-

Municipals returned 0.83% in July with a year-to-date return of 1.90%. High-yield returned 1.20% in July and 7.40% year-to-date. Taxables led July with 1.65% returns and 1.95% for the year.

August 2 -

Muni participants await a new month with growing issuance, but perhaps not quite enough as issuers are hesitant to add more debt before final word from Washington on infrastructure.

July 30 -

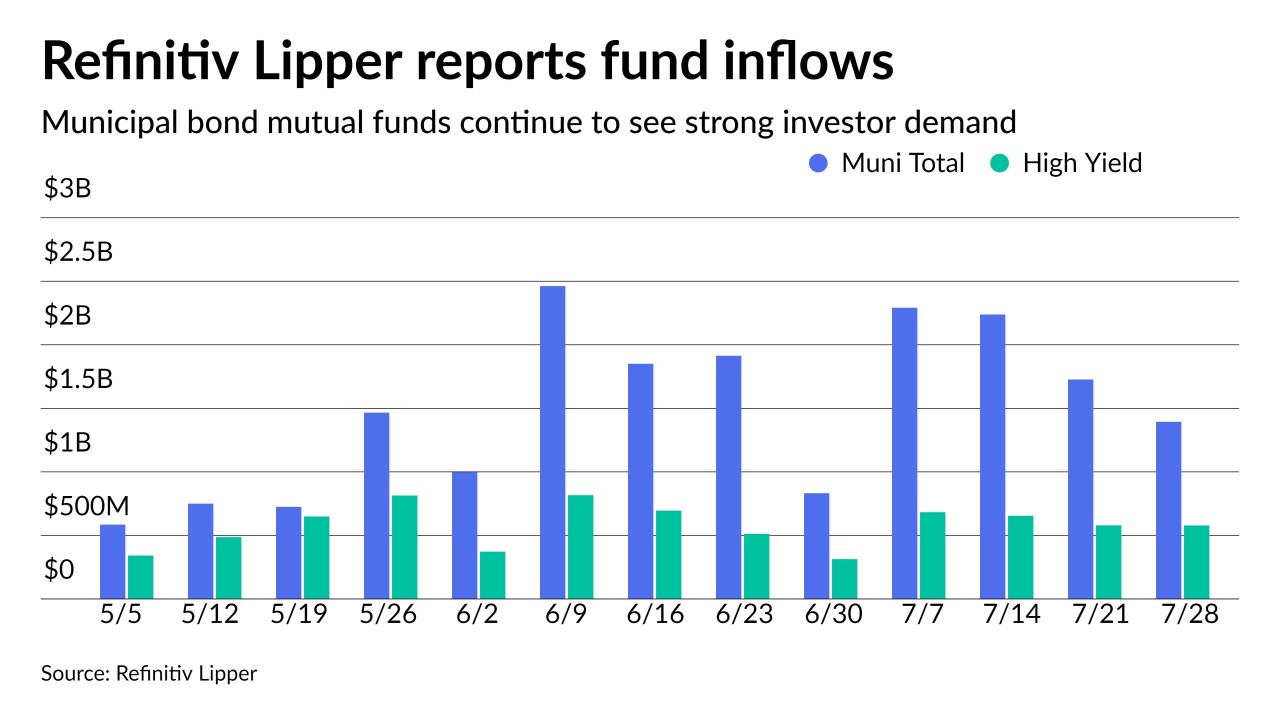

Washington GOs came at tighter spreads than a spring sale in the competitive market while sizable negotiated deals saw bumps in repricings. Refinitiv Lipper reported $1.4 billion of inflows in the 21st consecutive week.

July 29 -

The massive summer reinvestment into municipal bond mutual funds continue and are both sustaining the strength of investor demand and solidifying the technical footing of the market.

July 28 -

The economy continues to recover, with durable goods orders and consumer confidence suggesting strength, but concerns about the Delta variant of COVID-19 and continued supply-chain problems cloud the future outlook.

