SAN FRANCISCO - Kevin Kone sold $90 million of notes with a 1.5% yield this week, and he's going on vacation.

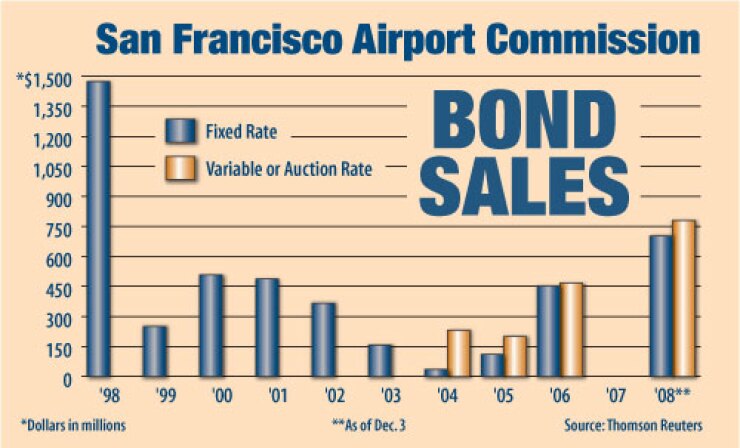

Like many municipal debt managers, Kone, the assistant deputy airport director for capital finance at the San Francisco Airport Commission, which runs San Francisco International Airport, has had a brutally busy year in 2008. Kone and the airport staff managed nine debt sales totaling more than $1.5 billion.

"We're done," Kone said, though he acknowledges he has said that many times before this year. "Hopefully we're not going to be doing anything else for a while. Knock on wood."

After the auction-rate securities market failed, Kone spent the first half of the year replacing the airport's $450 million ARS debt portfolio with variable-rate demand obligations backed by letters of credit or a combination of standby bond purchase agreements and bond insurance.

Since a portion of the VRDO portfolio stopped performing due to insurer and bank downgrades in late summer, he has been working overtime to restructure the debt in a market with no liquidity and little demand for long-term debt.

Those travails made Kone one of the poster children for the municipal market meltdown this year. He has faced front-page stories in The Bond Buyer that publicly chronicled how his carefully planned solutions to the ARS debacle crumbled with the advent of problems in the VRDO market.

Worse yet, SF Weekly - a local newspaper that is read by his supervisors and their elected bosses - wrote in August that the "apparent bumbling" and "maladroit financial engineering" by the "zeros" who manage the airport's bonds could result in a "fiery crash that could end up costing local taxpayers millions of dollars."

The paper objected to refunding ARS with insured debt after the last standing triple-A rated bond insurers, Assured Guaranty Corp. and FSA Assurance Corp., began to face credit questions from increasingly nervous investors and credit analysts.

What is unusual is that Kone has remained open and accessible about each new problem. Unlike many public servants stung by intense scrutiny and public criticism, he answers his phone and explains himself to investors and reporters.

He even laughs about his own frustration. And he understands the variable-rate debt portfolio he has helped create well enough to explain both the complex solutions he and his team of financial advisers devise, as well as the risks those solutions entail.

"He's not defensive about it because they've made some very informed decisions in terms of the marketplace," said airport financial adviser Vincent McCarley, chief executive officer of Backstrom McCarley Berry & Co. in San Francisco.

The airport was in a very tough position after the bursting of the dot-com technology bubble, the 2001 terrorist attacks, and the 2003 outbreak of Severe Acute Respiratory Syndrome in its key Asian markets.

Business contracted by 25%, and that meant debt service obligations rose relative to airport revenues, putting pressure on officials to hike already steep landing fees. Instead, they cut their debt service costs by diversifying into variable-rate debt. They accepted some risks to cut fees, and that paid off when relatively healthy discount carriers like Southwest Airlines and Virgin American moved flights to SFO.

Kone continues to believe that the airport has benefited by keeping a portion of its debt in variable-rate securities that take advantage of short rates at the front of the yield curve. He is not willing to throw away that benefit just because it's hard to explain.

"Our variable-rate debt for the most part is trading well again," Kone said. His VRDO resets ranged from 0.8% to 3.5% this week.

Through it all, Kone has also insisted on being among the first to hit the market with the latest solutions to the credit crunch when he gives up on an issue. In spring, the airport rushed to refinance with VRDOs the ARS that were facing failed auctions.

Kone wanted to get liquidity commitments before banks ran out of capacity to issue standby bond purchase agreements and LOCs for municipal issuers. That decision looked prescient when most banks stopped providing new liquidity early this summer.

But some of the repaired issues began to suffer with downgrades to their liquidity providers. The biggest problems hit bonds backed by a Depfa Bank standby bond purchase agreements. Investors refused to buy Depfa-backed debt after the bank was downgraded to BBB-plus in September. The bonds got put back to the bank, where they faced penalty rates as high as 9.5% and accelerated amortization.

Kone and his advisers decided they had to find a place to park $284 million of Depfa-backed debt while they waited for the market to regain equilibrium. In October, the airport sold $224 million of notes that mature in two to four years. This week's $90 million note deal was the second and final installment in the two-part restructuring.

The deals were subject to the alternative minimum tax, which limited their marketability. The airport decided to compensate by tapping into increasing demand for short-term debt.

This week's $90 million note garnered the highest ratings from the three rating agencies, compared to the airport's single-A long-term ratings, and the deal was five-times oversubscribed on strong interest from money market funds. The yield was just 1.5% on the notes, which were senior managed by Banc of America Securities in a syndicate with JPMorgan and RBC Capital Markets.

Both of the Depfa-repair deals were the first of their kind for a U.S. airport, hitting the market with AMT debt and tapping money fund demand before competitors.

The deals also employed a novel structure under which the airport bought the outstanding VRDOs and parked them in a trust. By keeping the VRDO issue alive, SFO keeps the option of salvaging the deal, its swap, and its insurance when market conditions improve.

"We've left ourselves a number of different options that are not contingent upon whether there is revived LOC or SBPA support available," McCarley said.

The airport can remarket the variable-rate debt next year if new liquidity agreements are available. If liquidity remains scarce, the airport can sell long-term fixed-rate debt or continue to roll over the short-to-intermediate term debt until the credit crunch ends.

By staggering the maturities over four years, Kone and his colleagues made sure the airport is prepared if the market is completely dead by then. SFO would have the money to pay off the bonds if the market is still dysfunctional in one to four years.

"I'm managing a very big variable-rate portfolio, and I don't know what is going to happen next," Kone concluded. "We're managing and monitoring it closely."

If the market takes another turn south, he says he'll be quick to react. Just not next week - he's taking a long-awaited vacation.