-

Top quality municipal bonds finished mixed on Monday, according to traders as the first of the week’s big new issues came to market out of the Midwest.

August 7 -

On a quiet Monday where there is only one deal pricing for retail investors, municipals were mixed although some maturities on the long end were as much as one basis point higher, according to traders.

August 7 -

The municipal bond market is gearing up for about $7.3 billion of new supply this week, with $2.51 of that coming from two issuers.

August 7 -

Primary municipal bond market volume is expected to inch up to $7.3 billion, as analysts expect the muni market to stay on a path of suppressed supply and deep demand.

August 4 -

The New York City Transitional Finance Authority will competitively sell $1.35 billion of Fiscal 2018 Series A future tax secured tax-exempt and taxable subordinate bonds and about $162 million of Fiscal 2018 Series 1 fixed-rate tax-exempts on Aug. 8.

July 28 -

Municipal bond traders are returning to work on Monday set for the week’s $7.66 billion new issue calendar. The slate is composed of $3.99 billion of negotiated deals and $3.67 billion of competitive sales.

July 17 -

Top-shelf municipal bonds were stronger at mid-session, according to traders, who were looking ahead to next week’s new issue calendar. which Ipreo estimates at $7.66 billion.

July 14 -

Municipal bond traders are waiting to see how much volume the market will encounter next week as they eye volatile muni yields.

July 14 -

The New York City Transitional Finance Authority’s $1.01 billion deal was accelerated by a day with the bonds being priced for institutions on Tuesday.

July 11 -

The pricing on the New York City Transitional Finance Authority’s $1.01 billion deal was accelerated by a day as top-quality municipal bonds turned mixed on Tuesday.

July 11 -

The municipal bond market on Tuesday will see more supply head its way with the second day of retail orders being held on the New York City Transitional Finance Authority’s $1 billion of building aid revenue bonds and deals expected from Los Angles and Philadelphia.

July 11 -

Municipal bonds ended mixed on Monday, according to traders, as the New York City Transitional Finance Authority’s $1 billion of building aid revenue bonds were priced for retail investors and the Chicago Public Schools came to market with an unrated bond deal.

July 10 -

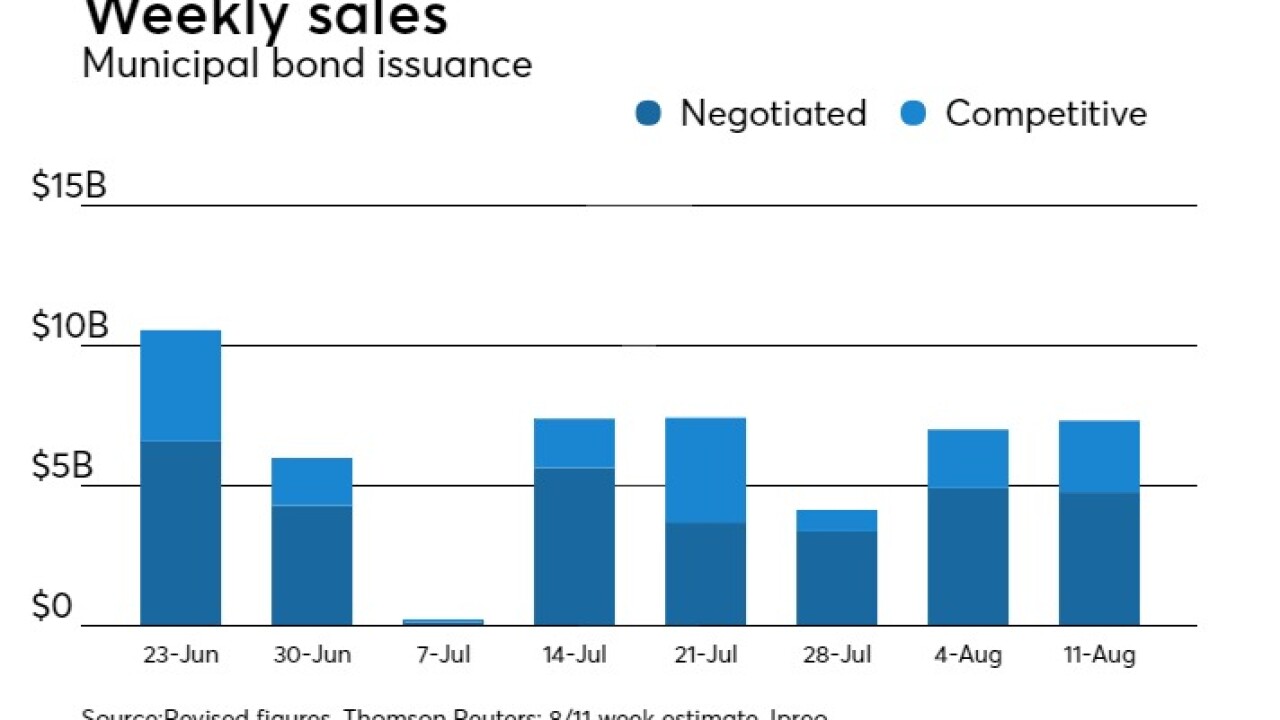

Municipal bonds were mixed at mid-session, according to traders, who are set to see a chunky new issue slate head to market this week. Volume is estimated at $9.29 billion, composed of $7.94 billion of negotiated deals and $1.35 billion of competitive sales.

