-

Returns of negative 0.40% would be the third-worst August performance of the past 10 years, according to Bloomberg data.

August 30 -

Experts agreed that Federal Reserve Board Chair Jerome Powell acknowledged the Fed could start tapering this year and that it would have no implications for liftoff, but not everyone was satisfied with what they heard.

August 27 -

Trades on alternative trading system platforms are smaller and more likely to involve securities with complex features, according to a new MSRB report.

August 27 -

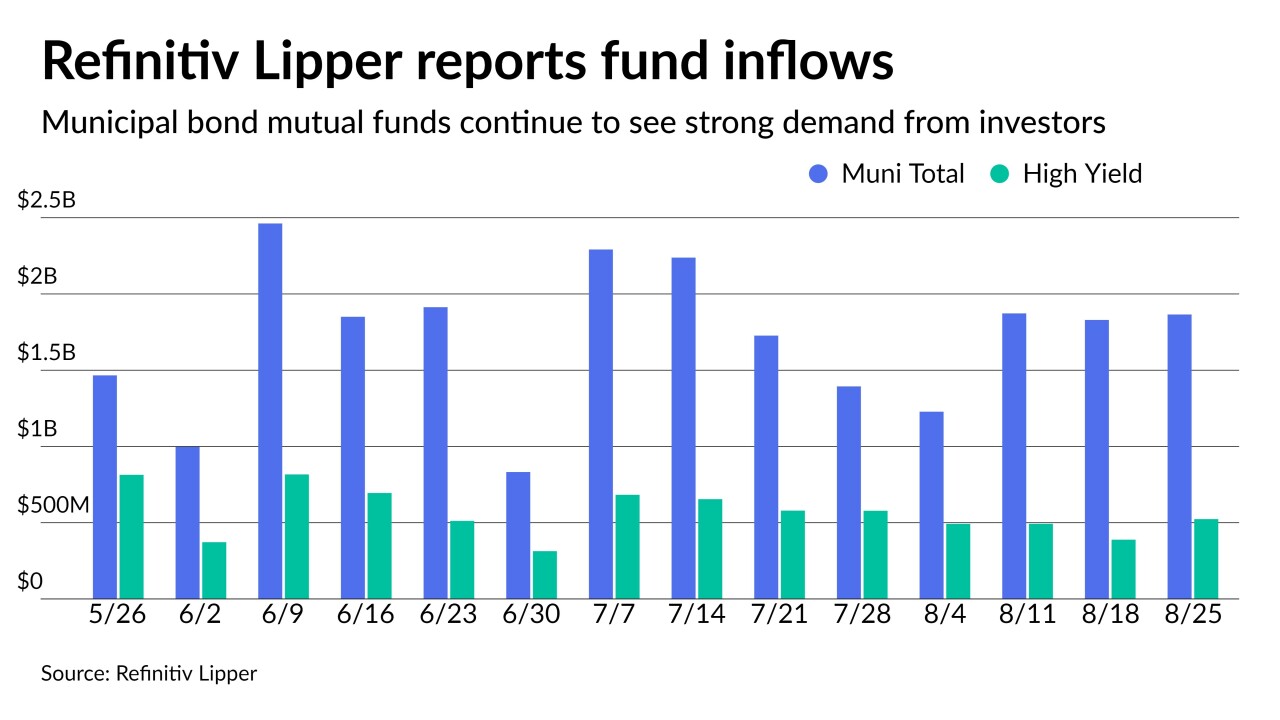

Refinitiv Lipper reported $1.9 billion of inflows, high-yield gaining $524 million, the 25th consecutive week of inflows into municipal bond mutual funds.

