-

A key demand component in the market again flexed its muscles with ICI reporting another round of $2 billion-plus fund inflows.

July 14 -

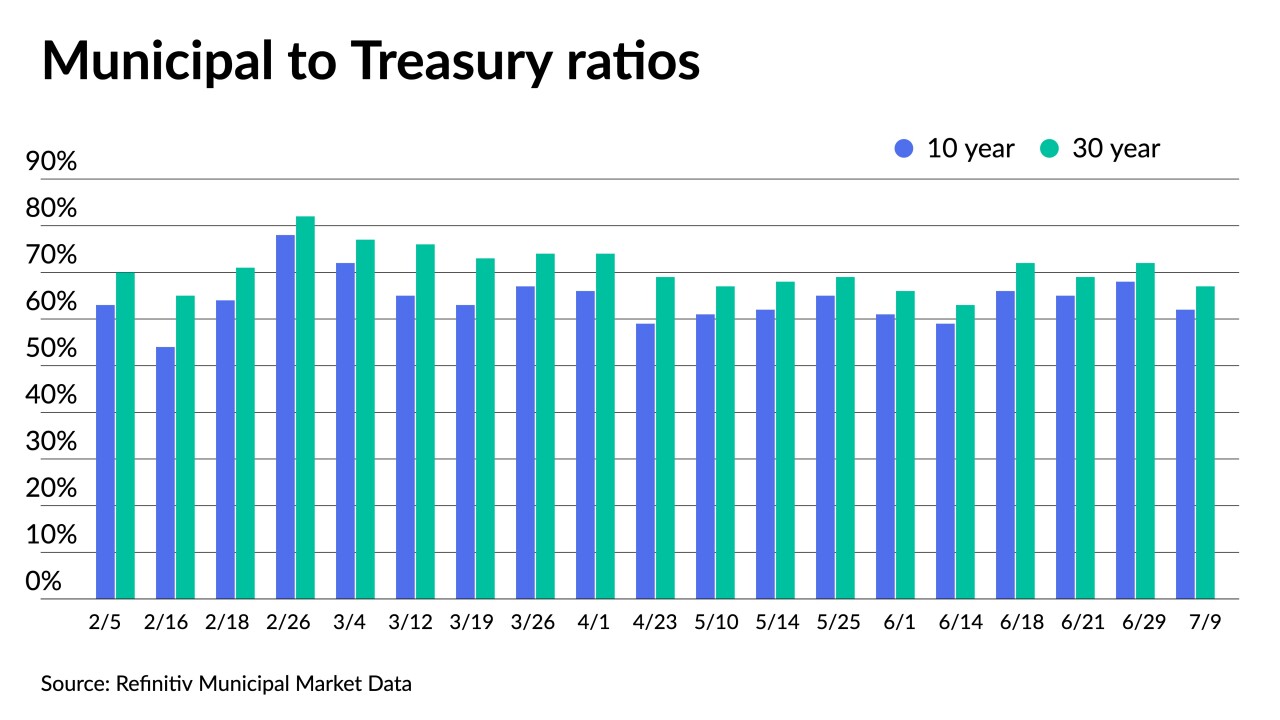

Municipals outperformed U.S. Treasuries for a third sessions moving the 10-year municipal to UST ratio below 60%.

July 13 -

Most participants expect better performance for munis in the near-term. Longer-term, a lot depends on rates, COVID and other outside factors, such as infrastructure.

July 12 -

While municipals hit the pause button Friday, the movement in yields in the first week of July marked the largest one-week decline in 2021.

July 9 -

Fund inflows are a demand component unlikely to slow during the heavy reinvestment season, keeping the yield environment squarely in issuers' favor.

July 8 -

More of the same from the FOMC did little to move UST or munis. ICI reported the 17th consecutive week of inflows at $1.98 billion. July is looking good for municipal issuers.

