-

The firm has brought on Kalotay Analytics' quantitative libraries to calculate certain metrics, including average life dates and cash-flow yields for taxable term bonds.

August 5 -

The short end of the market has little room to fall lower.

August 5 -

With all eyes on Friday’s employment report, since several additional strong months of gains are needed for the Federal Reserve to be comfortable announcing a tapering of its asset purchases, Wednesday’s news could signal trouble.

August 4 -

Effective spread data yielded interesting results about the way corporate and municipal bonds were treated by Fed backstop programs.

August 4 -

Tighter bidding on bonds 10 years and in pushed high-grade benchmark curves to bump yields.

August 3 -

Municipals returned 0.83% in July with a year-to-date return of 1.90%. High-yield returned 1.20% in July and 7.40% year-to-date. Taxables led July with 1.65% returns and 1.95% for the year.

August 2 -

Muni participants await a new month with growing issuance, but perhaps not quite enough as issuers are hesitant to add more debt before final word from Washington on infrastructure.

July 30 -

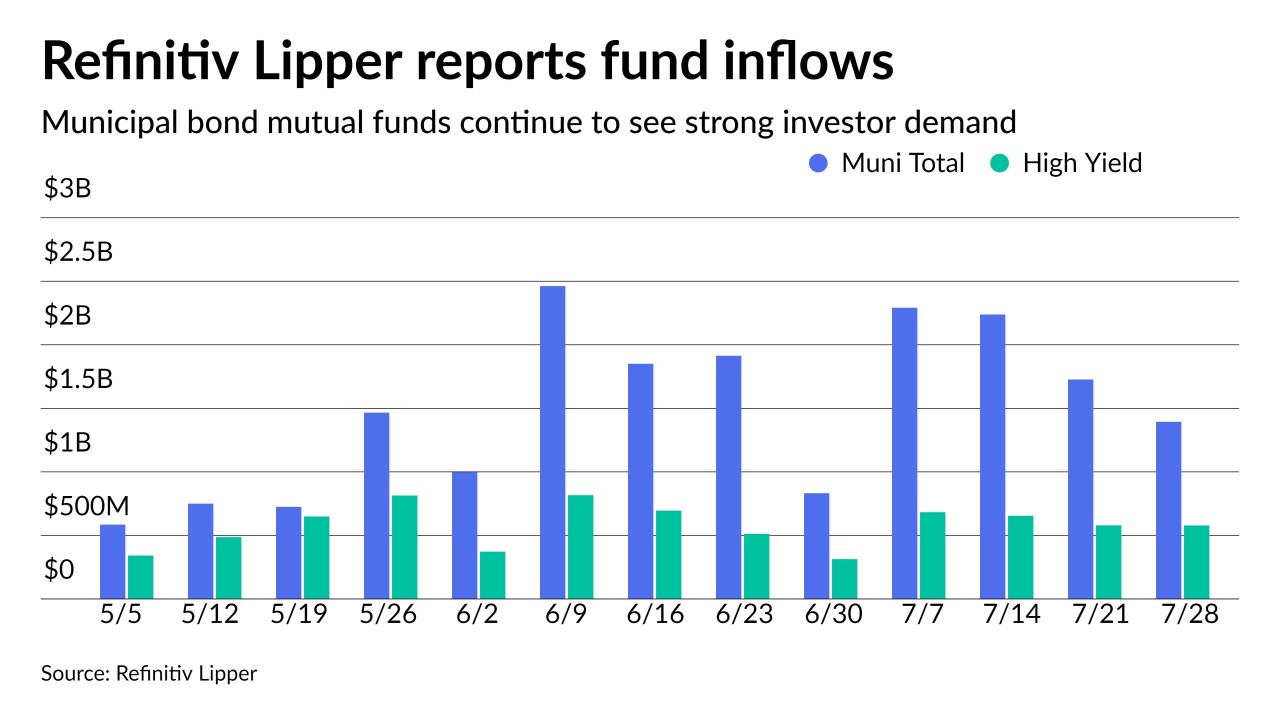

Washington GOs came at tighter spreads than a spring sale in the competitive market while sizable negotiated deals saw bumps in repricings. Refinitiv Lipper reported $1.4 billion of inflows in the 21st consecutive week.

July 29 -

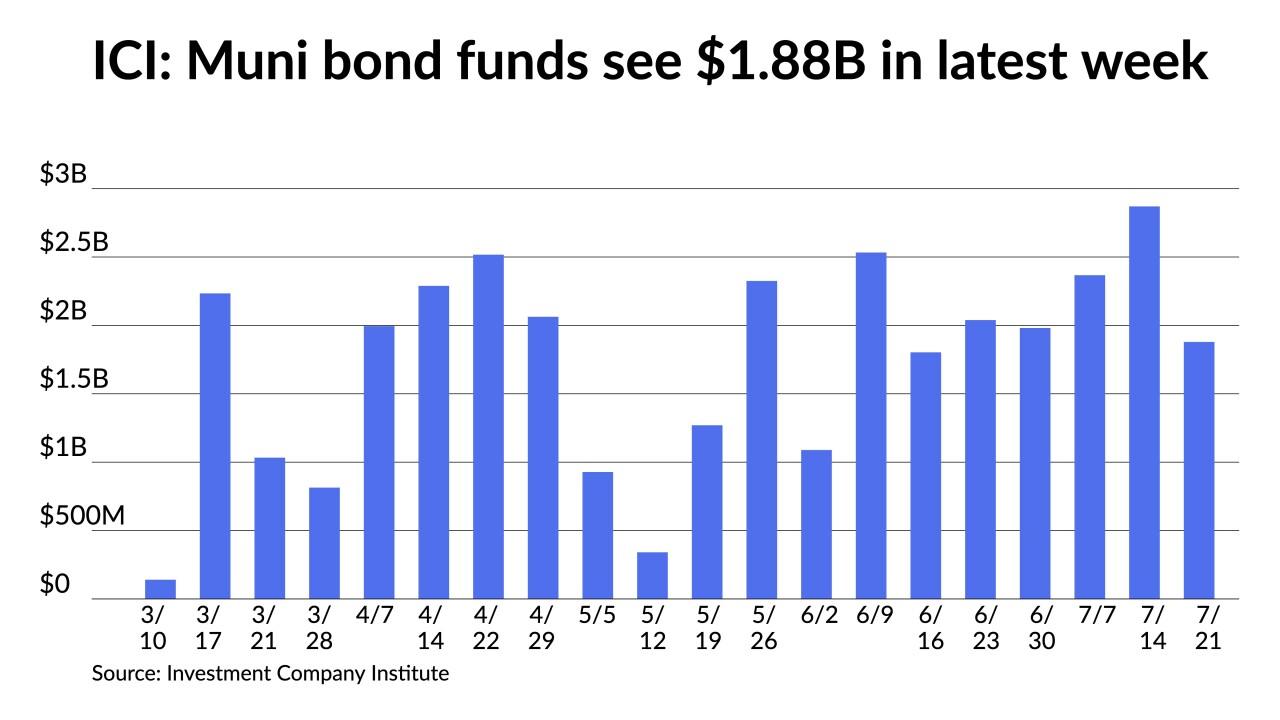

The massive summer reinvestment into municipal bond mutual funds continue and are both sustaining the strength of investor demand and solidifying the technical footing of the market.

July 28 -

The economy continues to recover, with durable goods orders and consumer confidence suggesting strength, but concerns about the Delta variant of COVID-19 and continued supply-chain problems cloud the future outlook.

July 27