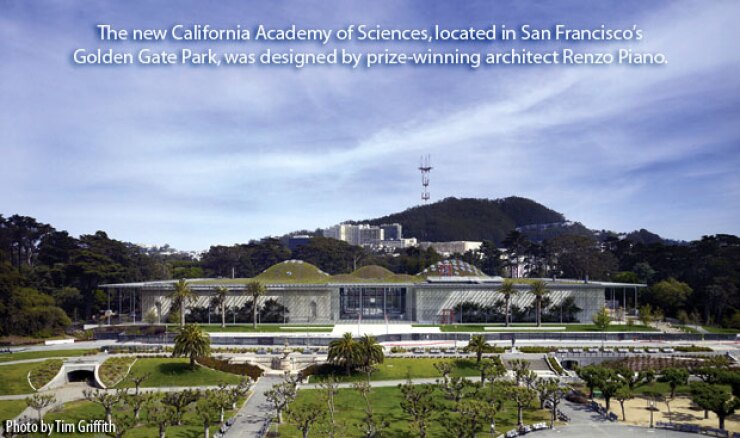

SAN FRANCISCO - The doors open tomorrow at the recreated California Academy of Sciences here in Golden Gate Park, transformed into what backers say is a world-class museum with equally world-class architecture.

Much of the financing for the $488 million project came through tax-exempt bonds, a large portion of which were refinanced this year during a tumultuous period in the variable-rate markets.

The academy combines a natural history museum, a planetarium, an aquarium, and a life sciences research organization into one institution under one roof.

That 2.5-acre living roof is the centerpiece of the new academy, designed by Pritzker Prize-winning architect Renzo Piano. It was designed to embody the institution's mission to explore, explain, and protect the natural world.

"This is going to be the largest and most visited green building in the world, and the design that Renzo Piano developed is expected to bring people who are interested in the content of the museum and people interested in the architecture as well," said Nikolai Sklaroff, head of cultural institution investment banking at JPMorgan, underwriter and remarketing agent for the academy's revenue bonds.

In its ultimate financing over the summer, the academy borrowed $281.5 million through daily variable-rate demand revenue bonds, in a deal that provided $89 million in new money while refinancing all of its outstanding revenue bonds issued in 2003 and 2005.

The new financing allowed the academy to get out of auction-rate securities, as its 2003 and 2005 deals were structured.

Sklaroff said that, even before the auction-rate market seized up, the academy had been planning to wrap everything together in a final financing. With construction of the academy's new building substantially complete by the end of 2007, the academy's credit risk profile had changed.

"By redoing the indenture now that construction was essentially complete, we were able to negotiate substantially less onerous covenants from a credit perspective," he said.

The final financing, issued through the California Infrastructure and Economic Development Bank, or I-Bank, came in six series of daily VRDBs, ranging in size from $24.6 million to $93.4 million, wrapped by six different letter of credit providers.

Hawkins Delafield & Wood LLP was bond counsel and Nixon Peabody LLP underwriter's counsel.

Sklaroff said a lot of effort went into making the liquidity arrangements manageable for the academy.

"An issuer like the academy isn't issuing tax exempt debt on a regular basis, and its unlikely they'll be issuing new bonds anytime soon," he said. "It was important to us to make sure that administratively, although we have six different banks, they didn't have six different covenants." The LOCs are for three years, he said.

The market dislocations caused by bond insurance downgrades did force the deal team to change its approach in some ways, Sklaroff said.

MBIA Insurance Corp. had insured the previous transactions and had been part of initial planning for this year's bond issue, according to a staff report prepared for an I-Bank meeting this year.

This spring, the Academy of Sciences went out to obtain its own underlying credit ratings: A2 from Moody's Investors Service, A from Standard & Poor's, and A-plus from Fitch Ratings.

Based on the joint support of the underlying ratings and LOC ratings, the bonds themselves secured triple-A long-term ratings from Moody's and Standard & Poor's.

"I think its clear that underlying ratings have become much more important for LOC transactions," Sklaroff said. "We see a discernible advantage to having that underlying rating in this market."

The bonds all carry a 2038 maturity, with principal amortized in the final five years.

"It is a structure that we've used a lot with these types of cultural institutions where there's a strong existing balance sheet, but there's also a strong fundraising campaign. They get the benefit of both sides," Sklaroff said.

The variable-rate demand structure allows prepayment at any time, but also allows the institution flexibility to negotiate with donors over the time frame in which pledges are paid, he said.

He added that the academy benefited from a strong public profile that enabled it to win two different San Francisco general obligation bond referendums, generating more than $116 million for the project. Those bond elections required two-thirds supermajorities.

"This museum - because it's so popular with families, because nearly every school kid in the Bay Area takes a field trip at some time to the California Academy of Sciences - it had strong popular support, and it had support for a GO bond," Sklaroff said.