-

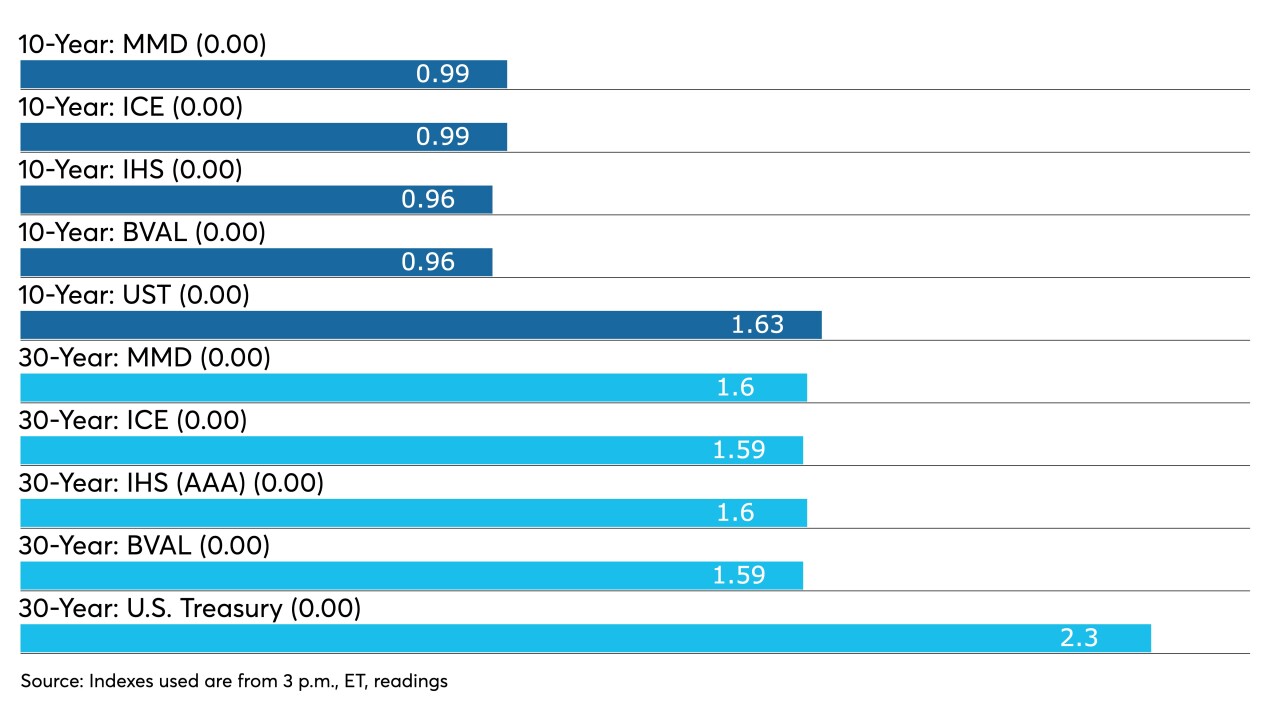

After just one session, the 10-year muni is back below 1% with ICE Data Services and Refinitiv MMD at 0.99% while Bloomberg BVAL is at 0.96% and IHS Markit at 0.95%.

May 4 -

Inflationary pressures remain high while the manufacturing sector continues to deal with supply chain woes that hold it back, analysts said.

May 3 -

Rates, ratios and credit spreads have munis entering May on solid footing, though some pressures due to tax season and rising U.S. Treasuries remain.

April 30 -

Refinitiv Lipper reported another week of inflows at $1.64 billion, with $630 million headed into to high-yield. Benchmark yields rose as much as four basis points following weaker U.S. Treasuries, resistance to ultra-low yields.

April 29 -

The municipal market largely ignored the FOMC news that it would hold rates steady. New Jersey was 20 times oversubscribed and ICI reported $2.5 billion of inflows into long-term municipal bond mutual funds.

April 28 -

Data released Tuesday show an improving economy, which continues to stoke fears of impending inflation. Muni investors await New Jersey's $1.57 billion transportation deal.

April 27 -

Jim Robinson, portfolio manager of the Robinson Tax Advantaged Income Fund at Liberty Street Advisors, talks about the changing ways investors should view stocks and bonds. Within the municipal bond market, closed-end municipal bond funds may represent a particularly attractive opportunity. Robinson notes that at a time when the cost of leverage is falling, discounts on closed-end funds are high. Lynne Funk hosts. (18 minutes)

April 27 -

The dearth of supply will likely hold down rates and keep certain investors out of the muni market. High-yield municipal bonds, still the most in-demand sector, tightened again.

April 26 -

Refinitiv Lipper reported $1.889 billion of inflows, with $641 million in high-yield. Negotiated deals repriced to lower yields while competitive loan yields were compelling from New Jersey and Los Angeles USD.

April 22 -

High-grade scales were little changed as ICI reports the sixth week in a row of inflows to the tune of $2.29 billion into municipal bond mutual funds.

April 21