August 26 -

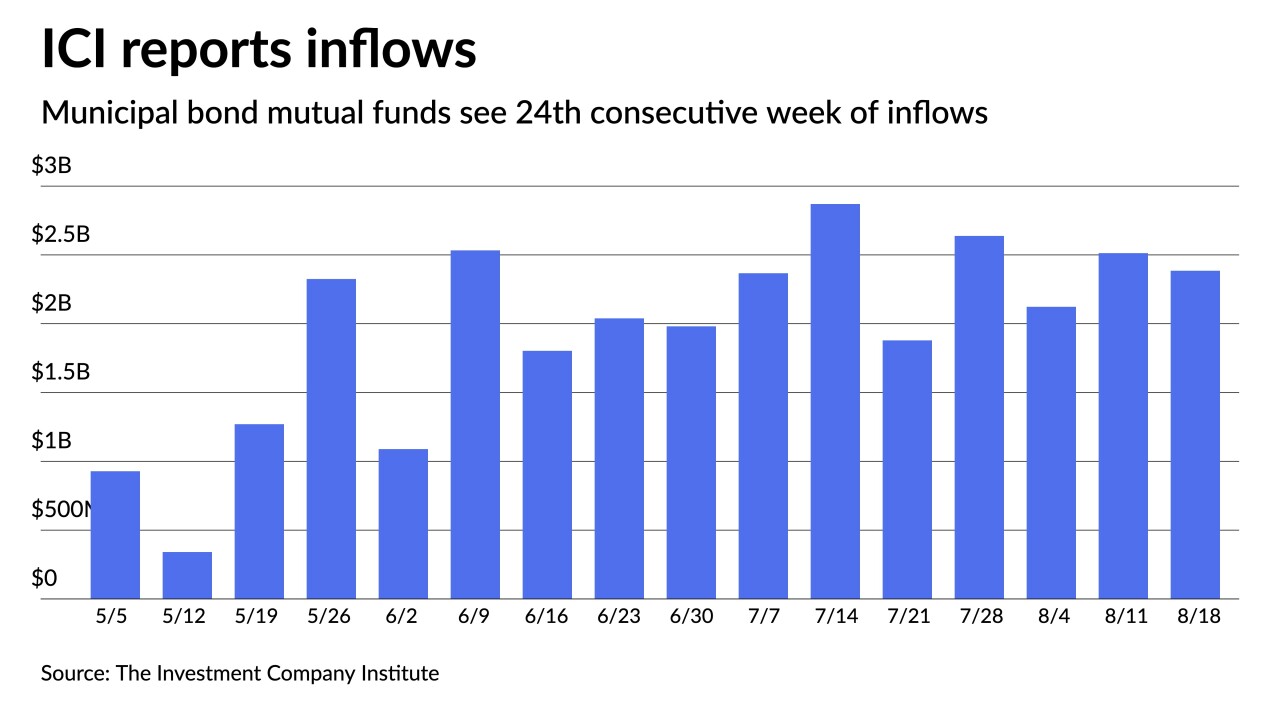

The Investment Company Institute reported $2.3 billion of inflows, bringing 2021 totals to $67 billion.

August 25 -

While municipals were little changed, broader markets remain focused on Jackson Hole and speculating what will be said about tapering.

August 24 -

John Ceffalio, Senior Municipal Research Analyst at CreditSights, talks with Chip Barnett about what to expect in the second half of the year. He discusses municipal bond market fundamentals, credit and climate disclosure. And he looks at the pandemic’s long-term risks for U.S. cities as the work-from-home culture becomes stronger and how higher education will cope with a new reality. (18 minutes)

