-

Though monetary policy has been in the forefront, at mid-month the tone changed with global inflation outlooks and federal infrastructure and social package in flux.

November 1 -

A lighter, $5 billion calendar, heavy on healthcare, kicks off November. Most participants agree volatility in U.S. Treasuries will be a leading factor for municipal market performance. Uncertainty in Washington also isn't helping the asset class.

October 29 -

Amid a flattening municipal yield curve and inversion of the Treasury market, new issues fared better than the secondary on Thursday as participants prepared for month end.

October 28 -

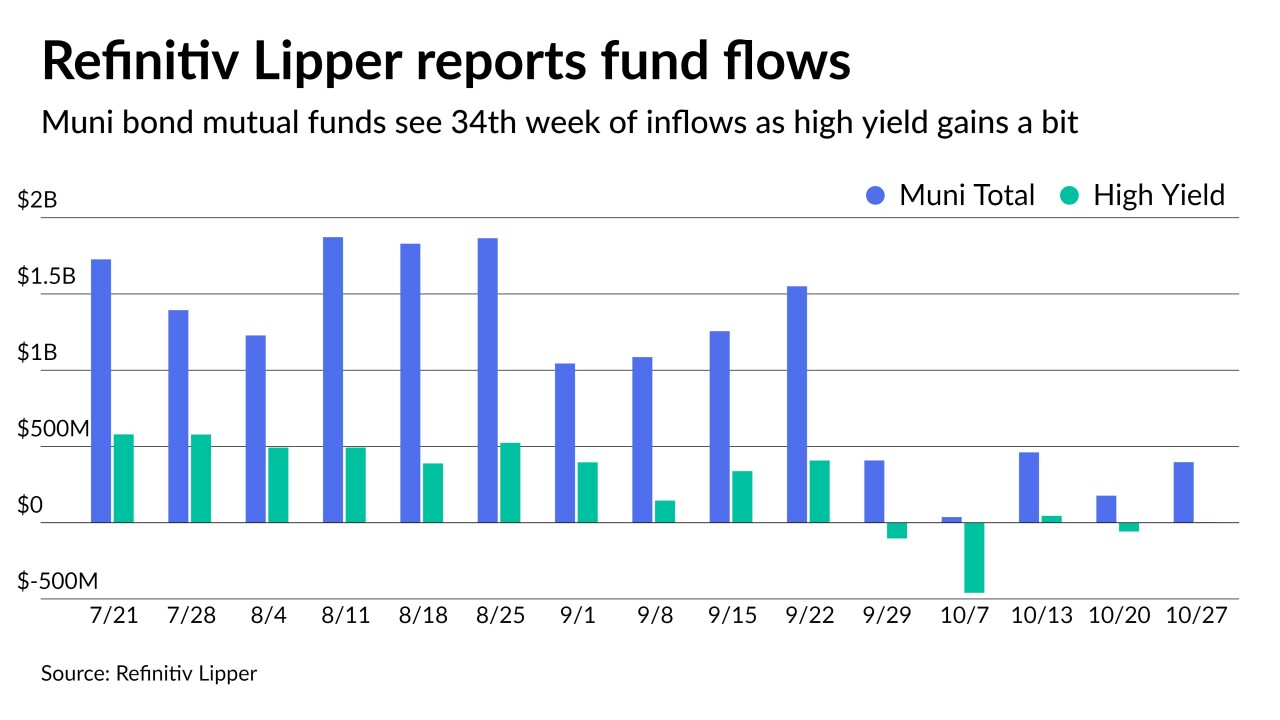

ICI reported the lowest inflows since outflows in March, while exchanged-traded funds saw an uptick.

October 27 -

As of now, returns for the month will very likely end in the red. The Bloomberg U.S. Municipal Index is at -0.40% for the month and +0.39% for the year.

October 26 -

Despite a short-end U.S. Treasury rally, municipals face pressure on the one- and two-year as participants look to month-end positioning.

October 25 -

Volume falls slightly in the week of October 25 with total potential volume estimated at $7.408 billion: $6.036 billion of negotiated deals and $1.372 billion in the competitive market.

October 22 -

Municipal bond mutual fund inflows fell to $177 million while high-yield is back to outflows, both signaling selling may be moving the market toward another larger correction.

October 21 -

The Investment Company Institute reported $385 million of inflows while ETFs fell to $124 million.

October 20 -

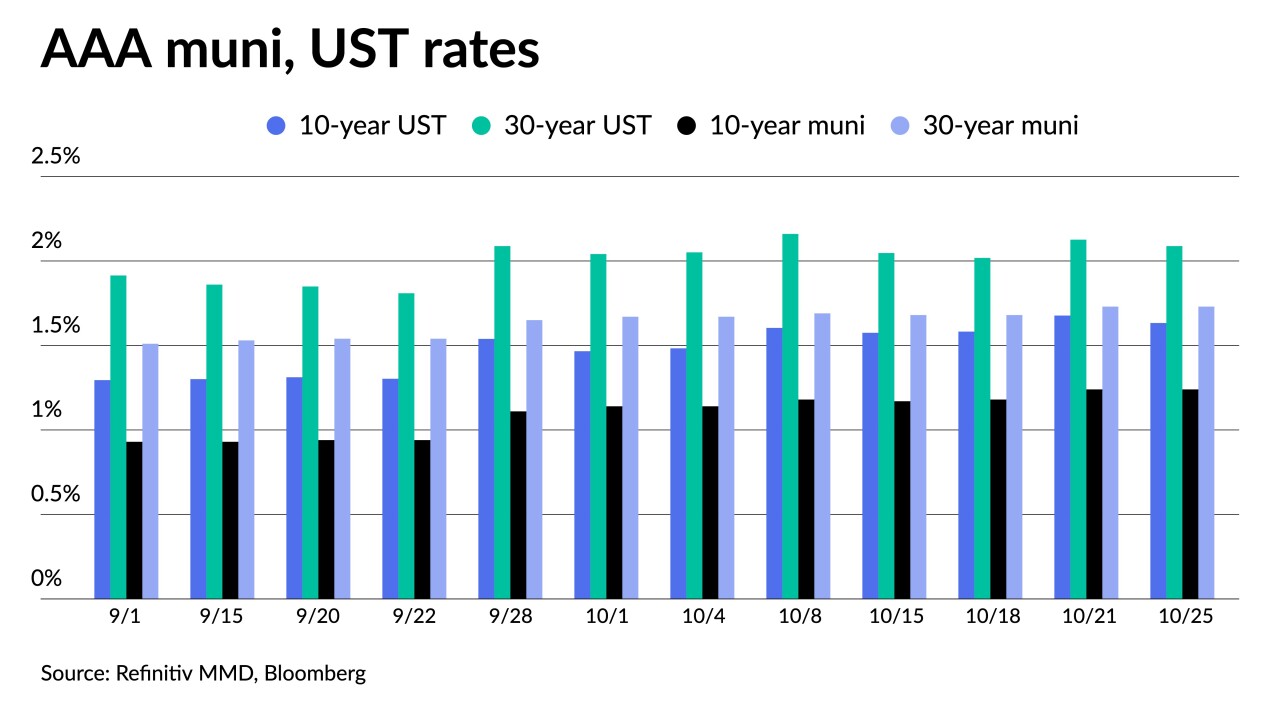

Spreads have been widening, but secondary trading was on the light side and triple-A benchmarks were cut by only a basis point in spots even as U.S. Treasury yields once again rose on the 10- and 30-year.

October 19