-

A majority of the week's largest new issues priced at yields mostly at or around benchmarks as secondary trading did little to move scales. In economic data released Tuesday, the June consumer confidence index climbed, suggesting spending will rebound.

June 29 -

With various Federal Reserve officials airing their views since the Federal Open Market Committee’s latest meeting, it may take a while for members to reach agreement on tapering, a boon for municipals.

June 28 -

Making it a summer Friday, munis were quiet. Participants contemplate why the market underperformed taxables to the degree they did when fundamentals are objectively strong and little has changed since before the FOMC.

June 25 -

The final new issues of the week close with some bumps in repricings while the secondary was quiet.

June 24 -

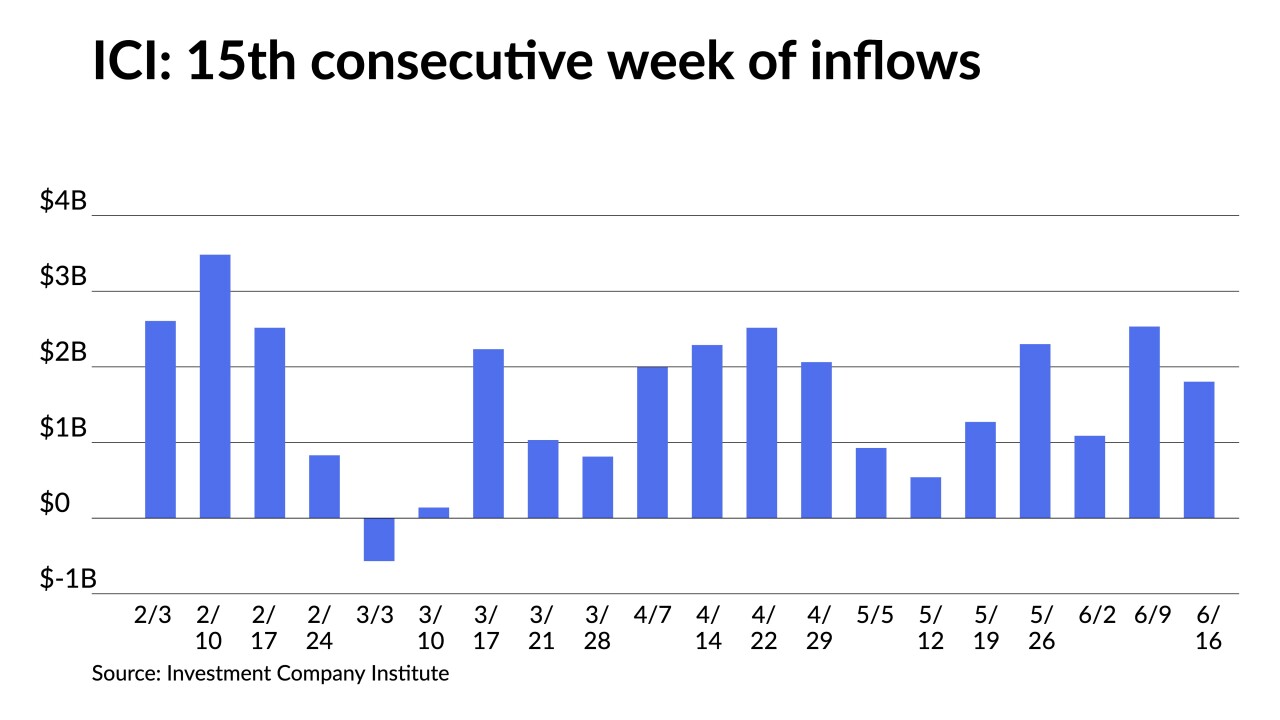

Triple-A benchmark yields moved higher by as much as five basis points while ICI reported another $1.8 billion of inflows and ETFs increase their share by $841 million.

June 23 -

A volatile U.S. Treasury market and month-end positioning are pressuring municipal yield curves.

June 22 -

John Hallacy, founder of John Hallacy Consulting LLC, talks with Chip Barnett about the pandemic’s lingering credit impacts on state finances in a wide-ranging discussion of the many issues affecting the municipal market today. (17 minutes)

June 22 -

The Federal Reserve must be prepared to move if inflation continues to surprise to the upside, according to one Fed president, while another again stated a desire for the Fed to pull back on its accommodation.

June 21 -

The short end of the yield curve faced pressure from a cheaper UST five-year. As the flattening trend in UST takes hold, demand for duration will also spill over into the tax-exempt space, with long-dated munis continuing to outperform, analysts say.

June 18 -

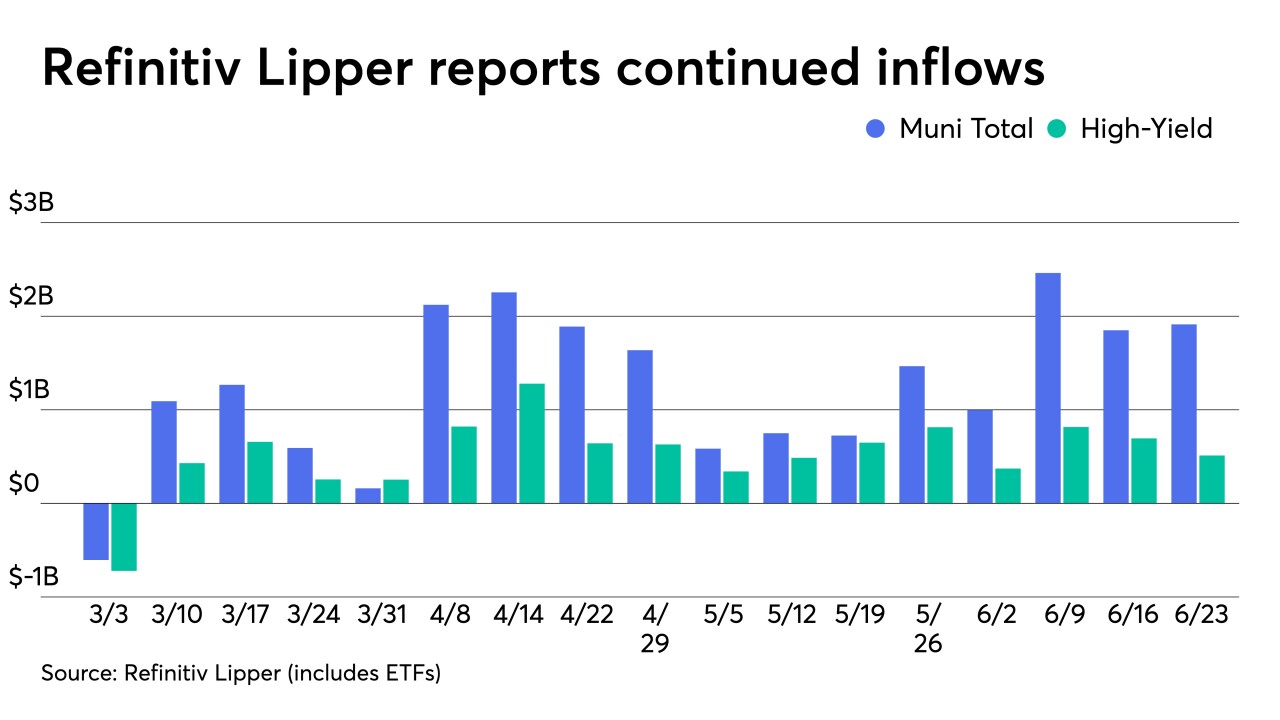

Refinitiv Lipper's $1.85 billion of inflows say investors aren't going anywhere.

June 17