-

Newly released transcripts of Federal Reserve policy meetings in 2016 show then-Governors Jerome Powell and Lael Brainard were quick to pivot away from planned interest-rate hikes in the face of risks posed by a stumbling Chinese economy.

January 14 -

Federal Reserve Board Chair Jerome Powell would not commit to timing for liftoff, stressing decisions would be data-based and the Fed will not allow inflation to become entrenched.

January 11 -

Pressures from inflation concerns and broader rising rates weigh on munis in the second week of 2022.

January 10 -

Until supply comes, market participants appear to be content to sit back and let the calendar flip to a new year without making any big moves.

December 27 -

Powell says the FOMC will consider ramping up tapering when more information about Omicron and its impacts are known, further flattening the UST yield curve.

November 30 -

This week will be all about the secondary market given that the majority of issuance was priced earlier in the month while Dec. 1 coupon payments should make secondary offerings look attractive.

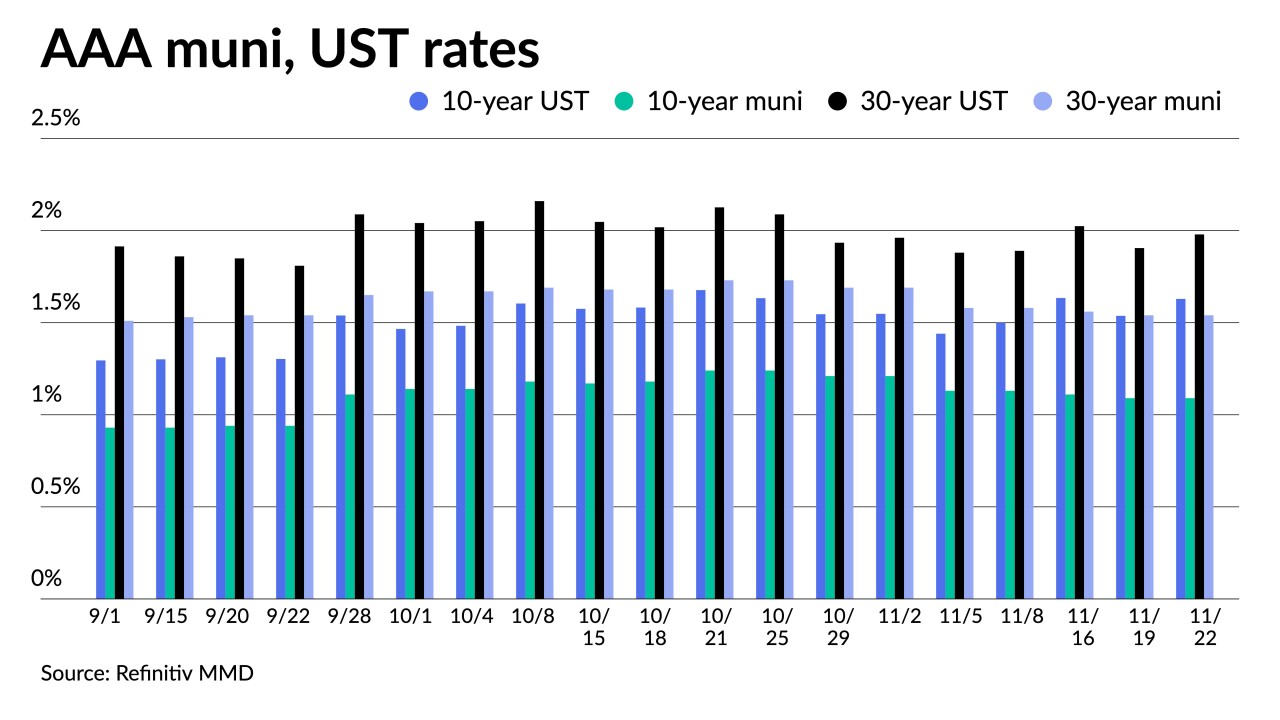

November 22 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

