-

The Investment Company Institute on Wednesday reported $2.533 billion of inflows into municipal bond mutual funds, the highest since February.

June 16 -

Most analysts expect the Federal Open Market Committee will alter its Summary of Economic Projections and perhaps begin to talk about tapering, without offering clues when they'll begin cutting back on asset purchases.

June 14 -

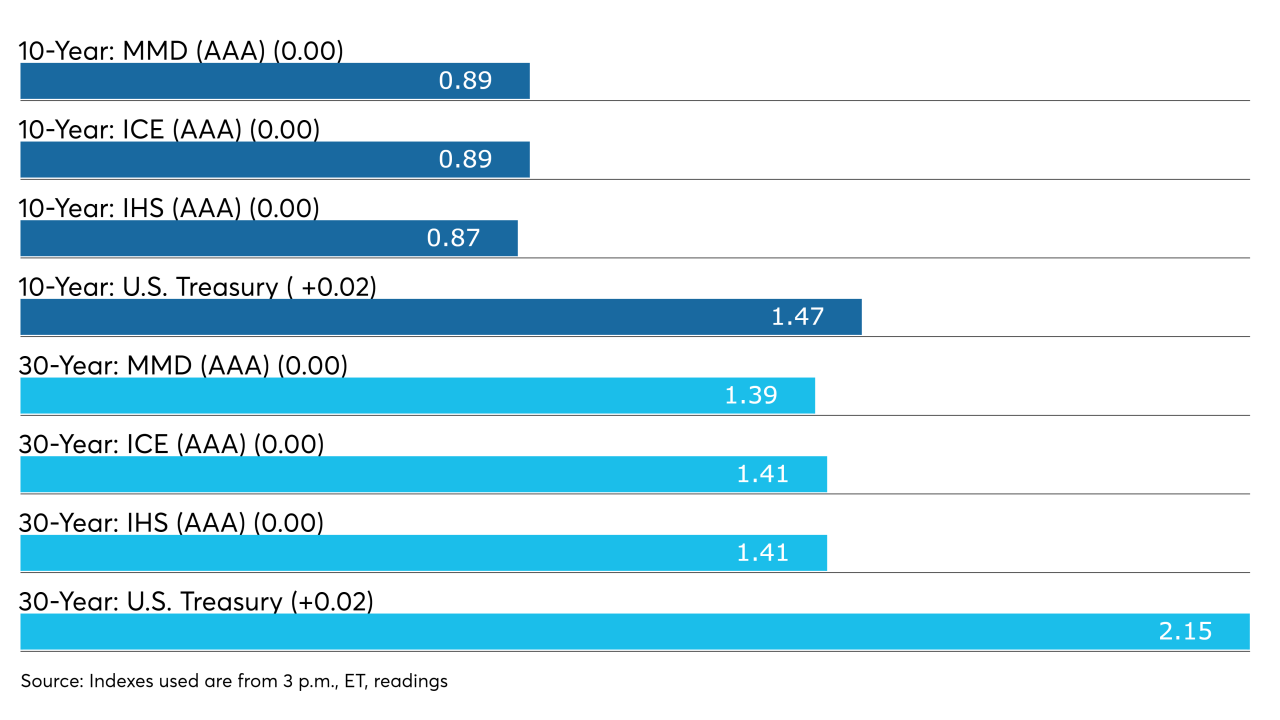

Yields on top-quality munis were flat on the AAA scales Friday; yields were seven to nine basis points lower on the week.

June 11 -

“We have to be careful in removing accommodation so that we don’t create any kind of ‘taper tantrum,’ ” Philadelphia Fed President Patrick Harker said.

June 2 -

Randal Quarles left open the possibility that he might remain in his role as a Federal Reserve governor after his tenure as vice chair for supervision expires on Oct. 13 — a move that would reduce the openings for the Biden administration to fill.

June 1 -

Municipal yields will likely stay in a narrow range with trading activity subdued unless larger interest rate volatility unexpectedly sets in, analysts say.

May 28 -

The Federal Reserve’s prestigious annual Jackson Hole policy symposium will be held in person this year, albeit in a modified form.

May 27 -

U.S. central bank officials may be able to begin discussing the appropriate timing of scaling back their bond-buying program at upcoming policy meetings, Federal Reserve Vice Chair Richard Clarida said.

May 25 -

Raphael Bostic, Federal Reserve Bank of Atlanta president, says he hears frequent speculation that he could be nominated to lead the central bank.

May 24 -

Factors pushing U.S. inflation higher are likely to ebb at the start of 2022, said Federal Reserve Bank of San Francisco President Mary Daly.

May 21 -

The Federal Reserve should get a conversation going on tapering its bond-purchase program “sooner rather than later,” Philadelphia Fed President Patrick Harker said.

May 21 -

The Investment Company Institute reported another week of inflows, but at a lower clip than recent weeks with $541 million coming into municipal bond mutual funds.

May 19 -

The Federal Reserve’s policy is in a good place right now, said Cleveland Fed President Loretta Mester, while playing down signals from data that she warns will be volatile as the economy reopens.

May 14 -

The U.S. labor market remains in a “deep hole” and needs aggressive support to speed its healing from the COVID-19 pandemic, said Federal Reserve Bank of Minneapolis President Neel Kashkari.

May 10 -

It will probably take “quite some time” for Federal Reserve officials to conclude the economy has made substantial progress following Friday’s disappointing jobs report, Chicago Fed President Charles Evans said.

May 10 -

Federal Reserve Bank of Minneapolis President Neel Kashkari said he has “zero sympathy” for critics on Wall Street, who slam the central bank’s aggressive support of the U.S. economy while millions of Americans remain out of work.

May 7 -

A rising appetite for risk across a variety of asset markets is stretching valuations and creating vulnerabilities in the U.S. financial system, the Federal Reserve said in its semi-annual financial stability report.

May 6 -

A senior White House economic aide said the decision on selecting the next central bank chief will come after a thorough “process.”

May 4 -

Federal Reserve Chair Jerome Powell said that while the U.S. economic recovery is “making real progress,” the gains have been uneven following a downturn that cut hard along lines of race and income.

May 3 -

Signs of excess risk taking in financial markets show it’s time for the U.S. central bank to start debating a reduction in its massive bond purchases, said the president of the Dallas Federal Reserve, breaking ranks with Chair Jerome Powell.

April 30