July 27 -

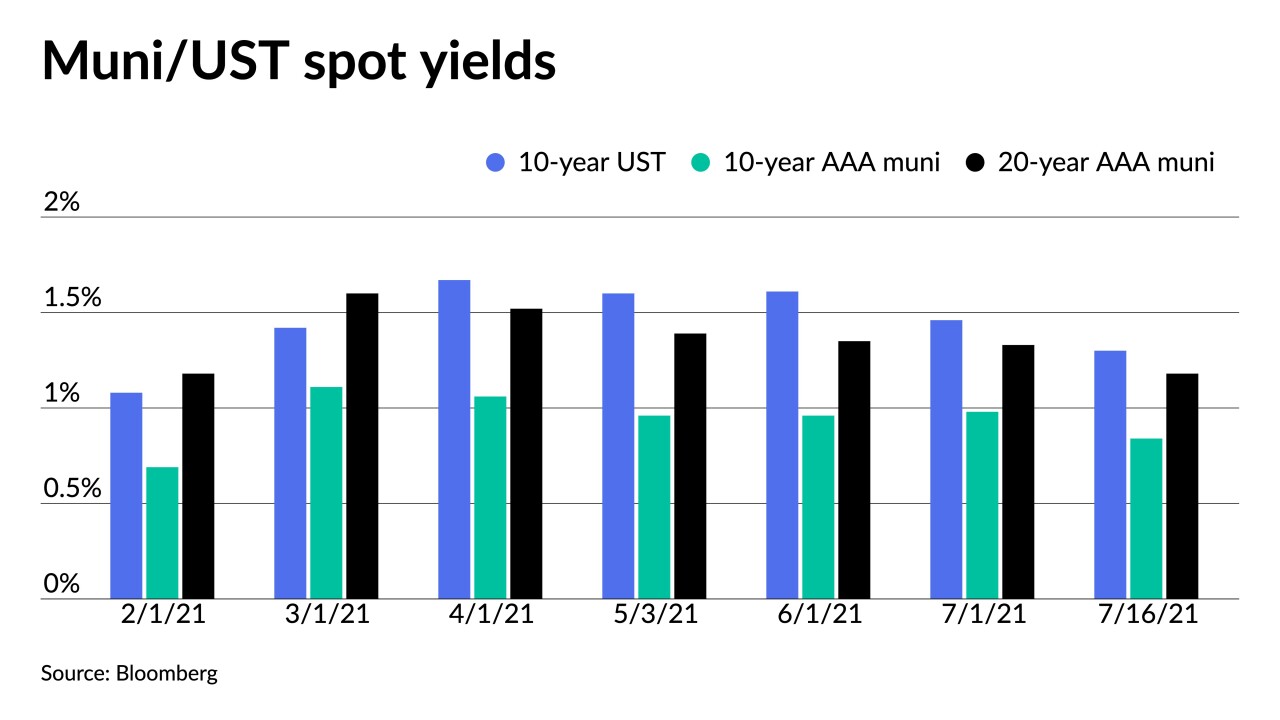

With municipal yields at exceedingly low absolute levels, the spread tightening between credits also continues.

July 26 -

The pilot program aims to expand its all-to-all Open Trading marketplace by allowing investor clients to select a diversity dealer to intermediate in secondary trading.