August 24 -

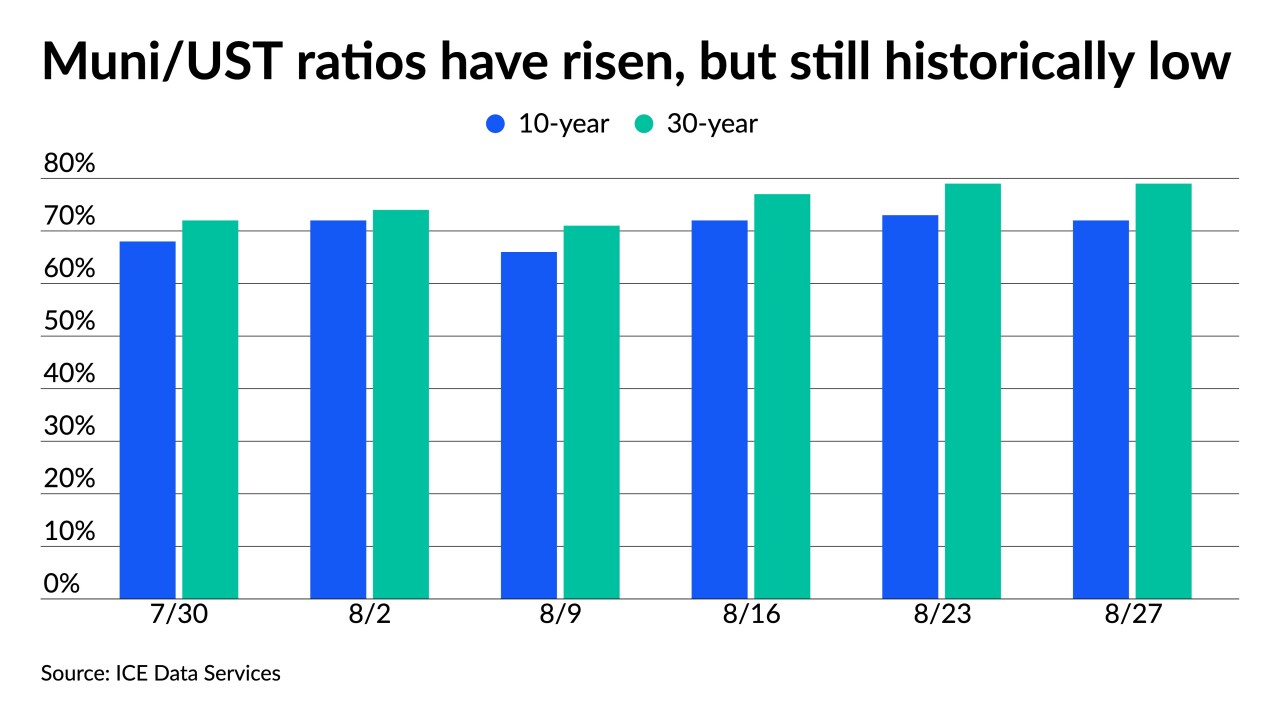

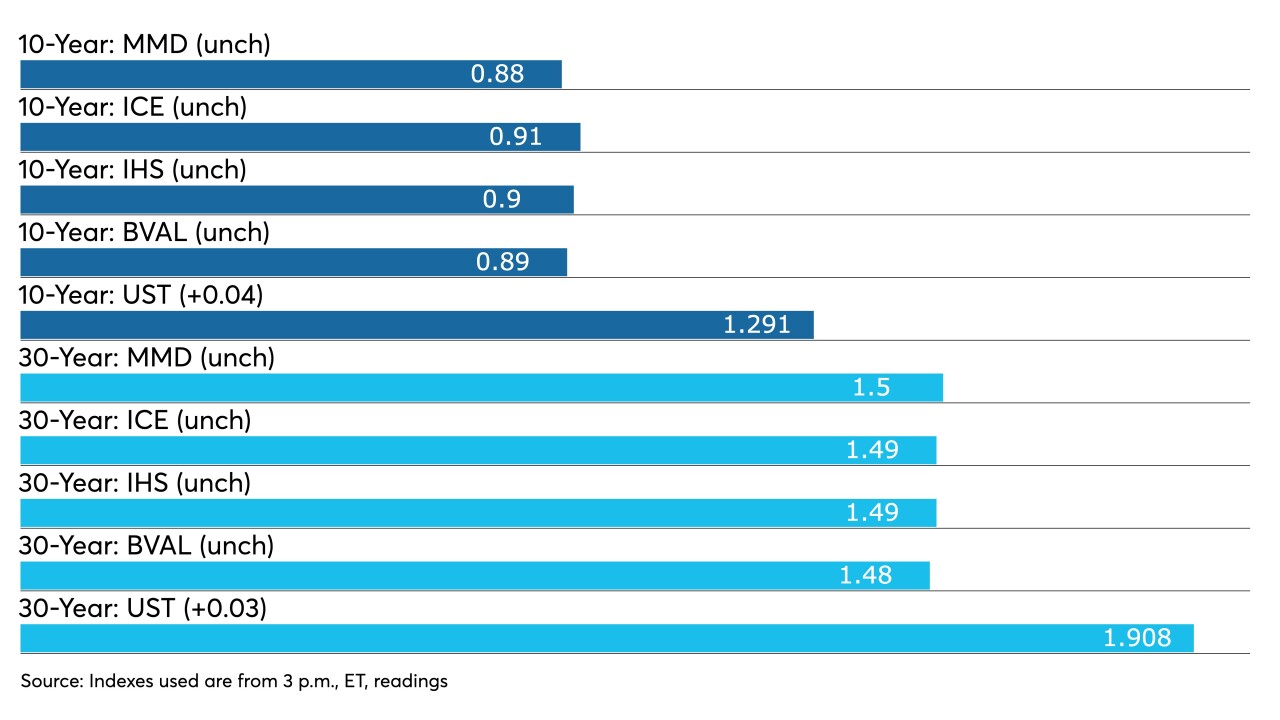

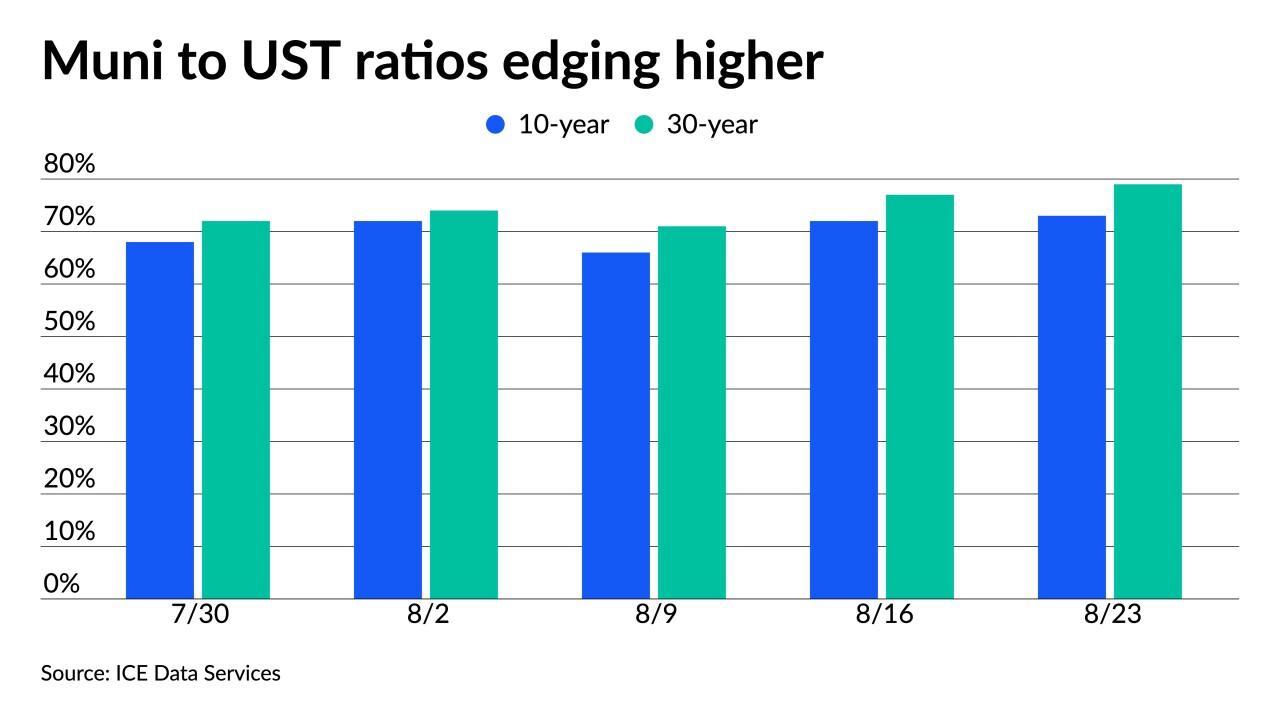

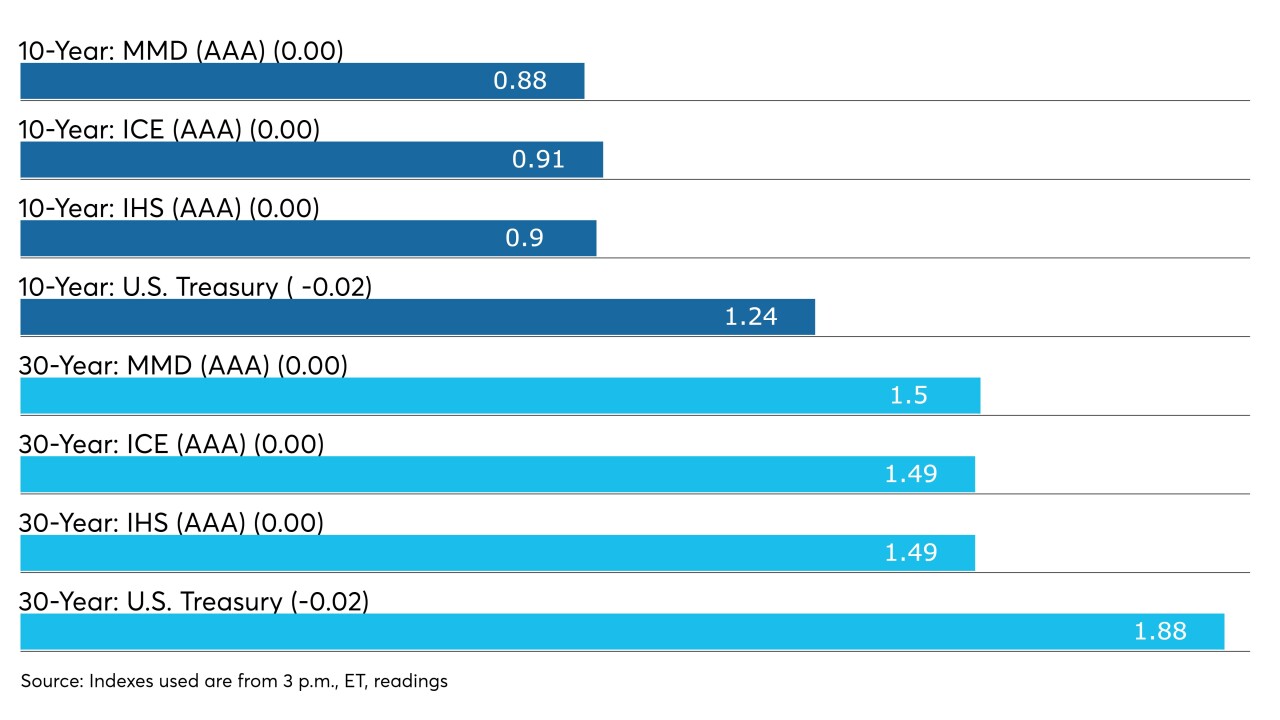

U.S. Treasuries gave little direction Monday, holding ratios and yields steady, leading most participants to argue both are satisfactory to ride out the summer.

August 23 -

Municipal bonds ended the week unchanged for the sixth consecutive trading session as inflows surged as more than $7 billion is headed to market next week.

August 20 -

Municipals were unchanged for the fourth consecutive day this week amid slight Treasury strength as demand for yield continued.

August 19