-

The New York/New Jersey agency's issuance of $1.1 billion in taxable notes underscores multi-year revenue challenges it confronts due to the COVID-19 pandemic.

July 2 -

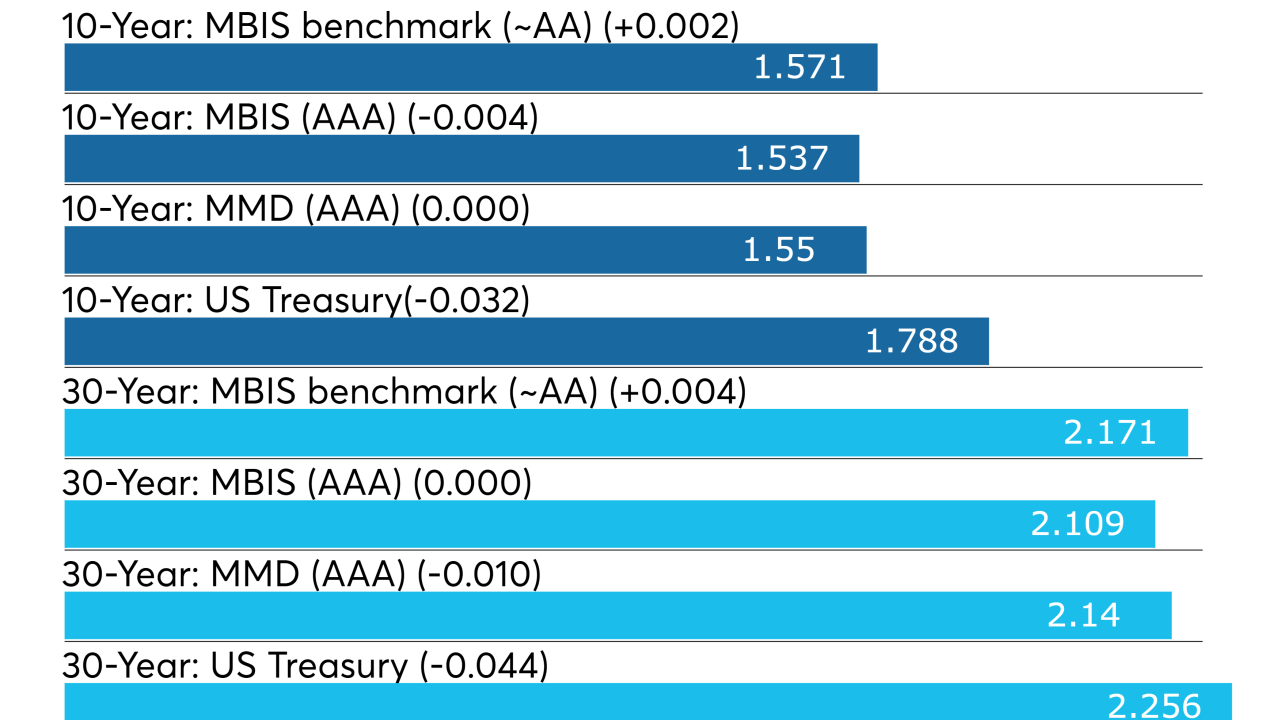

Traders and strategists say the dearth of tax-exempt debt and the surge of taxable issuance is keeping the market steady.

