-

Bond investors may not wait long to start pushing back against Federal Reserve Chair Jerome Powell’s efforts to delink the start of asset-purchase tapering from the countdown to eventual policy-rate hikes.

September 2 -

The members of Congress, in asking that Biden find some other, unspecified, nominee, are going against the preference of Treasury Secretary Janet Yellen, who has told Biden advisers that she wants to see Powell renominated.

August 31 -

Federal Reserve Chair Jerome Powell risks inflation getting out of control and his assurance that the central bank can keep it in check neglects to mention this would require traumatic surgery, said former Richmond Fed President Jeffrey Lacker.

August 30 -

U.S. Treasury Secretary Janet Yellen has told senior White House advisers that she supports reappointing Jerome Powell as Federal Reserve chair, according to people familiar with the matter, a move that greatly increases his chance for a second term.

August 23 -

Dallas Fed President Robert Kaplan said he’s open to adjusting his view that the Federal Reserve should start tapering its asset-purchase program sooner rather than later if the Delta variant persists and hurts economic progress.

August 20 -

As New York City launched the first of its two-day retail order period on $1.039 billion of GO bonds, the market was uneventful ahead of $9.76 billion in the primary market this week

August 16 -

Separately, Atlanta Fed President Raphael Bostic said the FOMC wouldn't raise rates in response to a “hot” labor market, out of fear over subsequent inflation.

August 12 -

The Federal Reserve is on track to begin increasing interest rates in 2023 if the economy performs as policy makers are projecting, Vice Chairman Richard Clarida said Wednesday.

August 4 -

President Joe Biden has a tough decision in choosing the next Federal Reserve chair: Play it safe by giving Jerome Powell a second term or take a chance on a liberal like Lael Brainard, who would please progressives in Congress yet potentially agitate Wall Street.

August 3 -

Joe Kalish, chief global macro strategist at Ned Davis Research, discusses his thoughts on when the Federal Reserve will announce it will cut back on its asset purchases, the possibility of Chair Jerome Powell’s re-nomination and what to expect from the Jackson Hole summit. Gary Siegel hosts (27 minutes)

August 3 -

Federal Reserve Governor Christopher Waller said that if the next two monthly U.S. employment reports show continued gains, he could back an announcement soon on scaling back the central bank’s bond purchases.

August 2 -

Federal Reserve Board Gov. Lael Brainard staked out some different ground from Chair Jerome Powell as the policy makers await a presidential decision on who should lead the central bank in the coming four years.

August 2 -

Federal Reserve Bank of Minneapolis President Neel Kashkari said the spread of the Delta variant of COVID-19 could keep some Americans from looking for work, potentially harming the U.S. recovery.

August 2 -

Financial markets “are very well prepared” for the Federal Reserve to start tapering its massive asset-purchase program in the fall, St. Louis Fed President James Bullard said.