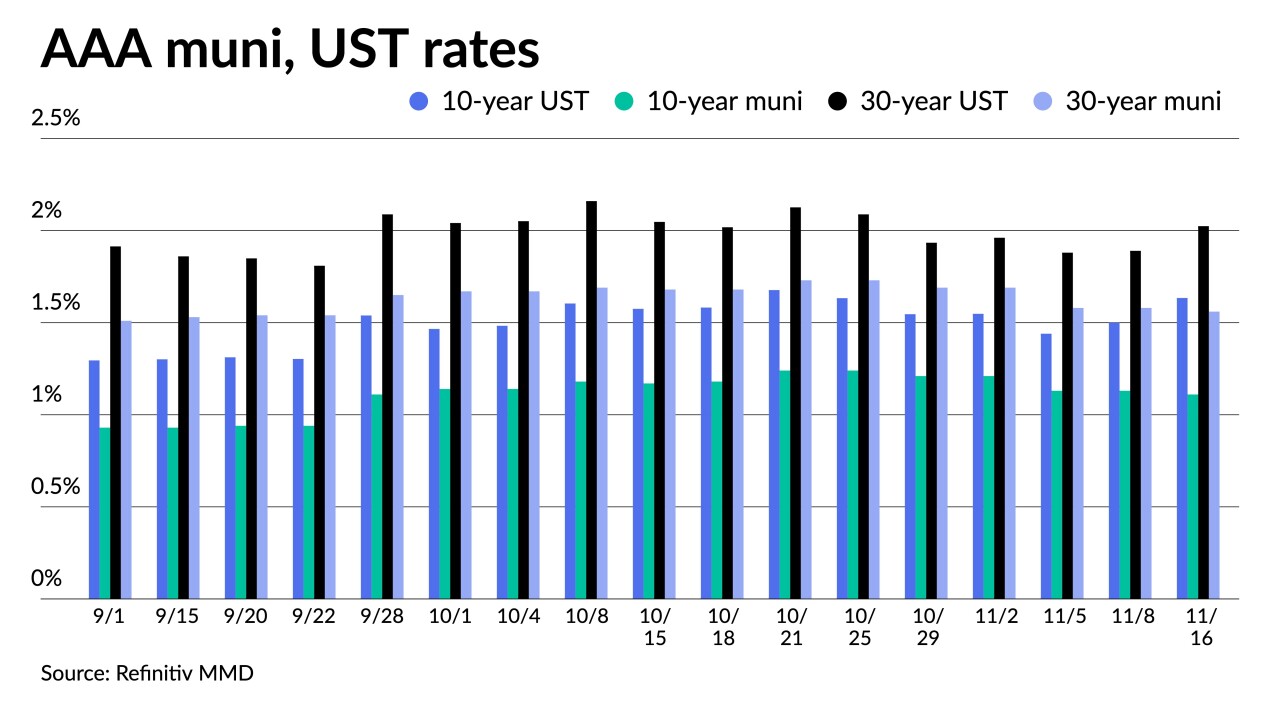

November 16 -

President Joe Biden met separately with Federal Reserve Chairman Jerome Powell and Fed Governor Lael Brainard at the White House on Thursday as he considers who will lead the central bank next year.

November 5 -

President Joe Biden said he’ll announce soon his choice of nominees for chair and other vacancies on the Federal Reserve, amid a scandal over stock trades by central bank officials.

November 2 -

Jerome Powell is widely expected to be renominated to a second term as Federal Reserve chair, but his chances have been modestly dented by the revelations of stock trading by some senior Fed officials in 2020, according to economists surveyed by Bloomberg News.

November 2 -

The Federal Reserve will ban top officials from buying individual stocks and bonds as well as limit active trading after an embarrassing scandal that led two officials to resign and clouded Chair Jerome Powell’s path to renomination.

October 21 -

What once seemed like an easy potential renomination for Powell has morphed into a problem for the White House as Sen. Elizabeth Warren, a Massachusetts Democrat, and progressive groups call into question the trading activity.

