DALLAS - The Bexar Metropolitan Water District's underlying A credit rating is off Standard & Poor's negative watch after the San Antonio-based utility raised water rates to replenish its dwindling cash reserves.

The rating agency placed the utility on CreditWatch on March 13 after net revenues were reported as insufficient for monthly payments to the interest and sinking fund for debt service. The resulting shortfall represented a technical default under the district's bond covenants.

Moody's Investors Service, which placed BexarMet's A3 rating on negative watch Feb. 27, is reviewing recent actions by the district for a possible change in that status, said analyst Douglas Benton.

Fitch Ratings placed the utility's A-minus rating on its negative watch list March 20 but has not announced any change in status.

To meet a required May 1 debt service payment, district officials issued $10 million of taxable revenue notes that were privately placed with Bank of America. The noncallable notes are payable on May 1, 2011. The notes are subordinate to about $140 million of outstanding bonds.

"The district's willingness to adopt the necessary rate adjustments to meet its obligations with operating revenues will be a key determinant of its future credit quality," Standard & Poor's credit analyst Horacio Aldrete advised the district in his March ratings watch statement.

The district's credit was imperiled after the board approved a rate cut that reduced revenues pledged toward repayment of the bond debt. After the utility was placed on the watch list, BexarMet's general manager Gil Olivares sought to replace the financial adviser Samco Capital Markets on the basis that Samco's Mike Villarreal, also a Texas state legislator, failed to warn of the impending trouble. However, the San Antonio Express-News obtained a memo showing that Villarreal did warn of the threat nearly a year earlier. Ultimately, the board voted to retain Samco.

Since the issuance of the notes, the district has approved a 14% increase in water rates beginning July 1. The higher rates are expected to gradually restore the system's cash reserve levels to 66 days of cash on hand by the end of fiscal year 2009, and 120 days by the end of fiscal 2010.

The district also is selling off several properties to improve its balance sheet.

Standard & Poor's also took the Canyon Regional Water Authority and Bexar Metropolitan Development Corp. off CreditWatch, where they were placed in March because of their relationship with the water district.

A pledge of lease payments from a Bexar Metropolitan Water District treatment plant secures the Bexar Metropolitan Development Corp.'s bonds.

The Canyon Regional Water Authority's bond rating is based on the strength of its largest participant, the Bexar Metropolitan Water District, and the utilities' joint contracts.

In addition to the rate increases, the Bexar district's board on Wednesday adopted new policies that include boosting the reserve fund to 120 days of cash on hand and providing monthly reports to the district's financial adviser on debt management and capital improvement plans.

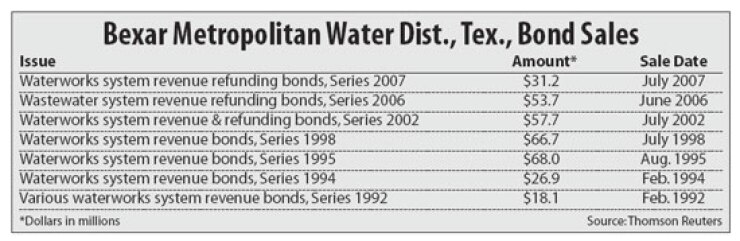

The district in 2007 issued $31 million of refunding bonds backed by XL Capital Assurance Corp. A previous $39 million refunding issue in 2006 was insured by MBIA Insurance Corp.

The district provides water to about 85,000 customers not served by the San Antonio Water System. The district has historically served low- to moderate-income residential customers in outlying areas south of San Antonio but has recently encompassed some high-wealth subdivisions in areas north of the city.