July 30 -

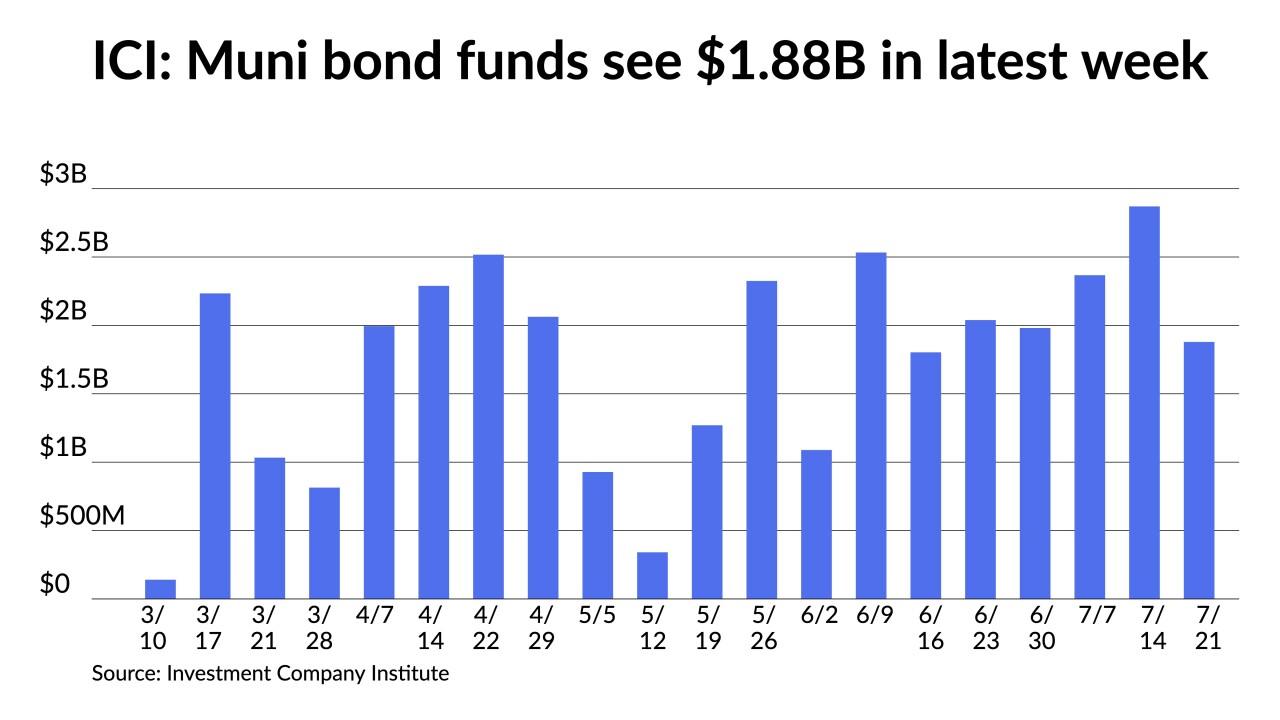

The massive summer reinvestment into municipal bond mutual funds continue and are both sustaining the strength of investor demand and solidifying the technical footing of the market.

July 28 -

The economy continues to recover, with durable goods orders and consumer confidence suggesting strength, but concerns about the Delta variant of COVID-19 and continued supply-chain problems cloud the future outlook.

July 27 -

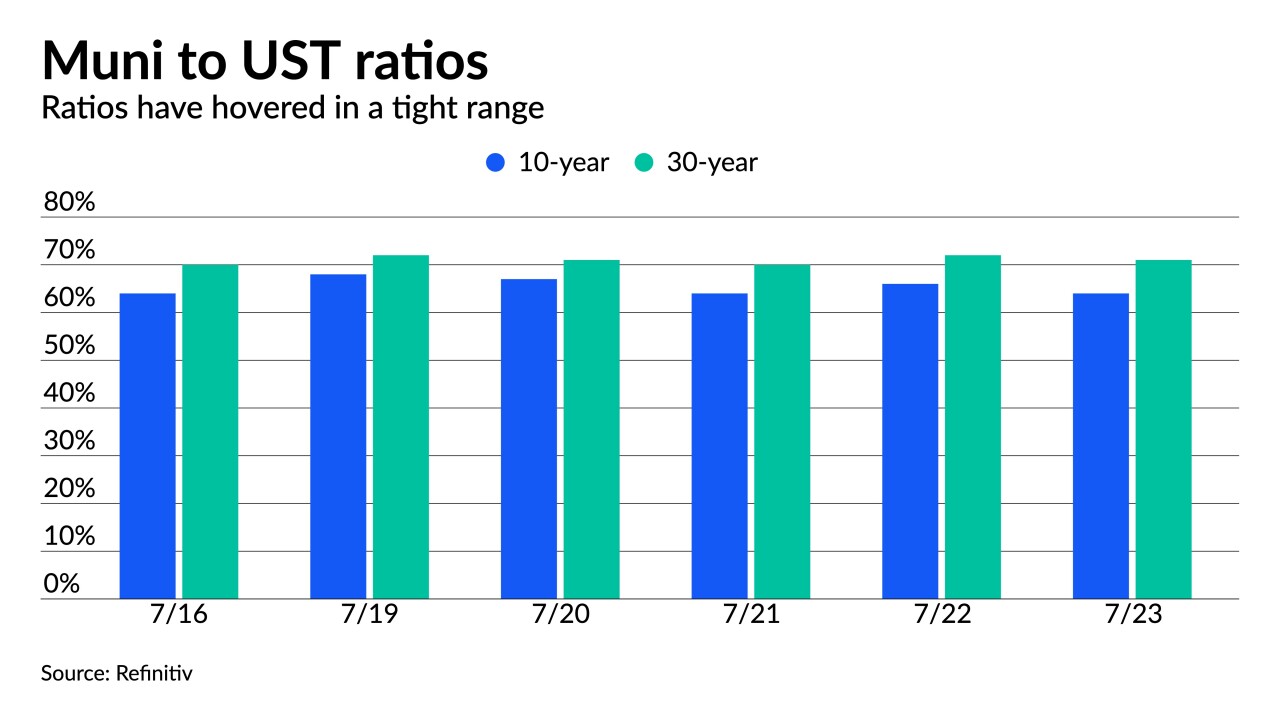

The last week of July marks a lighter calendar while August redemptions are huge compared to the expected supply. Investors need to get in line and likely accept lower yields and continued historically low ratios.

July 23 -

Federal Reserve Chair Jerome Powell enjoys broad support for his renomination among top White House advisers, though the decision is expected later this year.

July 21 -

Increasing attention to whether inflation is a problem for the U.S. economy and financial markets isn’t resolved easily by looking at the most recent economic and financial market data.

July 21 Keel Point

Keel Point -

Ed Moya, senior market analyst for the Americas at OANDA, talks with Bond Buyer Managing Editor Gary Siegel about the upcoming FOMC meeting, inflation, the possibility of tapering and the future make-up of the Fed in a wide-ranging discussion on the economy and monetary policy. (31 minutes)

July 20