-

Municipals were weaker on Friday, with yields on the long end finishing out the day up one basis point. Since Aug. 12, when the muni market correction began and yields moved off record low levels, the yield on 10-year muni has risen by 23 basis points while the 30-year yield is up 29 basis points, according to Refinitiv MMD.

August 28 -

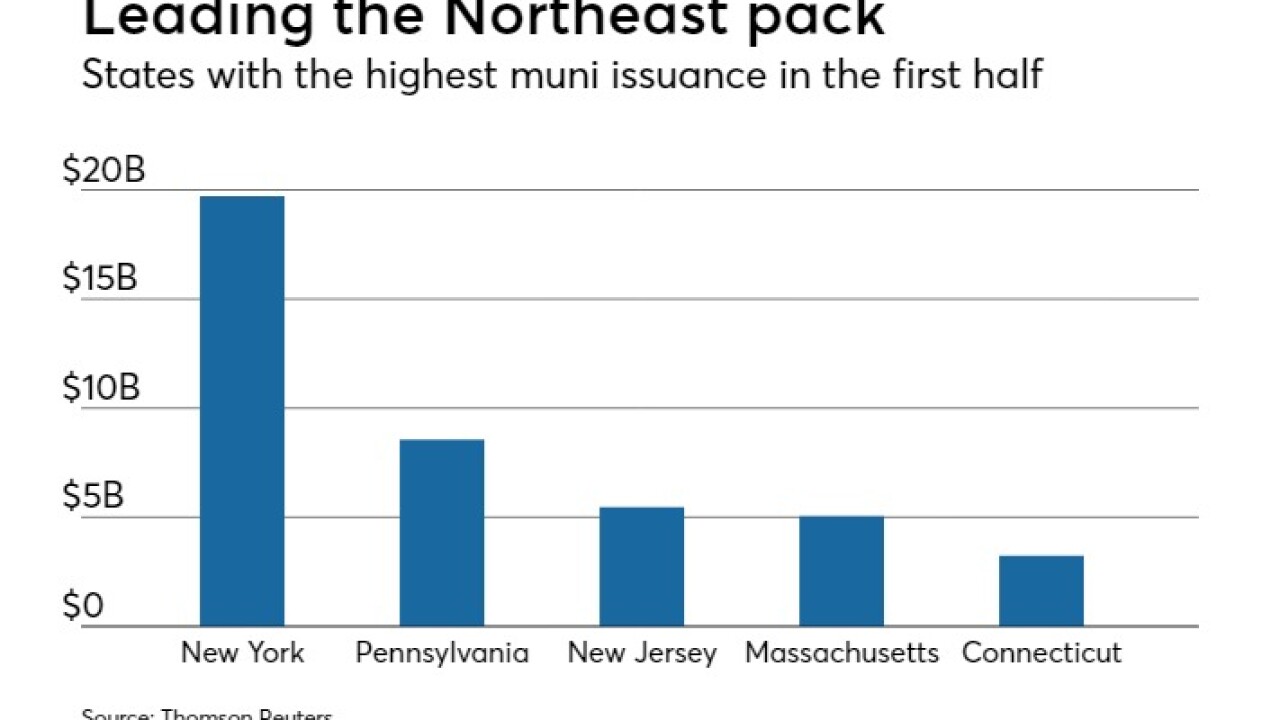

Northeast municipal bond issuance sank 11.7% in the first half of 2018 compared to a year earlier, reflecting a national trend driven by federal tax changes.

August 17 -

The quarterly update showed growth slowed from 3.4% amid declining commercial leasing activity, and sluggish private sector job growth.