July 7 -

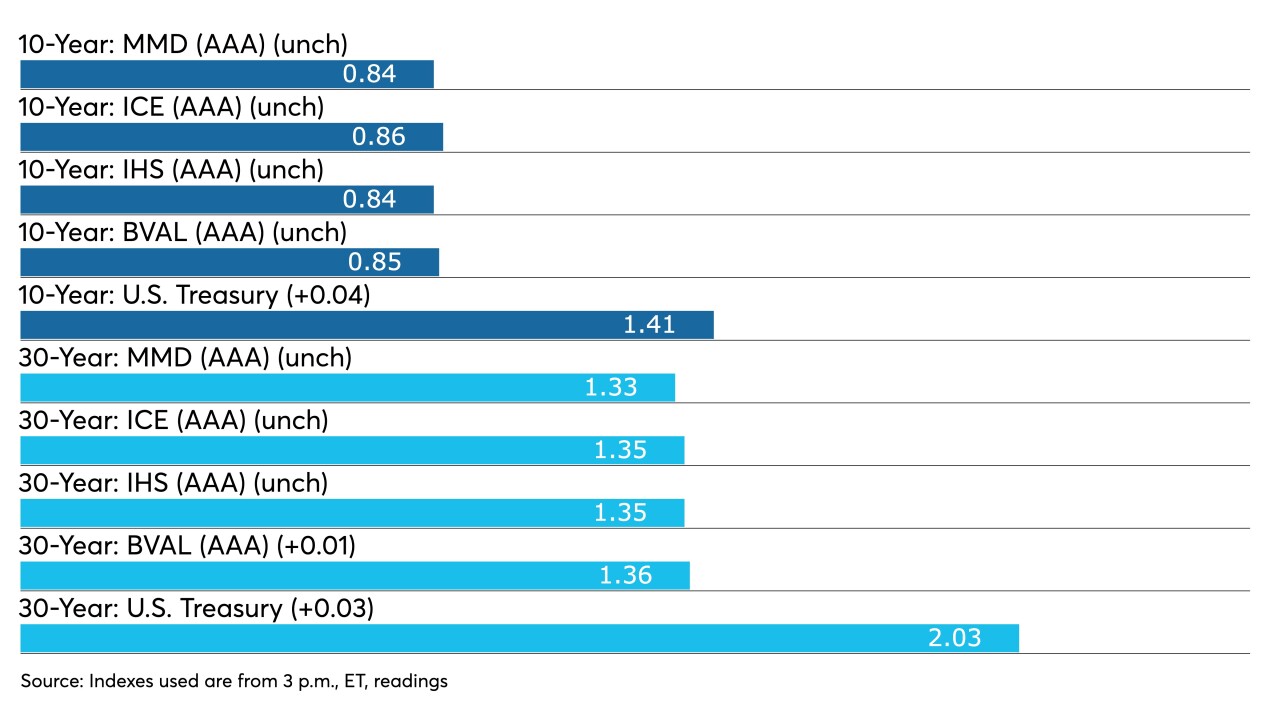

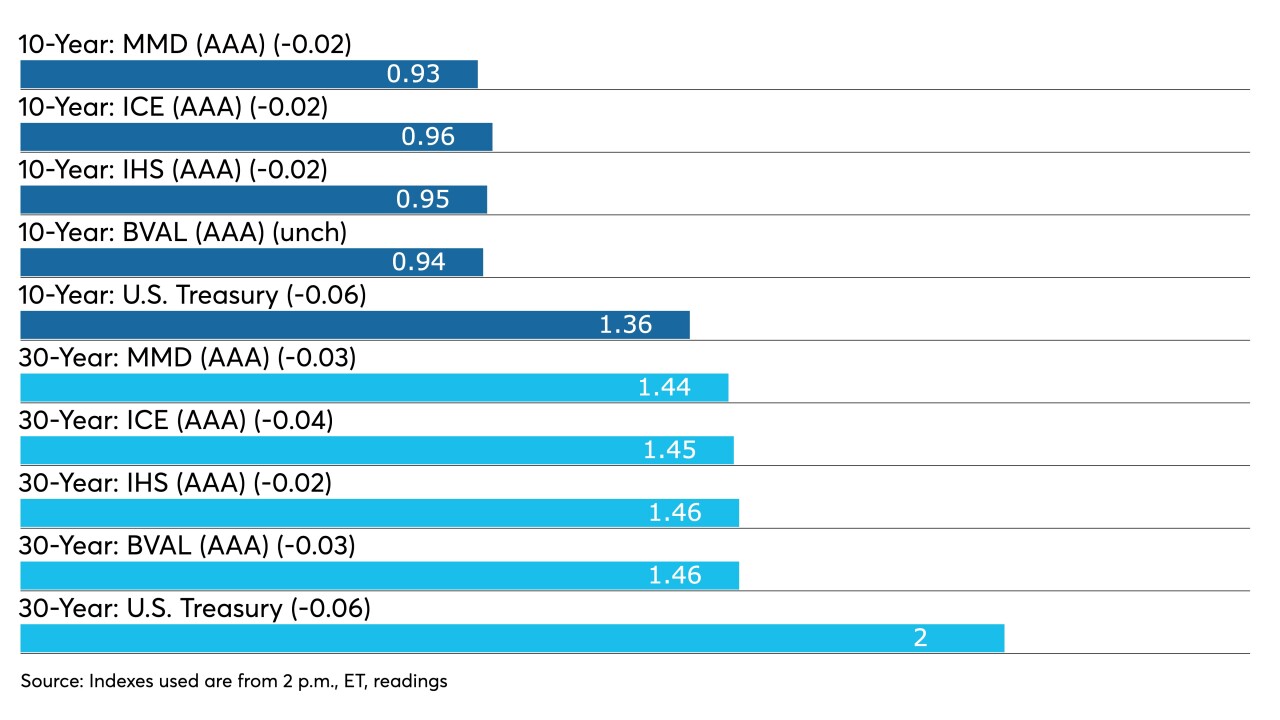

U.S. Treasury 10- and 30-year yields hit February lows. Large blocks of high-grades in secondary trading led triple-A benchmarks to lower yields by two to four basis points across the curve.

July 6 -

With better-than-expected payrolls, economists still caution full recovery is a ways away. Muni participants are closely following how the Fed's action — or inaction — will affect the municipal market going forward.

July 2 -

The broader market awaits Friday’s nonfarm payrolls report, but Thursday brought some helpful labor news — unemployment claims dropped to the lowest since before the pandemic-caused economic shutdowns and layoffs plunged in June.

July 1 -

Gilt-edged munis fell as much as two basis points Wednesday as the month ended and the first half stats were put into the record books.

June 30