-

The state prices $2.1 billion for institutions on Tuesday, also the date of the statewide vote on whether to recall Gov. Gavin Newsom.

September 9 -

Refinitiv Lipper reported just over $1 billion of inflows into municipal bond mutual funds, an $800 million drop from a week prior, moving the four week moving average to $1.6 billion.

September 2 -

Bond investors may not wait long to start pushing back against Federal Reserve Chair Jerome Powell’s efforts to delink the start of asset-purchase tapering from the countdown to eventual policy-rate hikes.

September 2 -

The members of Congress, in asking that Biden find some other, unspecified, nominee, are going against the preference of Treasury Secretary Janet Yellen, who has told Biden advisers that she wants to see Powell renominated.

August 31 -

Returns of negative 0.40% would be the third-worst August performance of the past 10 years, according to Bloomberg data.

August 30 -

Federal Reserve Gov. Lael Brainard spoke with the Biden-Harris Federal Reserve transition team in January and with the president’s Council of Economic Advisers in May, her calendar shows.

August 27 -

Experts agreed that Federal Reserve Board Chair Jerome Powell acknowledged the Fed could start tapering this year and that it would have no implications for liftoff, but not everyone was satisfied with what they heard.

August 27 -

ReThinkNYC, battling entrenched transit and real-estate interests in its call for a unified network, cites economic development gains and capital savings.

August 27 -

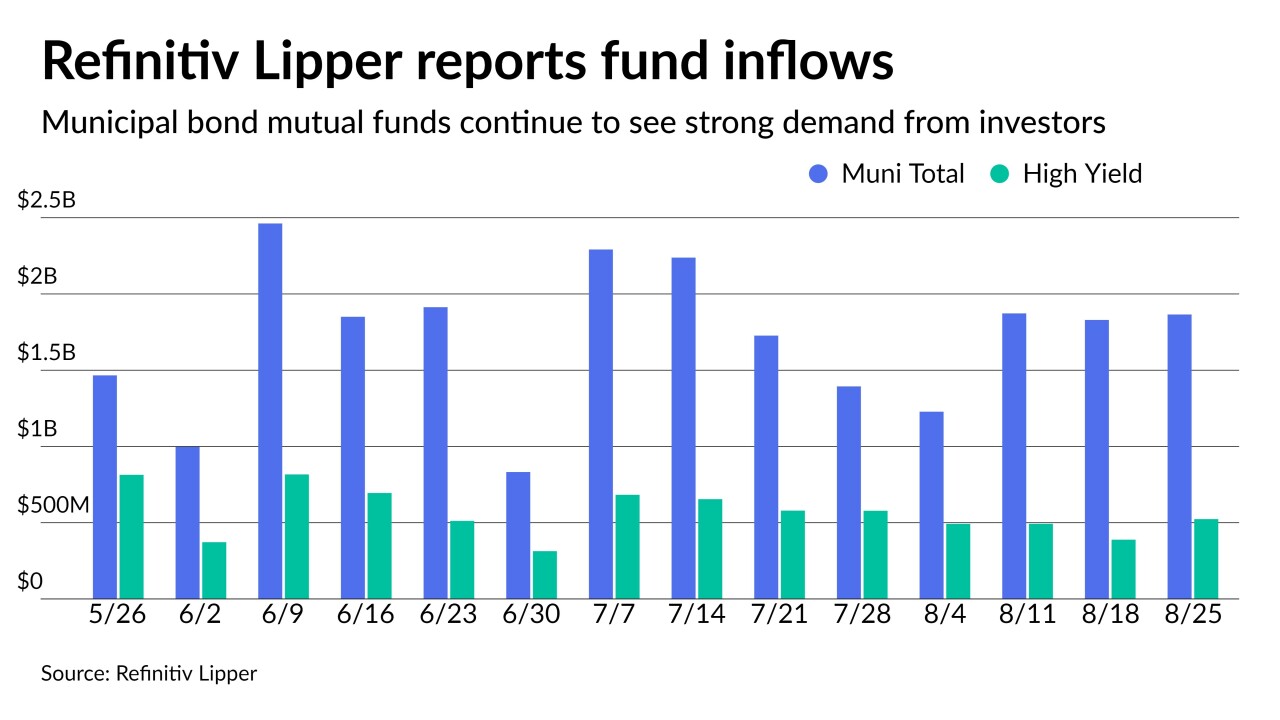

Refinitiv Lipper reported $1.9 billion of inflows, high-yield gaining $524 million, the 25th consecutive week of inflows into municipal bond mutual funds.

August 26 -

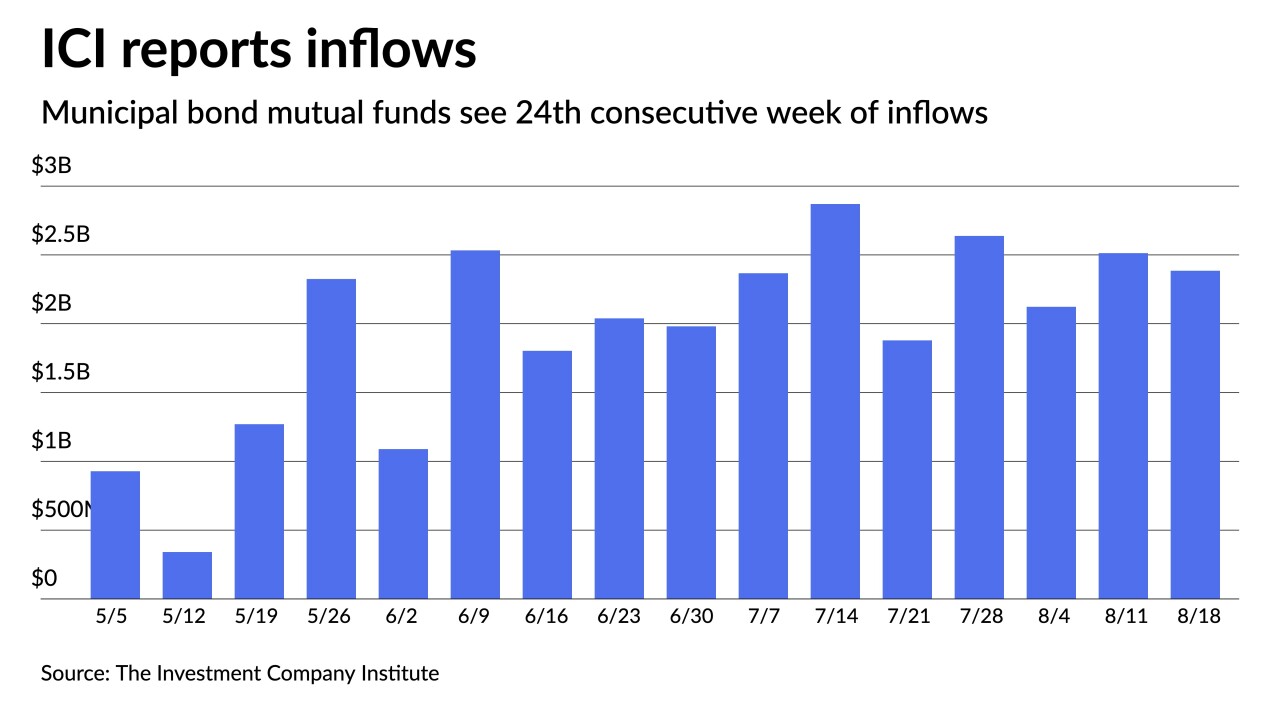

The Investment Company Institute reported $2.3 billion of inflows, bringing 2021 totals to $67 billion.

August 25