May 8 -

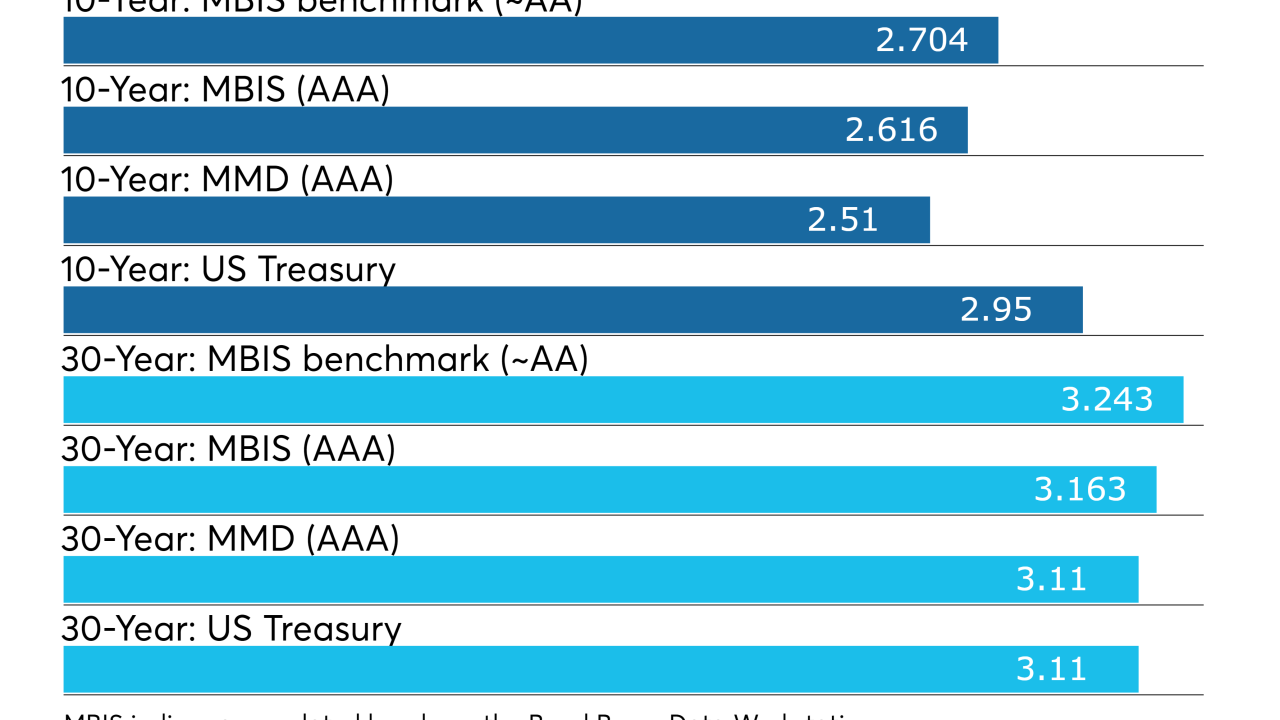

Munis were stronger Monday as bond buyers kept an eye on the Federal Reserve policy makers' meeting.

