried a yield of 4.5679%. A team led by Goldman, Sachs & Co., which beat out five other syndicates, underwrote the deal.

This week's sale comes as two of the nation's most notable investors have recently taken large stakes in munis. Wilbur Ross of WL Ross & Co. reportedly purchased $1 billion of municipal bonds, and PIMCO bond fund manager Bill Gross acquired $1.5 billion of tax-exempt securities.

Investors have been buying munis in order to take advantage of high yields that have resulted from various factors, including failed auctions for auction-rate securities, a type of long-term debt with rates that reset periodically through a Dutch auction. Lenders also have increased their standards as a result of losses triggered by record defaults of subprime mortgages that were used to back collateralized debt obligations and other corporate debt instruments.

The MdTA has no auction-rate or variable-rate debt.

The subprime crisis also has affected some bond insurers with significant exposure to debt backed by troubled subprime mortgage loans. Those insurers have faced financial troubles and actual or threatened rating downgrades.

The Maryland agency is still deciding whether to use bond insurance with the upcoming deal. The authority used Financial Security Assurance, which has retained its gilt-edged rating from the major rating agencies, to insure the $300 million issue in September.

"We are still evaluating, so I really can't say one way or the other," Williams said "What you do is compare what the cost would be with insurance versus without insurance and make sure that it is cost-effective, so you are not purchasing bond insurance and not receiving any benefit."

Bond counsel for the transaction is McKennon Shelton & Henn LLP. Davenport & Co. and Public Financial Management Inc. are the financial advisers.

Williams said the MdTA had considered selling as much as $685 million of bonds this week but it was decided to do $570 million as finance officials "fine tuned the cashflows on various projects."

The Maryland Transportation Authority was established in 1971 to construct, manage, operate ,and improve the state's seven toll facilities, as well as for financing new revenue-producing projects. The net revenues generated by the transportation facilities will repay the bonds.

The facilities include a system of toll roads serving established, high-volume travel markets, including Interstate 95 between Baltimore and the Maryland-Delaware state line; three bridges which cross the Chesapeake Bay near Annapolis, the Potomac River connecting Southern Maryland with Virginia, and the Baltimore harbor; and tunnels on I-95 and Interstate 895, which both cross Baltimore harbor.

The system is "well-diversified" and the MdTA maintains "monopoly control over central Maryland's essential highway, bridge, and tunnel network, particularly Interstate 95," Standard & Poor's analyst Adam Torres said.

He also pointed out that the MdTA has a "willingness and ability to raise toll rates, [which they] demonstrated by a 100% to 150% toll increase for noncommuters from 2001 to 2003, and traffic levels that showed relative inelasticity over that time, growing 3.4% since 2002, and taking into account an initial slight 0.3% decline in traffic from 2002 to 2003."

Fitch analyst Manutosh Mathur said "the rating incorporates MdTA's track record of strong financial performance that has allowed the authority to meet its operating, debt service, and capital needs while at the same time maintaining high liquidity levels."

Tom Paolicelli, an analyst with Moody's, said its rating is based, in part, on a "long history of strong demand for the authority's essential and established transportation facilities based on well-developed and growing service area."

All three analysts warned that about 70% of the MdTA's $4.15 billion six year capital improvement plan will be bond financed, which will put pressure on the system's finances to pay the additional debt service and reduce debt service coverage ratios.

Much of the capital plan involves the construction of the Intercounty Connector, which is a $2.4 billion, 18.8-mile toll road that will provide an east-west traffic link between I-270 in Montgomery County and I-95 in Prince George's County. The road will begin contributing revenue once it becomes operational in 2010.

The MdTA plans to issue about $425 million of grant anticipation revenue vehicles for the ICC project sometime after July 1, Williams said. The Garvee deal will be the state's second. Garvees are typically issued by state governments to finance the construction of transportation projects and are repaid with future federal transportation grant funds

The first Garvee deal came in May when the MdTA issued $325 million in a negotiated transaction that financed initial construction costs of the ICC.

In addition to the $750 million of Garvees, other sources of project funding include $264 million from Maryland, $180 million from the Maryland Department of Transportation, and $1.2 billion of MdTA-issued toll revenue bonds