July 26 -

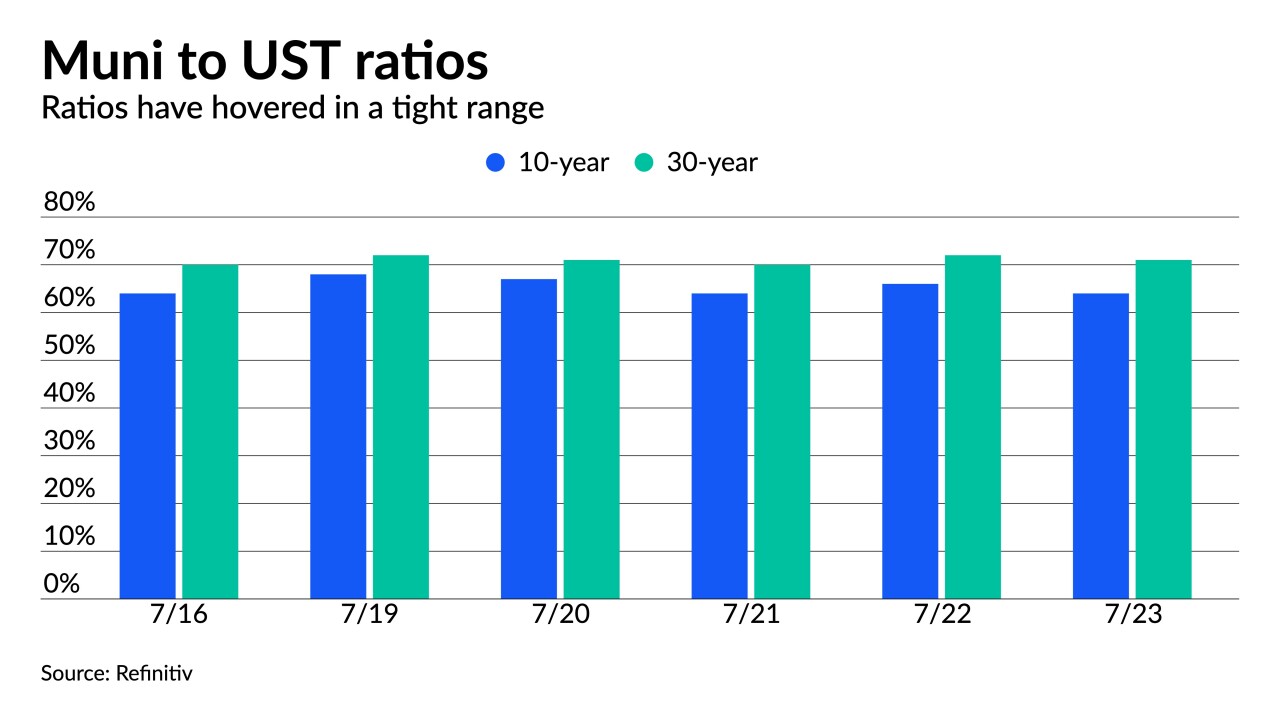

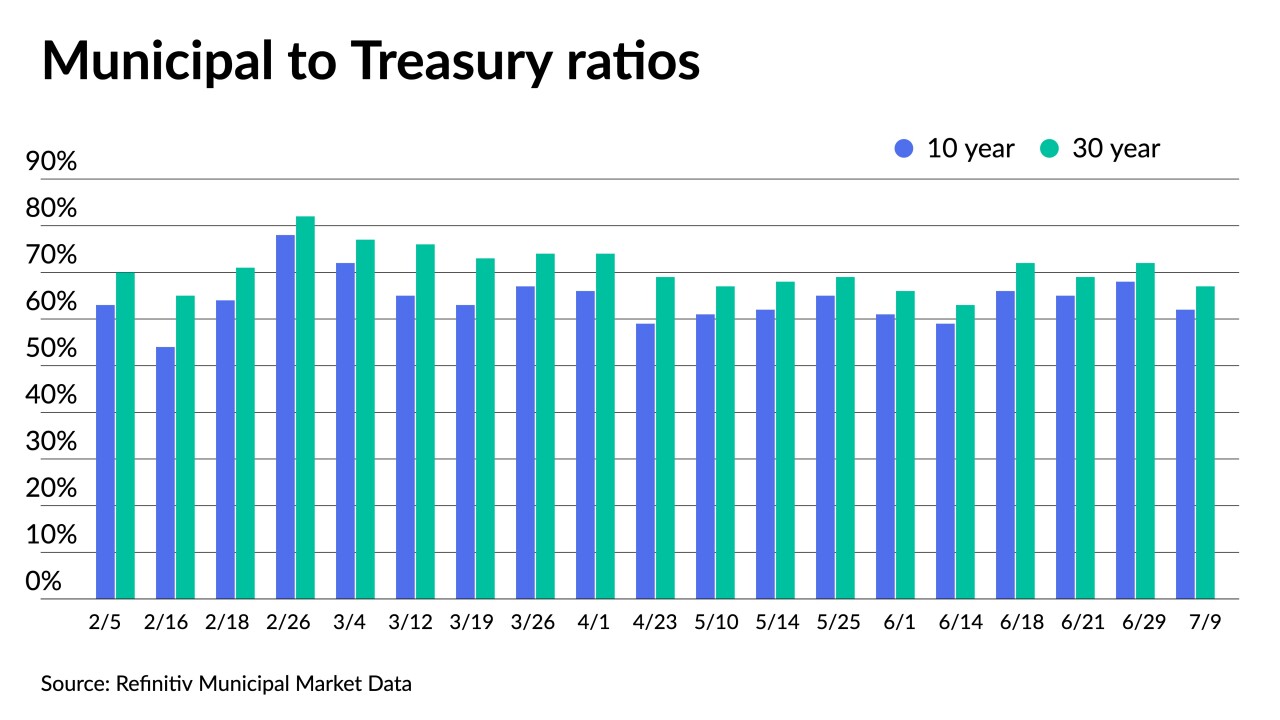

The last week of July marks a lighter calendar while August redemptions are huge compared to the expected supply. Investors need to get in line and likely accept lower yields and continued historically low ratios.

July 23 -

Low ratios, low yields and massive demand are leading to a market that is mostly on its own. Refinitiv Lipper reported $1.7 billion of inflows.