October 7 -

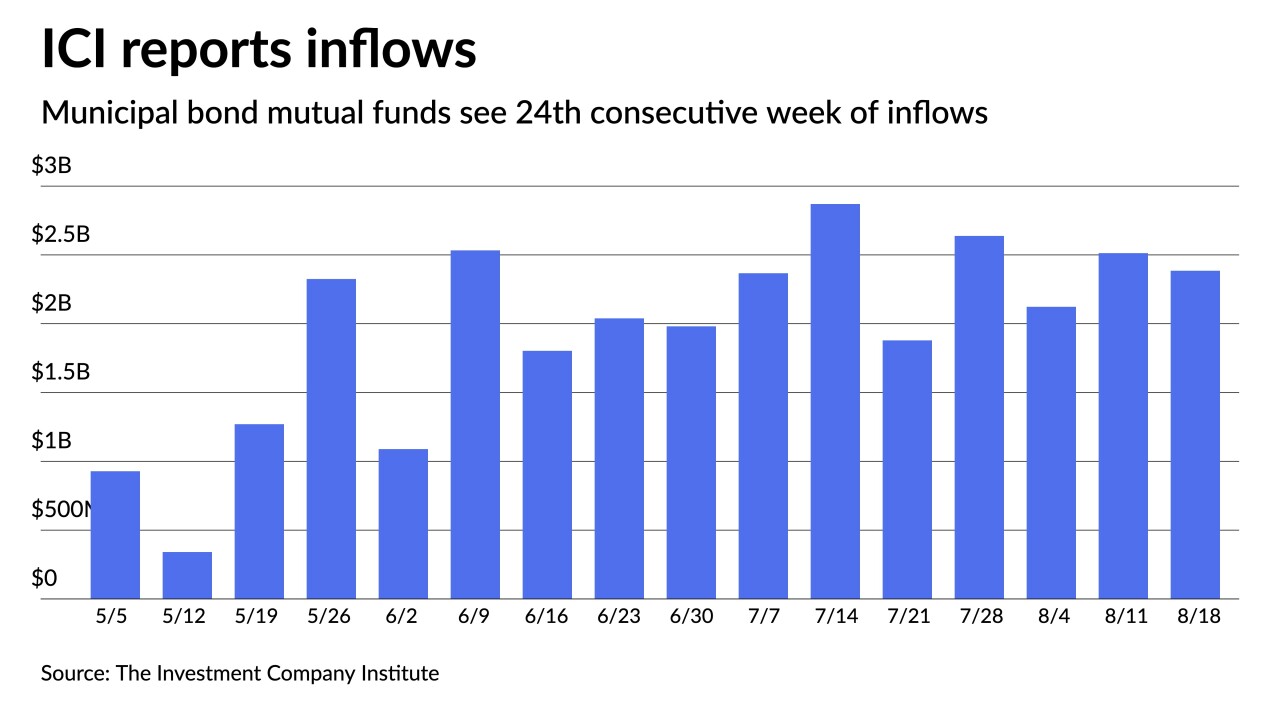

Municipals continue to stay in their own lane. ICI reported $1.4 billion of inflows in the 28th consecutive week.

September 22 -

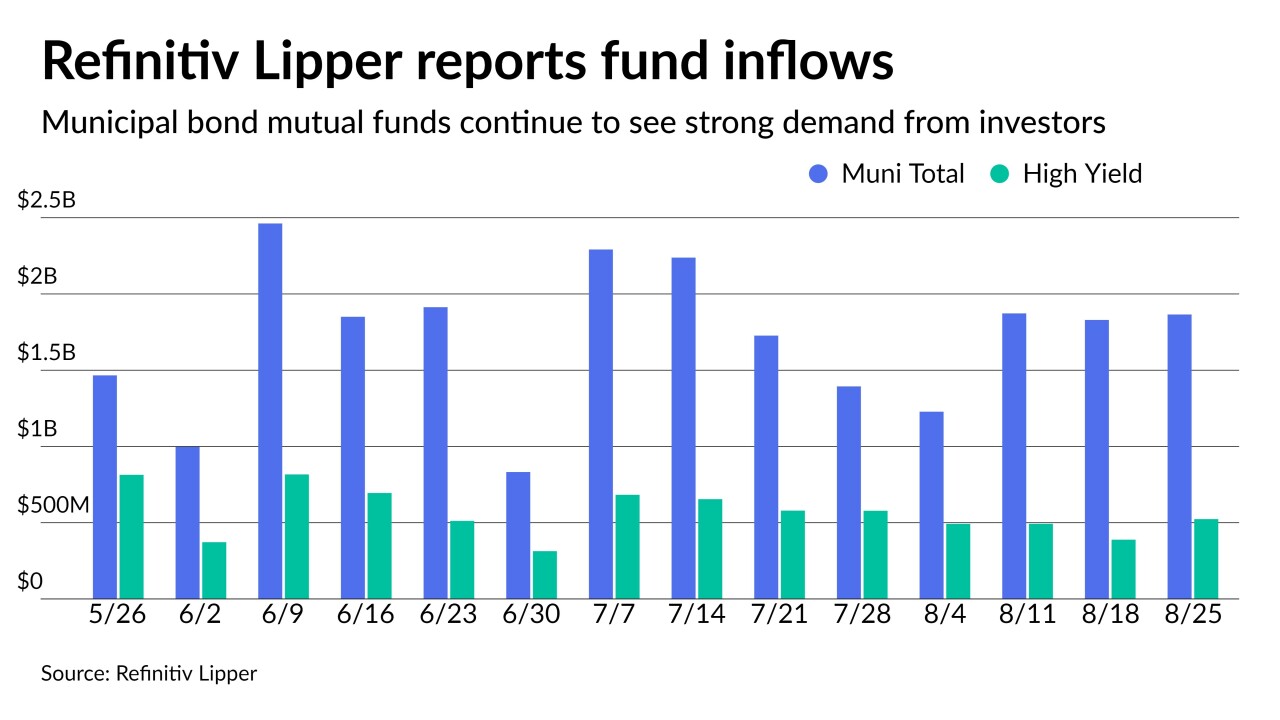

Refinitiv Lipper reported just over $1 billion of inflows into municipal bond mutual funds, an $800 million drop from a week prior, moving the four week moving average to $1.6 billion.

September 2 -

Bond investors may not wait long to start pushing back against Federal Reserve Chair Jerome Powell’s efforts to delink the start of asset-purchase tapering from the countdown to eventual policy-rate hikes.

September 2 -

The members of Congress, in asking that Biden find some other, unspecified, nominee, are going against the preference of Treasury Secretary Janet Yellen, who has told Biden advisers that she wants to see Powell renominated.

August 31 -

Returns of negative 0.40% would be the third-worst August performance of the past 10 years, according to Bloomberg data.

August 30 -

Experts agreed that Federal Reserve Board Chair Jerome Powell acknowledged the Fed could start tapering this year and that it would have no implications for liftoff, but not everyone was satisfied with what they heard.

August 27 -

Refinitiv Lipper reported $1.9 billion of inflows, high-yield gaining $524 million, the 25th consecutive week of inflows into municipal bond mutual funds.

August 26 -

The Investment Company Institute reported $2.3 billion of inflows, bringing 2021 totals to $67 billion.

August 25