-

Top-quality municipal bonds ended weaker on Monday, according to traders, who were looking ahead to a $7.42 billion new issue slate dominated by deals from New York City and Maryland.

September 11 -

Municipal bonds were weaker, traders said, as they look to the $7.42 billion new issue slate, headed by deals from New York City and Maryland.

September 11 -

Municipal bond traders were returning to their desks on Monday and looking ahead to the week’s $7.42 billion new issue slate, which will be dominated by big bond deals from New York City and Maryland.

September 11 -

Ipreo estimates total bond volume for next week at $4 billion, down from a revised total of $5.9 billion this week, according to data from Thomson Reuters. Next week’s calculations do not include note sales.

August 18 -

Muni traders on Friday are looking ahead to next week’s lighter new issue slate, which will be dominated by a note deal, rather than a bond sale.

August 18 -

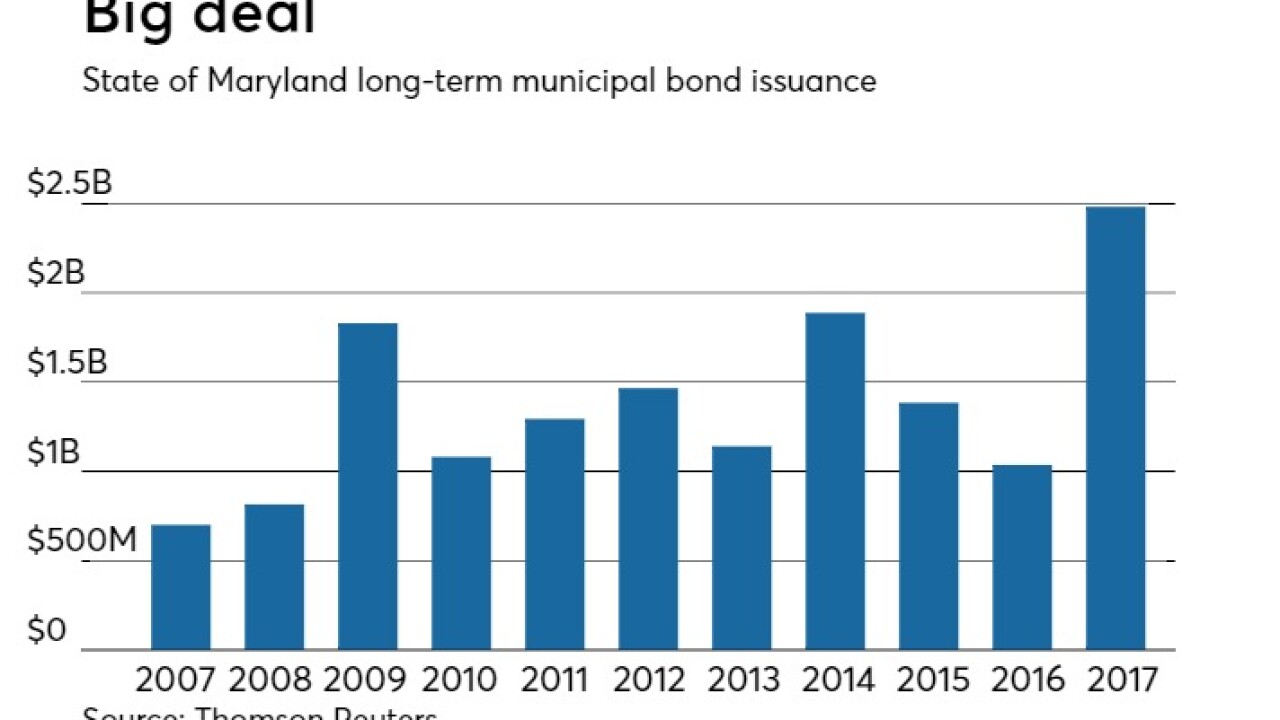

The $358 million deal saw net present value savings of 9.46%, among the highest the state has seen.

August 17 -

Municipal bonds ended mixed on Wednesday, according to traders, as the gilt-edged state of Maryland came to market with competitive sales won by Bank of America Merrill Lynch and Citigroup.

August 16 -

Municipal bonds were weaker at midday, according to traders, as the gilt-edged state of Maryland came to market with two competitive sales won by BAML and Citi.

August 16 -

Municipal bond traders are set to see the state of Maryland come to market with two top-quality competitive sales on Wednesday.

August 16 -

Primary municipal bond market volume is expected to increase to $6.7 billion.

August 11