July 22 -

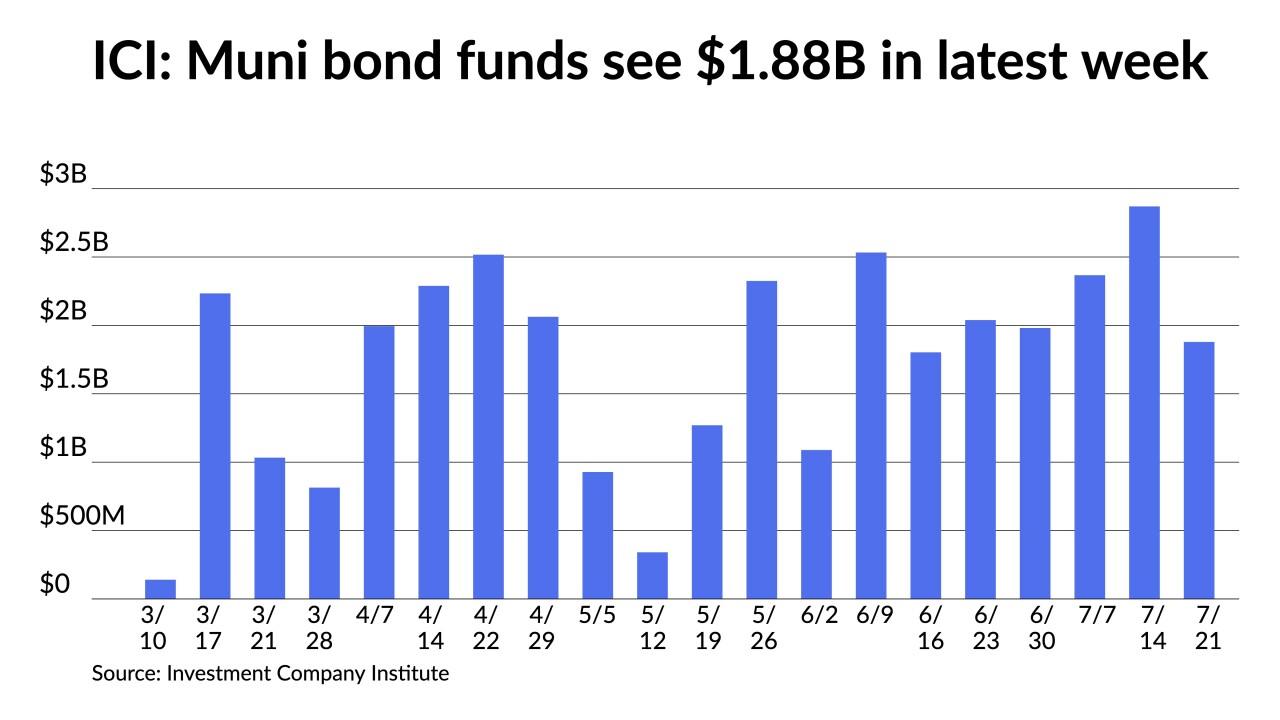

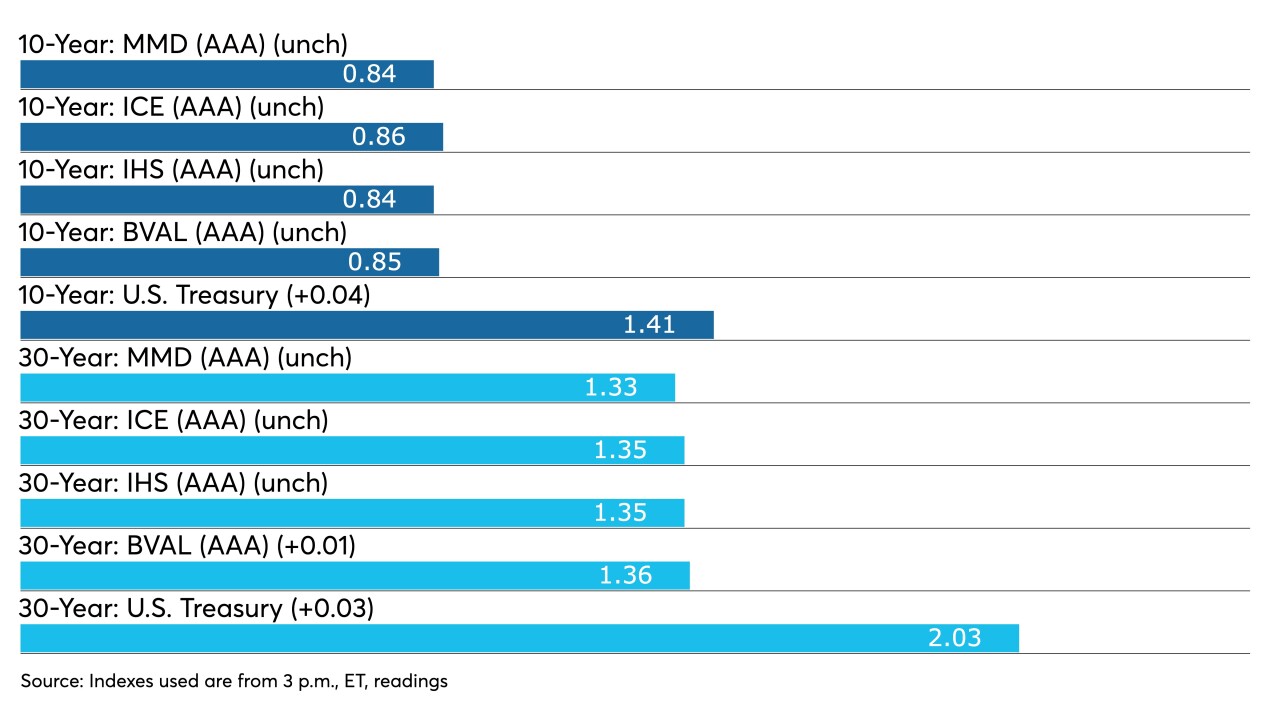

The larger new issues and aggressive swings in taxables had investors on guard as triple-A curves were pressured outside 10-years, but the asset class still vastly outperformed UST while ICI reports nearly $3 billion more inflows.

July 21 -

Negotiated deals were repriced to lower yields while competitive deals saw levels coming in through triple-A benchmarks. High-grade benchmarks were little changed.

July 20 -

Municipal triple-A benchmarks were pushed to lower yields by one to three basis points across the curve, with the bigger moves out long, but still vastly underperformed the 10-plus basis point moves in UST.

July 19 -

Supply, however, is still less than the massive amounts of cash on hand. Bond Buyer data shows 30-day visible supply at $12.53 billion.

