Moody's Investors Service Friday downgrade of Assured Guaranty Corp. and Financial Security Assurance Inc. from Aaa had little immediate impact on the municipal market, participants said.

Moody's downgraded Assured Guaranty to Aa2 with a stable outlook and FSA to Aa3 with a developing outlook. Both had been on review for possible downgrade since July 21.

"I don't think anybody's really reacting to it, since everybody knew it was coming," said Bob MacIntosh, chief economist and co-director of municipal investments for Eaton Vance. "It's kind of a relief to get it over with."

"I don't think of this as catastrophic news," said John Mousseau, vice president and portfolio manager at Cumberland Advisors.

Moody's downgraded the insurers Friday, one day after releasing a report that raised questions about whether any bond insurer could have a stand-alone rating triple-A rating in light of recent developments in the industry. In its report, Moody's re-evaluated many of the historical assumptions it made about the companies, noting the industry "is facing its biggest stress of its 30-plus year history."

The downgrade to Assured reflected its "view that the business model of financial guaranty insurance has been damaged over the past year due to sustained turmoil in credit markets and the very poor performance exhibited by a number of guarantors."

Moody's said the downgrade of FSA represented its "diminished business and financial profile resulting from its exposure to losses on US mortgage risks and disruption in the financial guaranty business more broadly."

Assured Guaranty Ltd. earlier this month agreed to purchase Financial Security Holdings Ltd., excluding its troubled financial-products unit.

Berkshire Hathaway Assurance Corp., the lone remaining insurer rated Aaa by Moody's, would not be rated as highly without a guarantee from affiliate Columbia Insurance Co., the rating agency has said in the past.

Assured Guaranty Ltd. president and chief executive officer Dominic Frederico criticized Moody's methodology, saying it emphasized Moody's subjective view of the future of the industry, rather than capital adequacy and portfolio quality. Although he said the future concerns are valid, "they should not be overwhelming criteria," Frederico said.

"That's all in the future, that has nothing to do with our ability today to settle every policyholder obligation on a timely basis," he said in an interview yesterday.

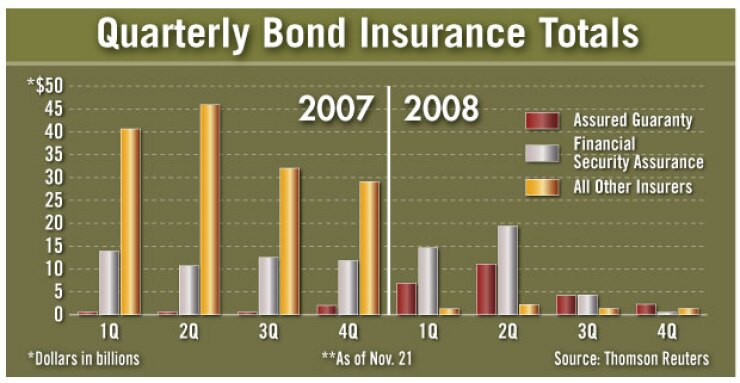

Assured and FSA mostly avoided the exposures to collateralized debt obligations of asset-backed securities that haunted other insurers, putting themselves in position to score new business as others got downgraded. With FSA taking the top spot, they combined for a market share of more than 80% through the first half of the year and benefitted from better pricing because of a lack of competition.

But business has slowed for both firms since Moody's put them on review for downgrade in July. Insurance penetration has fallen to below 10% so far in the fourth quarter from 27% in the first quarter of this year.

Frederico criticized Moody's in a statement Friday for its "repeated and long credit-review process," which "exacerbated investors' fears and harmed overall financial market credibility, which ultimately has created more unceratinty about the value of our product than was necessary."

Although Assured was "disheartened" by the downgrade, it sees some relief in having a stable rating. Frederico expects the market will recognize its strength in the future.

Assured and FSA still have AAA ratings from Standard & Poor's and Fitch Ratings. Both agencies have FSA's rating on negative watch.

"[The downgrade] will have a short-term impact, but we think in the longer term people are going to pay attention to those issues that are most important, and, therefore, give the company the credit and position that it deserves," Frederico said.

Assured will not change its strategy as a result of the downgrade, he said. Following its acquisition of FSA, it still plans to maintain two insurance companies: one to write only municipal credits and a second that will back public and structured finance deals.

The market had already priced potential downgrades into bonds wrapped by Assured and FSA, market participants said. Except for Berkshire Hathaway Assurance, the market has largely discounted the value of insurance, according to Paul Brennan, portfolio manager at Nuveen Investments.

"Investors aren't assigning much if any value to the bond insurance anymore, so it wasn't really a main event in the fact that it's affecting valuations on bonds," he said.

Brennan, though, said there is still likely a need for bond insurance in the long term. Mousseau said "there's certainly room for bond insurers down the road, especially for either lower rated or less well known issuers."

With the stable rating, Assured should still be able to do some business in the near term, according to Municipal Market Advisors managing director Matt Fabian. Once more risky sectors and lower-rated credits try to enter the market, penetration could increase, he said. But given the changing nature of the industry, it's difficult to make any predictions about the future.

"The market is evolving so quickly, it's really hard to judge what people's appreciation of bond insurers will be," Fabian said.

Elsewhere, Standard & Poor's downgraded Financial Guaranty Insurance Co. to CCC from BB with a negative outlook. FGIC earlier this year ceded $166 billion of its public finance portfolio to MBIA Inc.

"The current loss estimates for FGIC's exposure to 2005-2007 vintages of nonprime and second-lien mortgages and related collateralized debt obligations of asset-backed securities of almost $5 billion remain in excess of the company's claims paying resources of about $4.2 billion," Standard & Poor's credit analyst Robert Green said in a statement.