CHICAGO - Minnesota faces a record $5.2 billion deficit in its current budget and through the next two-year spending cycle, a number that prompted several lawmakers to propose leasing the state's lottery and main airport to raise revenue. The budget situation also prompted warnings of the need for steep cuts, tax and fee increases, and draining reserves to erase the red ink.

The annual November forecast - traditionally released in early December - anticipates a revenue shortfall of $412 million in the current biennium that ends June 30. With some small increases in spending, the current budget deficit would increase to $426 million.

Collections from income, sales, corporate, and motor vehicle taxes are all expected to slip. Income taxes will generate $201 million, or 1.9%, less than previously projected and sales taxes will fall about $145 million, or 1.6%, short.

State economic advisers also now anticipate that revenues in the fiscal 2010-11 biennium that begins July 1 will fall 9.4% short of previous estimates released last February.

Officials now expect to collect $3.321 billion less in revenue than previously predicted while anticipating $580 million more in spending. When combined with the previous estimate of a $946 million deficit, Minnesota faces a $4.8 deficit over the two-year period.

Total revenues are expected to be down 1.8% or $579 million less than revenues collected in the current biennium. Nearly $1.8 billion of spending growth during those next two years will come from steep increases needed to cover health care and human service expenses.

The state's economic advisers attributed the anticipated shortfall to the significant deterioration of the nation's economic outlook with slight growth not expected until 2010 and more traditional growth of at least 3% not anticipated until 2011.

Minnesota is required under its statutes to close the current shortfall before the fiscal year ends.

"This historic budget deficit will be a challenge, but it will also be a further opportunity to reform, prioritize, streamline, and shrink state government, not add to the burden on Minnesotans by raising their taxes," Gov. Tim Pawlenty said at a news conference with Department of Finance Commissioner Tom Hanson and state economist Tom Stinson to announce the forecast.

Pawlenty ordered state government agencies to cut by 10% their unspent operating funds to save $25 million to $50 million and the state will tap the $155 million that remains in its once flush reserve.

The governor said he would consult with legislative leaders on other actions to shore up the current budget. The Legislature is controlled by Democrats while Pawlenty is a Republican. The state previously had imposed hiring restrictions on departments.

The governor will present his next two-year budget to lawmakers on Jan. 27. Minnesota last May closed a nearly $1 billion deficit in the current budget through a mix of spending cuts and by taking $500 million from state reserves.

Two Republican lawmakers - Geoff Michel of Edina and Laura Brod of New Prague - floated the idea of leasing state assets including the Minneapolis-St. Paul International Airport and the lottery as options for raising revenues.

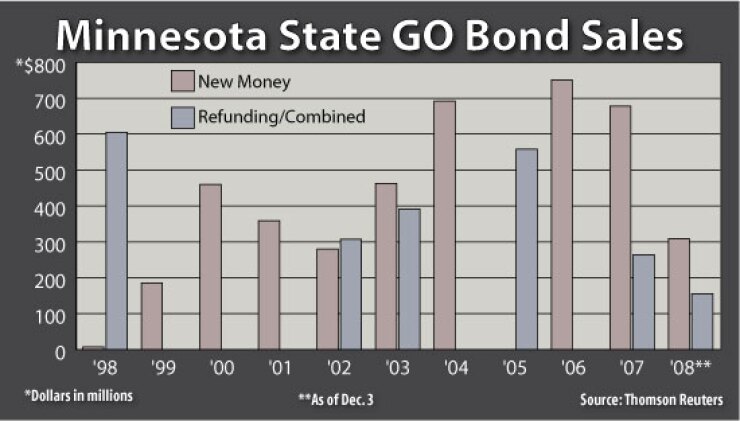

The projected deficit also stands to impact future state borrowing plans. The state has traditionally limited its debt service to no more than 3% of non-dedicated general fund revenues. Minnesota has $4.25 billion of outstanding general obligation bonds and another $3.14 billion of authorized borrowing capacity from its past bonding bill packages.

In reviewing anticipated borrowing over the next six years, anticipated borrowing rates, revenue projections, and other economic factors, officials anticipate exceeding that 3% capacity if bonding bills of $720 million are approved in even years and $120 million in odd years. The state typically passes a larger package in the first year of a new biennium, and an operating budget in the second year.

"When you look at all the factors we will exceed our 3% cap," said Kathy Kardell, assistant commissioner for treasury. She added that it "will be a policy decision" as to whether the state should scale back on future capital budgets or exceed the cap.

The revenue projections will not impact a stalled $443 million GO sale. Its timing remains dependent on market conditions. Officials put the deal on hold earlier this fall as they watched for others to bring their large competitive transactions. None have sold to date in the range of Minnesota's deal. The Port Authority of New York and New Jersey this week postponed a sale after receiving no bids on its planned competitve $300 million taxable note sale.

Kardell hopes to bring the deal to market in January and is watching to see how a large competitive GO deal from Pennsylvania - which was cut back to $300 million from $600 million this week - and a big Miami-Dade County GO sale scheduled for next week are received. Minnesota's timing is also dictated by disclosure items such as the November and February forecasts and passage of the budget.

The state's GOs are rated AAA by Fitch Ratings and Standard & Poor's and Aa1 by Moody's Investors Service with a positive outlook.