July 10 -

Municipal bond traders are set to see a chunky new issue slate head to market this week. Volume is estimated at $9.29 billion, composed of $7.94 billion of negotiated deals and $1.35 billion of competitive sales.

July 10 -

Municipal market participants will get back to work and find their hands full, with $9 billion of new issuance forecast for the primary market.

July 7 -

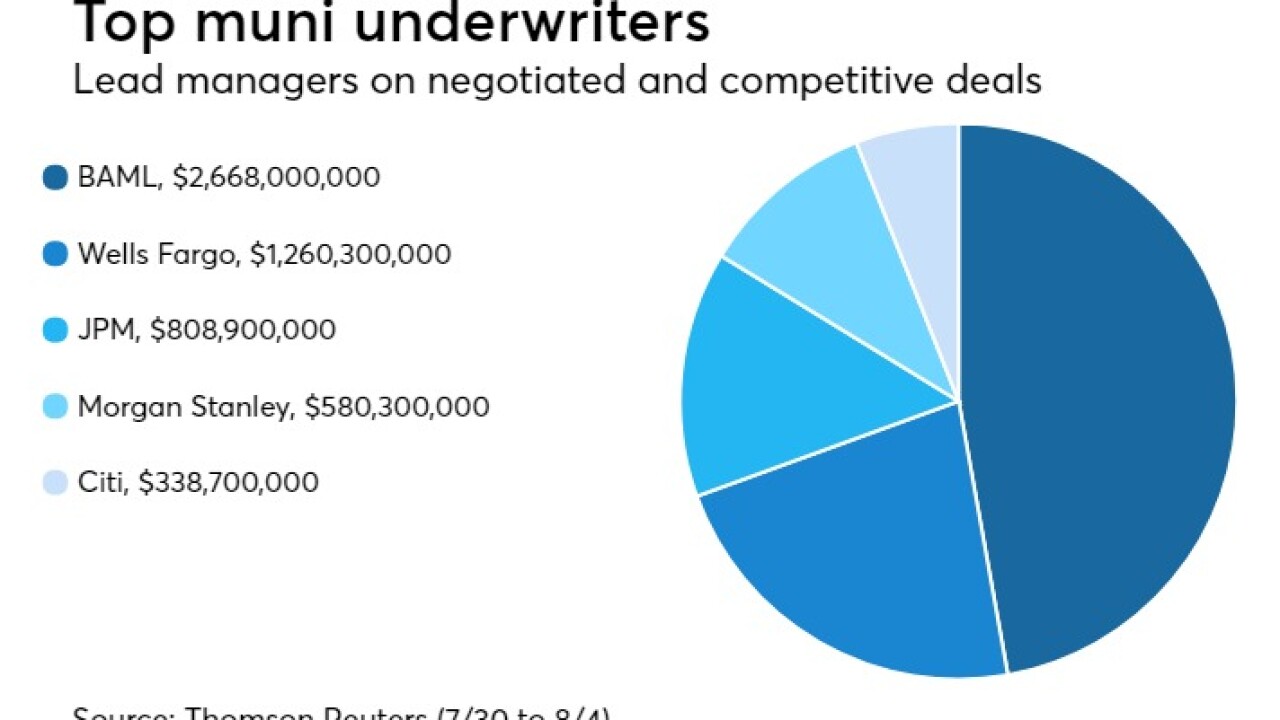

Bank of America Merrill Lynch used a big second quarter to overtake Citi at the top of the municipal league tables, while Morgan Stanley, RBC Capital Markets and Goldman Sachs moved up in the first half rankings.

July 7 -

The municipal bond market was quiet on Monday ahead an early close to trading and Tuesday’s full close for the Fourth of July holiday.

July 3 -

New York lawmakers approved a three-year extension of counties' authority to levy local sales tax.

June 29 -

New York municipalities may see a lapse in tax collections absent new legislation, according to Fitch Ratings.

June 26 -

Top-shelf municipal bonds were flat at midday as traders take a break from the primary on Friday to look ahead to next week’s new issue slate. an estimated $6.82 billion.

June 23