July 1 -

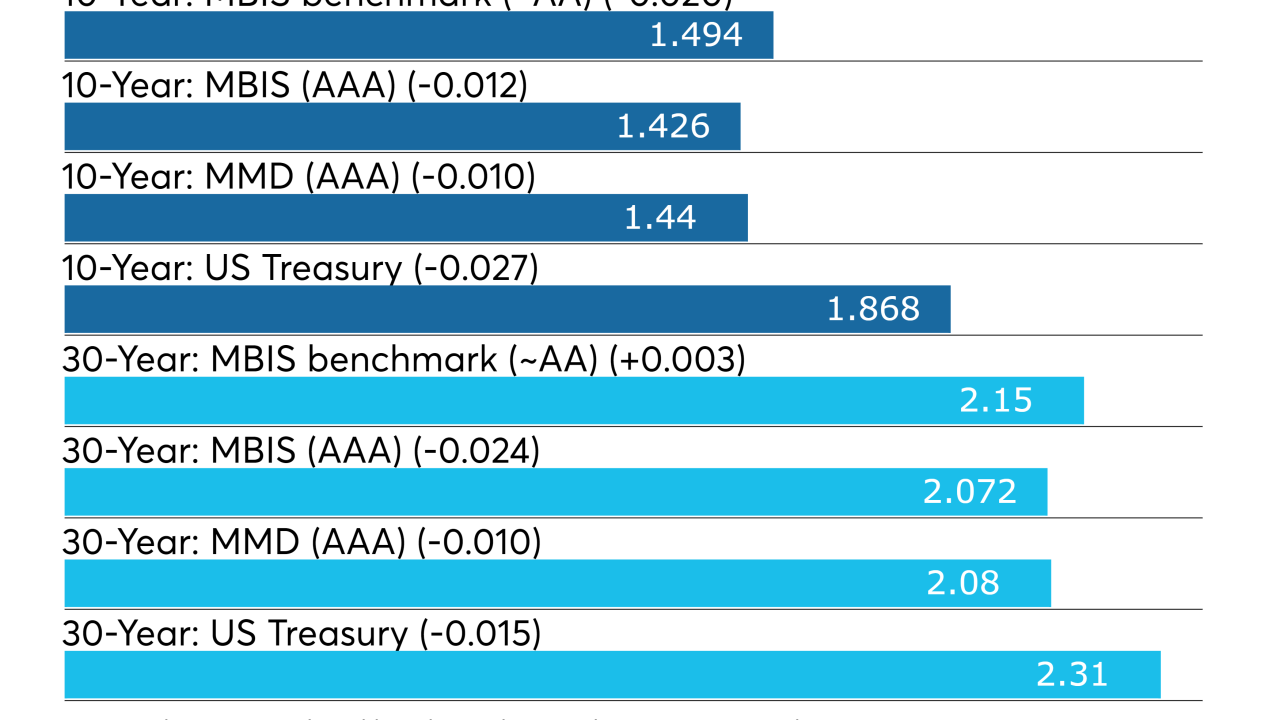

Municipal bonds were little changed as the first half of a tumultuous year comes to a close.

June 30 -

Municipal bonds finished mostly steady on Friday ahead of a $7.2 billion holiday week new issue calendar.

June 26 -

S&P Global Ratings lowered the Port Authority’s special project bonds issued of behalf of JFK International Air Terminal LLC to BBB from BBB-plus.

June 4 -

The bi-state agency can apply to use the Federal Reserve’s Municipal Liquidity Facility, if it chooses.

June 3 -

For the second time in two weeks, a rating agency lowered the Port Authority of New York and New Jersey's outlook.

April 27 -

One of the nation’s largest transportation borrowers issued its first bond disclosure about the fiscal impacts from the COVID-19 pandemic.

April 16 -

Volume is down sharply across the Port Authority of New York and New Jersey's transportation assets since the March COVID-19 outbreak.

April 14 -

Tom Prendergast and Denise Berger were hired by the engineering firm to spearhead major infrastructure needs facing the New York City region.

March 31 -

Of $10 billion allocated in the CARES Act, public airports can use $7.4 billion for any lawful purpose, including the payment of debt service.

March 30 -

The bi-state transportation agency's executive director, Rick Cotton, recovered from virus than three weeks after testing positive.

March 30 -

They asked for a combined $4.4 billion.

March 24 -

Gerrard Bushell, executive chair of the New Terminal One Development Project at John F. Kennedy International Airport, discusses how the $7 billion public-private partnership is progressing under the leadership of New York Gov. Andrew Cuomo. Hosted by Andrew Coen.

March 24 -

Port Authority of New York and New Jersey Executive Director Rick Cotton plans to maintain day-to-day operations from home after a positive coronavirus test.

March 10 -

A key New Jersey link to the long-stalled Gateway Tunnel project under the Hudson River into Manhattan cleared a major barrier for federal funding Monday and now awaits clearance from the White House.

February 11 -

Private sector involvement will fuel timely completion of a large-scale overhaul of John F. Kennedy International Airport, according to head of the multibillion-dollar modernization project.

February 4 -

Retail investors have felt confident in the muni bond space for most of 2019.

December 27 -

A new fiscal plan adopted by the Port Authority of New York and New Jersey increases debt service payments by 8% to support large-scale infrastructure efforts.

December 17 -

The influx of issuance continued on Tuesday, with the largest deal of the week leading the way in the downpour of pricings.

November 19