-

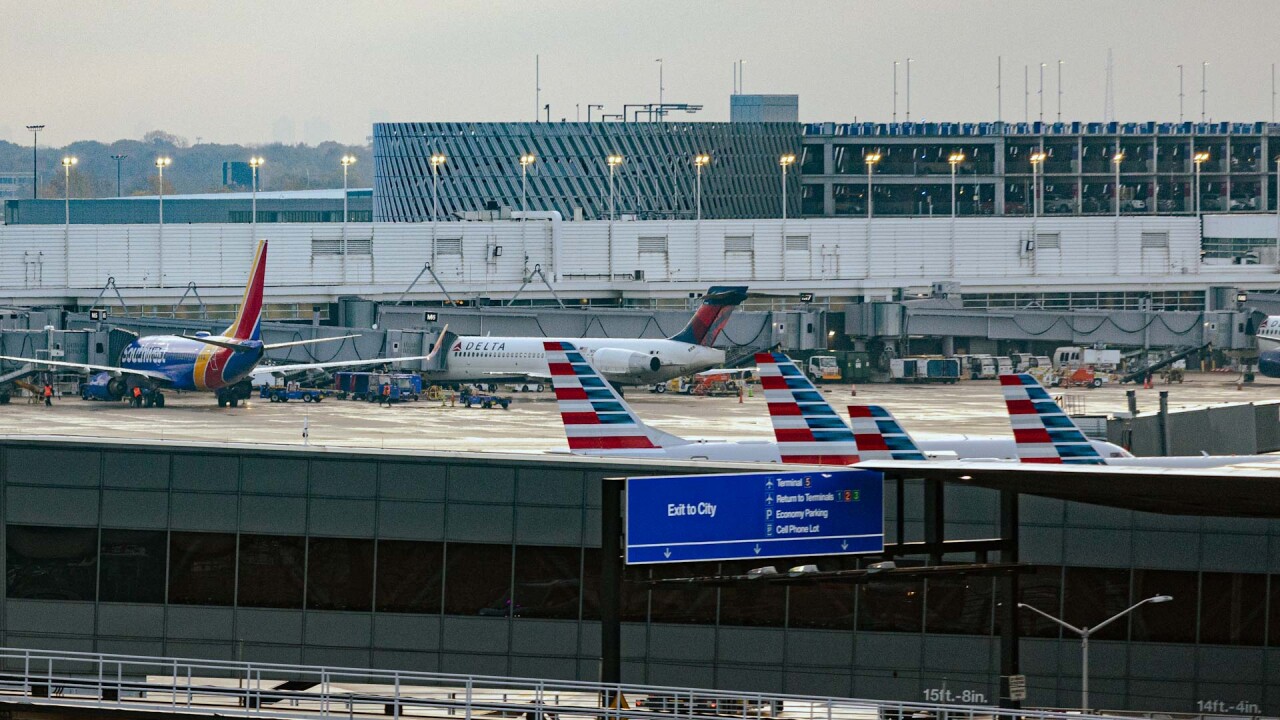

The airport paired long fixed-rate debt with four- and seven-year mandatory tender bonds in the transaction honored as the Southwest region's Deal of the Year.

November 18 -

The long-awaited budget closely resembles the governor's original proposal, pared down by just over $1 billion.

November 17 -

Negative rating and outlook revisions for U.S. K-12 public school districts rose markedly from 2024 to 2025, according to S&P Global Ratings.

November 14 -

The Florida county is in the midst of executing a $9 billion capital improvement plan.

November 13 -

The airport's sprawling capital improvement program is expected to total $11.5 billion over the next decade, $9 billion of it bond funded.

November 12 -

New York will license up to three casinos in New York City. What returns can the state and expect on new entrants to an increasingly crowded gambling market?

November 10 -

The California Debt and Investment Advisory Commission explored public finance solutions to child sexual abuse claims this week at an event in San Diego.

November 7 -

Louisiana State Treasurer John Fleming indicated he is open to compromise on the nature of state oversight for the city, which may have trouble making payroll.

November 6 -

City and state law mean it's unlikely that Mamdani will be able to enact the parts of his agenda that would have major impacts on the city's credit.

November 5 -

Illinois' General Assembly passed a bill that provides both governance reforms sought by lawmakers and funding to avert a Chicago transit fiscal cliff.

November 5 -

Federal immigration and trade policies are a likely factor in the triple-A-rated state's weak job growth and pose risks for its southern border cities' budgets.

November 4 -

Pennsylvania's budget impasse has surpassed four months. Local governments and schools that rely on state funds are getting frustrated.

November 3 -

The Los Angeles Department of Water and Power will sell $977.6 million of water revenue bonds as it grapples with the impacts of January's devastating wildfire.

October 31 -

The bankruptcy judge suggested Jackson Hospital and Clinic may be closed if it doesn't propose a plan of adjustment before the end of the calendar year.

October 30 -

After Immigration and Customs Enforcement agents arrested its superintendent, Des Moines Public Schools is taking a $265 million GO bond measure to voters.

October 29 -

Voters will decide the fate of 447 bond propositions totaling a record $83.7 billion with development-related districts accounting for most of the debt.

October 28 -

California's recent tax revenues exceeded forecasts, but the state faces structural deficits that drive budgetary borrowing and have narrowed its reserves.

October 24 -

North Carolina's triple-A ratings were affirmed ahead of plans to sell up to $506 million in general obligation and limited obligation bonds.

October 23 -

Brandon Johnson released his $16.6 billion 2026 budget last week. The budget calls for new revenue sources, but avoids property tax hikes.

October 22 -

Cities are responding to a state directive to remove symbols on crosswalks and other so-called distractions or risk losing state and federal funding.

October 21