July 16 -

U.S. Treasuries have been volatile the past five sessions, with municipals largely ignoring the ride. Participants mostly have accepted current rates and ratios as large amounts of cash slosh around a market with strong technicals.

July 15 -

Perform, a portfolio management platform for institutional investors who want to accesses the municipal bond market, will be integrated into ICE Bonds.

July 15 -

A key demand component in the market again flexed its muscles with ICI reporting another round of $2 billion-plus fund inflows.

July 14 -

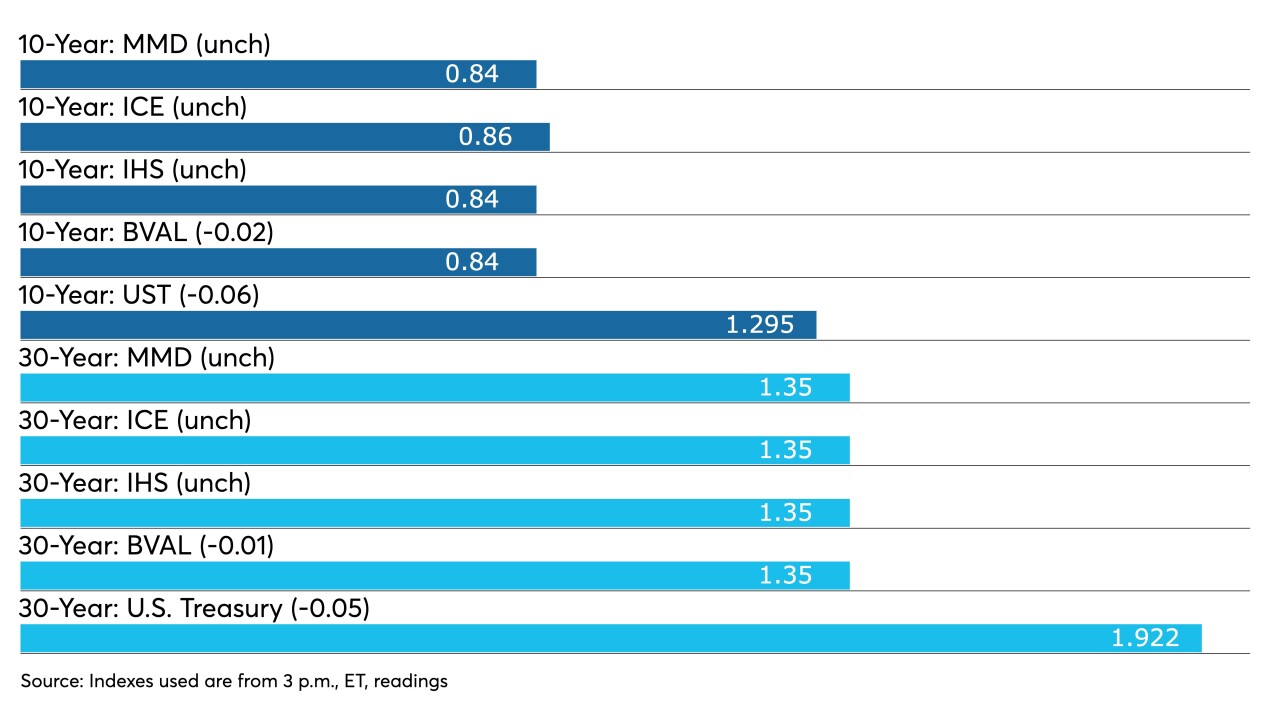

Municipals outperformed U.S. Treasuries for a third sessions moving the 10-year municipal to UST ratio below 60%.

July 13 -

Most participants expect better performance for munis in the near-term. Longer-term, a lot depends on rates, COVID and other outside factors, such as infrastructure.

July 12 -

While municipals hit the pause button Friday, the movement in yields in the first week of July marked the largest one-week decline in 2021.

July 9 -

Fund inflows are a demand component unlikely to slow during the heavy reinvestment season, keeping the yield environment squarely in issuers' favor.

July 8