-

A “sensibly priced” deal from a New York issuer was snapped up by buyers on Thursday as municipals weakened slightly in secondary trading.

January 25 -

As Pennsylvania gets set to sell $1.39 billion of tobacco bonds next week, Invesco released a report on the sector that offers several reasons why investors should be holding tobacco bonds.

January 25 -

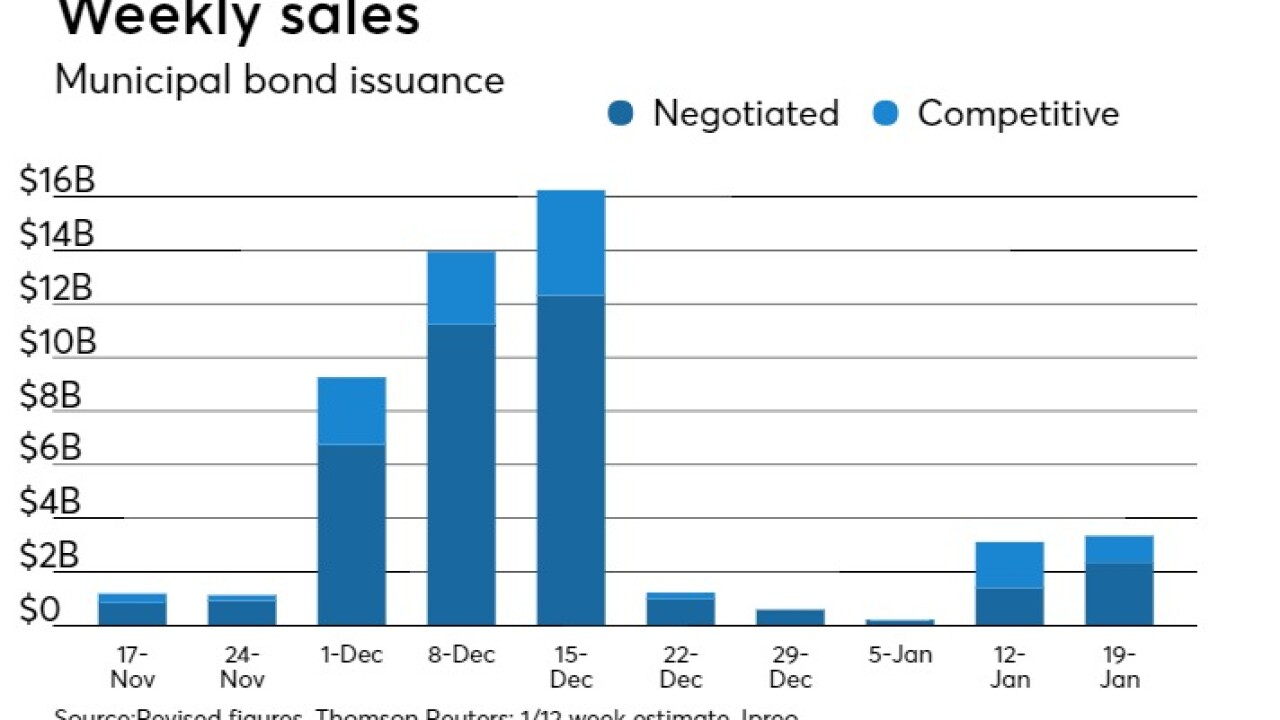

Muni volume in the last week of January is forecast to match that of the first three weeks combined, satisfying pent-up investor demand.

January 19 -

Municipal bond prices remain under pressure at midday as U.S. Treasury yields hit three-year highs and the market looks to next week's $7.17 billion slate.

January 19 -

Munis came under pressure as Treasuries weakened on concern over a possible government shutdown and traders looked ahead to a return to normal in deal volume next week.

January 19 -

Loop Capital also priced refunding bonds for Cook County, Ill., in the negotiated market.

January 18 -

The New York Metropolitan Transportation Authority sold a $478.18 million competitive deal to Bank of America Merrill Lynch as bond yields moved higher on Thursday.

January 18 -

The municipal bond market on Thursday will see the last of this week’s deals hit the screens as muni yields remain range-bound.

January 18 -

Tax-exempt issuance again dominates the calendar, after a week of mostly taxable deals .

January 12 -

The municipal bond market will see $3.35 billion of new deals hit the screens next in a holiday-shortened week. Ipreo estimates weekly volume at $3.35 billion, up from $3.12 billion this week.

January 12