-

The MSRB's first podcast will focus on yield curves.

April 9 -

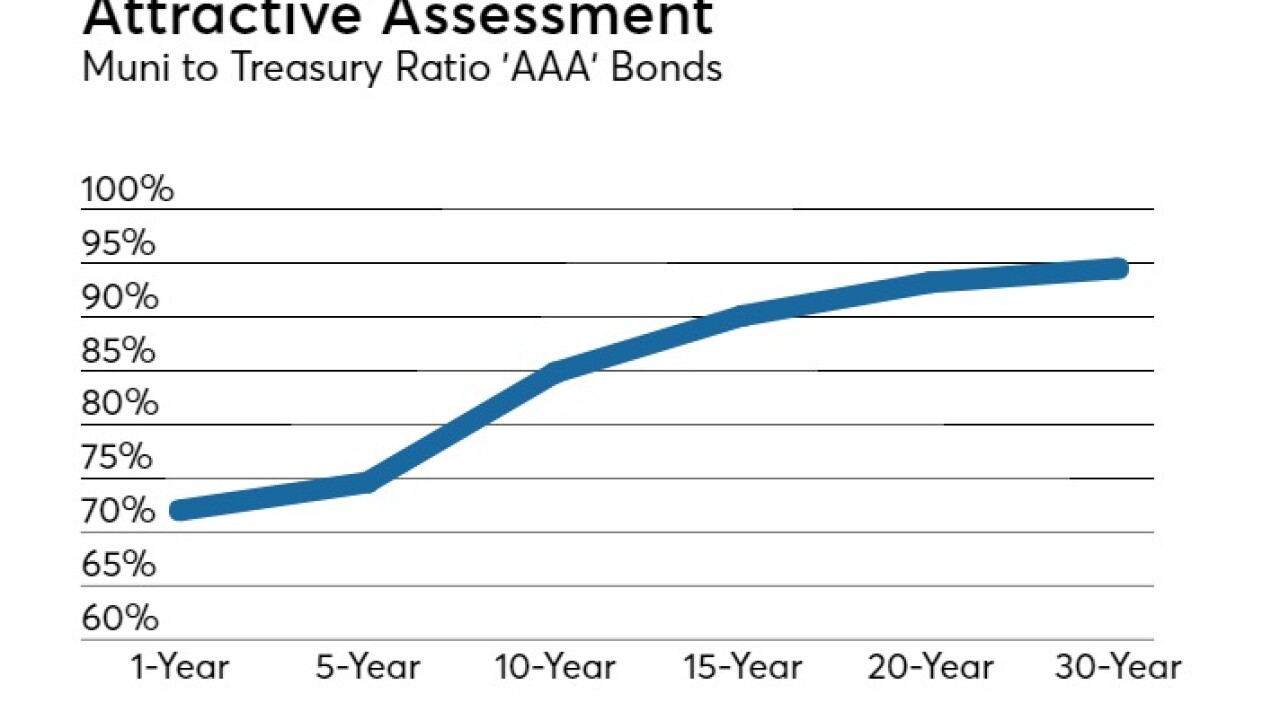

Undersupply and demand for the muni exemption in high tax states are expected to help municipal bonds outperform in the second quarter.

April 5 -

Analysts say lessons from the events of 2018 can forecast what lies ahead in 2019.

January 2 -

With municipal yields rising more than they have in years, investors see a rare opportunity for fourth-quarter tax swaps.

October 9 -

Portfolio managers say taxable alternatives have appeared cheaper lately when compared to the short end of the tax-exempt yield curve.

August 27 -

While aversion to an inverted yield curve is strong in the municipal market, an inversion isn’t yet a foregone conclusion.