April 30 -

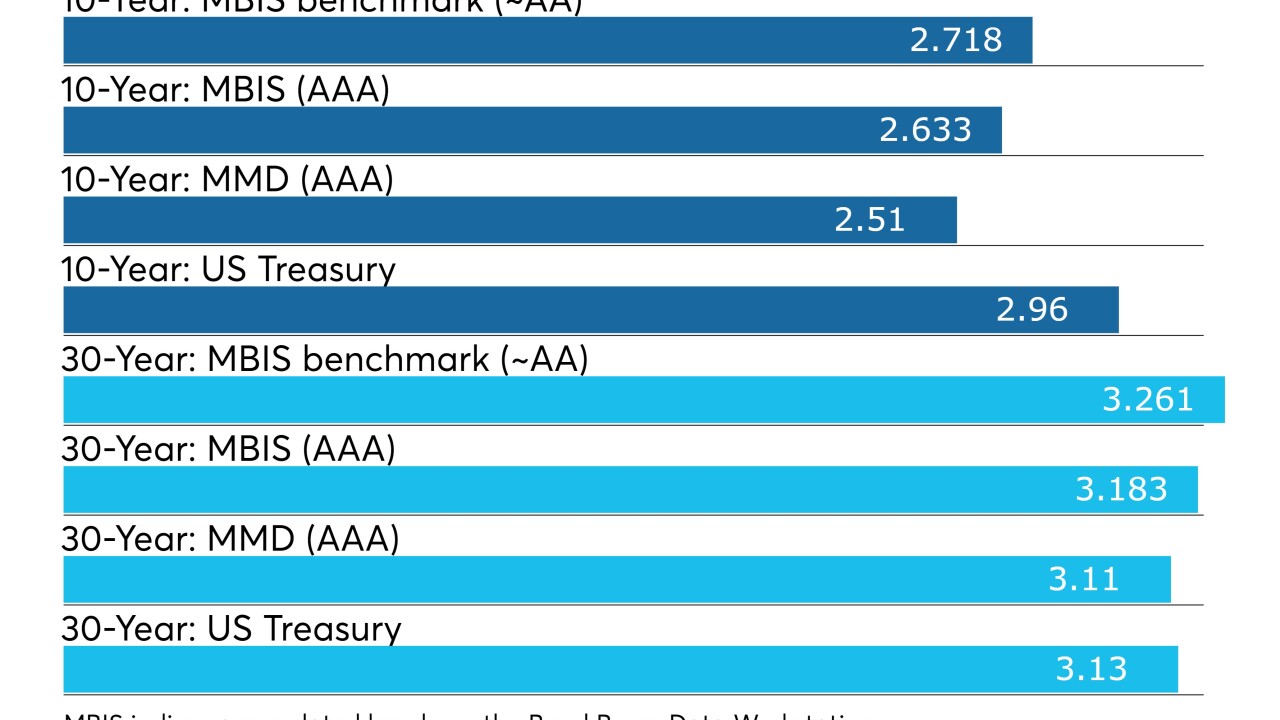

Municipal bond buyers are awaiting this week’s new issue supply as they keep both eyes firmly on the Federal Open Market Committee’s monetary policy meeting.

April 30 -

Weekly municipal bond volume will be down with the Federal Open Market Committee set to meet, though no interest rate increase is expected.

April 27 -

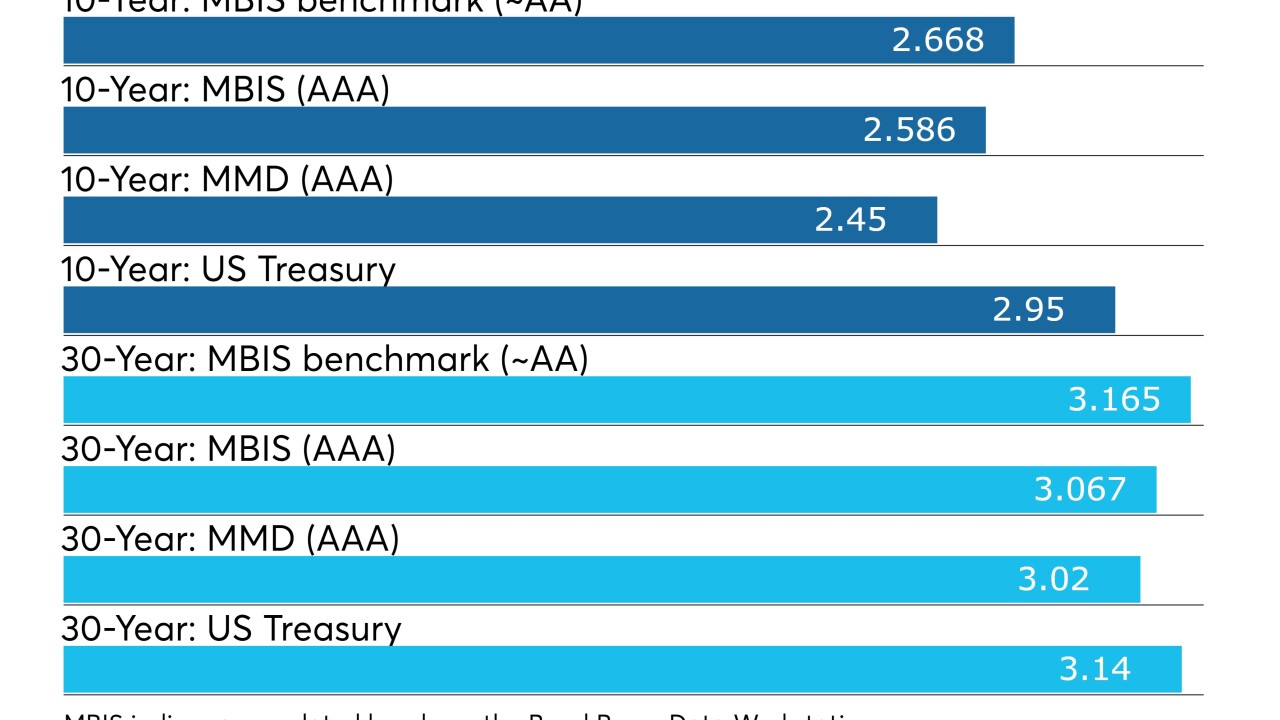

The municipal bond market will see a light new issue calendar next week as the Federal Reserve meeting on monetary policy puts a damper on new debt issuance.

April 27 -

With tax season in the rear view mirror, supply is set to rise to $7.8 billion as demand rebounds.

April 20