June 20John Hallacy Consulting LLC -

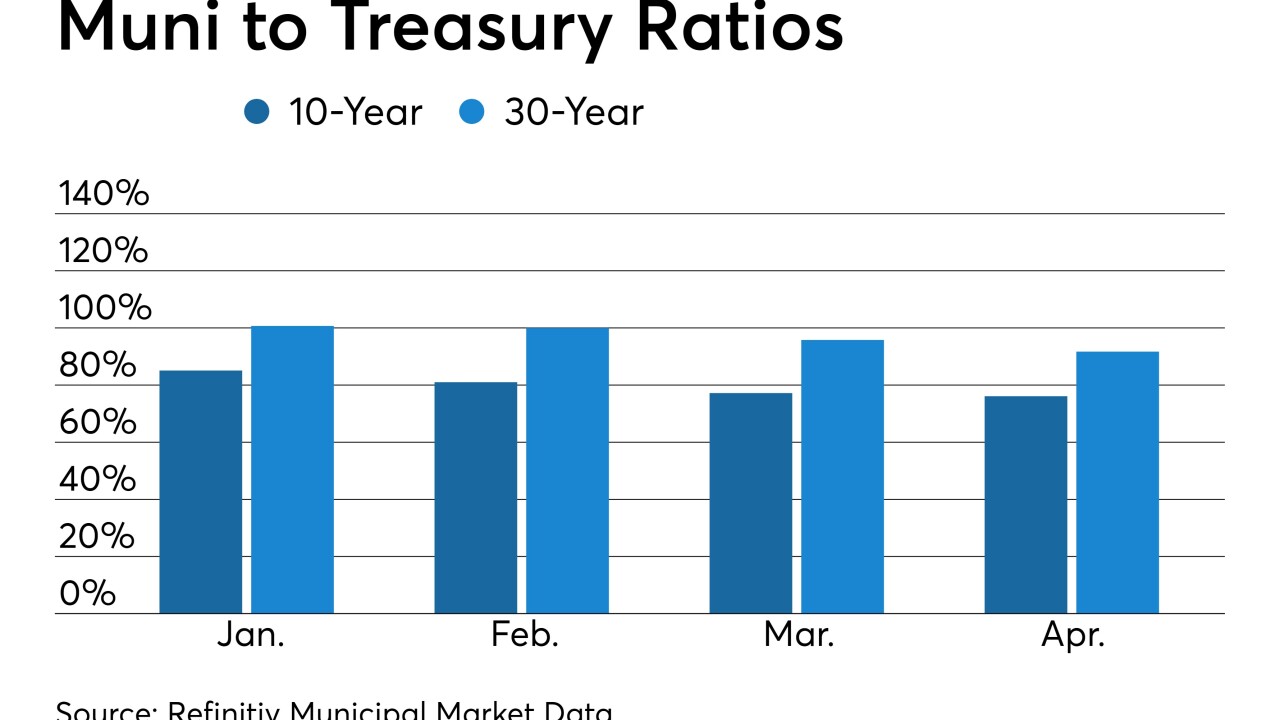

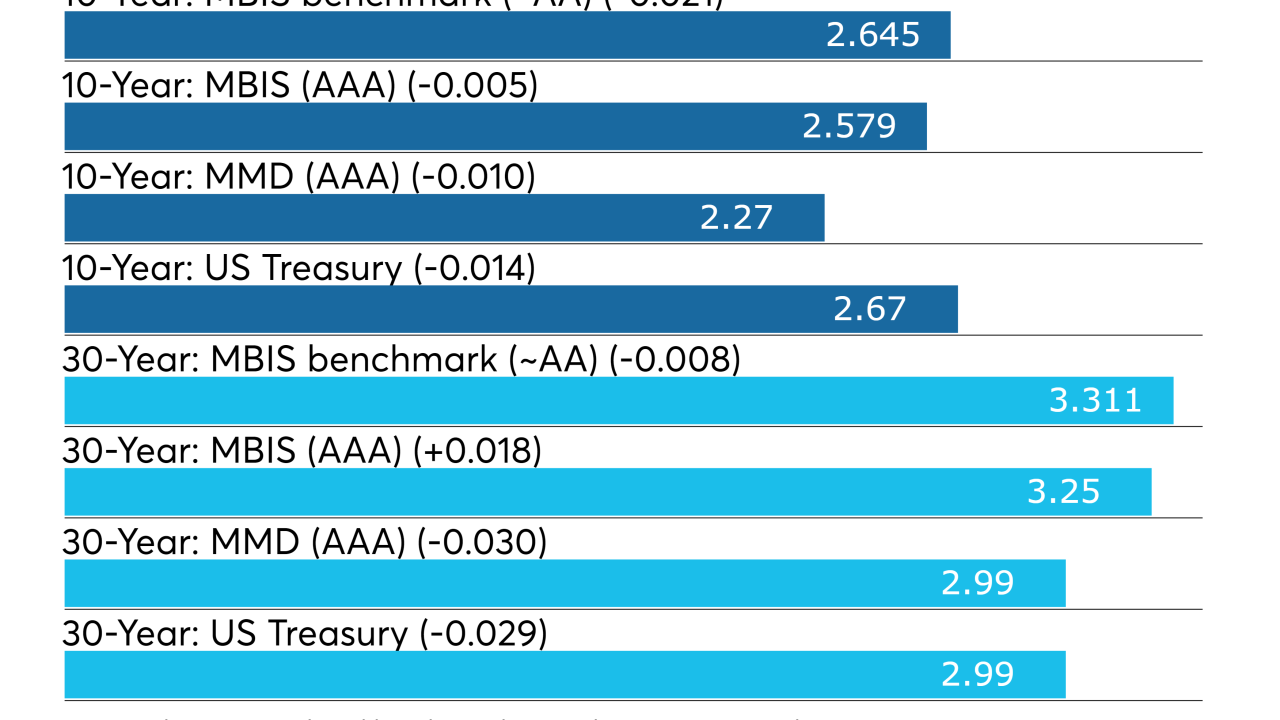

Scarcity mixed with strong demand and Fed announcements on rates and inflation helped munis outperform most fixed-income assets so far this year.

May 24 -

Muni portfolio manager J.B. Golden combats spread compression with defensive duration, laddering, premium bonds, and a tilt toward credit opportunities.

May 14 -

Susan Courtney of PGIM Fixed Income navigates her muni team toward value in improving market.

April 24 -

With the latest bout of flattening, the reality of sub-zero spreads may soon collide with an otherwise sanguine outlook on the economy.

April 18 -

Investors should minimize risk, upgrade quality, and remain defensive awaiting higher rates and price discovery, according to analyst reports this week.

February 23 -

Tim Heaney of NewFleet Asset Management uncovers yield, credit, and coupon opportunities with a quality-minded strategy.

February 12 -

Ronald Schwartz of Seix Investment Advisors resolves to upgrade credit, keep duration neutral to shorter, and remain selective about investments.

February 2 -

Although he continues to maintain that two rate hikes this year are appropriate, Federal Reserve Bank of Philadelphia President Patrick Harker said Friday he is closely monitoring the flattening yield curve.

January 12 -

The new tax law and imminent scarcity threaten to change market dynamics for muni buyers in 2018.

December 26 -

Investors plan to make the most of the volume blitz and higher yields in the last month of the year, as issuers rush to market ahead of a sweeping tax law overhaul.

December 4 -

Retail investors are overcoming concern over interest rates and tax reform by extending duration, upgrading to high-quality, and buying defensive premium bonds.

November 2