-

The Federal Reserve is monitoring the COVID-19 issue and its economic effects, according to a release from the central bank, attributed to Chairman Jerome Powell, released Friday.

February 28 -

Federal Reserve Bank of St. Louis President James Bullard said the Fed is ready to act if the COVID-19 virus develops into a destabilizing force.

February 28 -

GOP’s Shelby says he could support Shelton for Fed board

February 27 -

It’s too soon to judge the potential impact of the coronavirus outbreak on the U.S. economy or consider a monetary policy response, Chicago Fed President Charles Evans said.

February 27 -

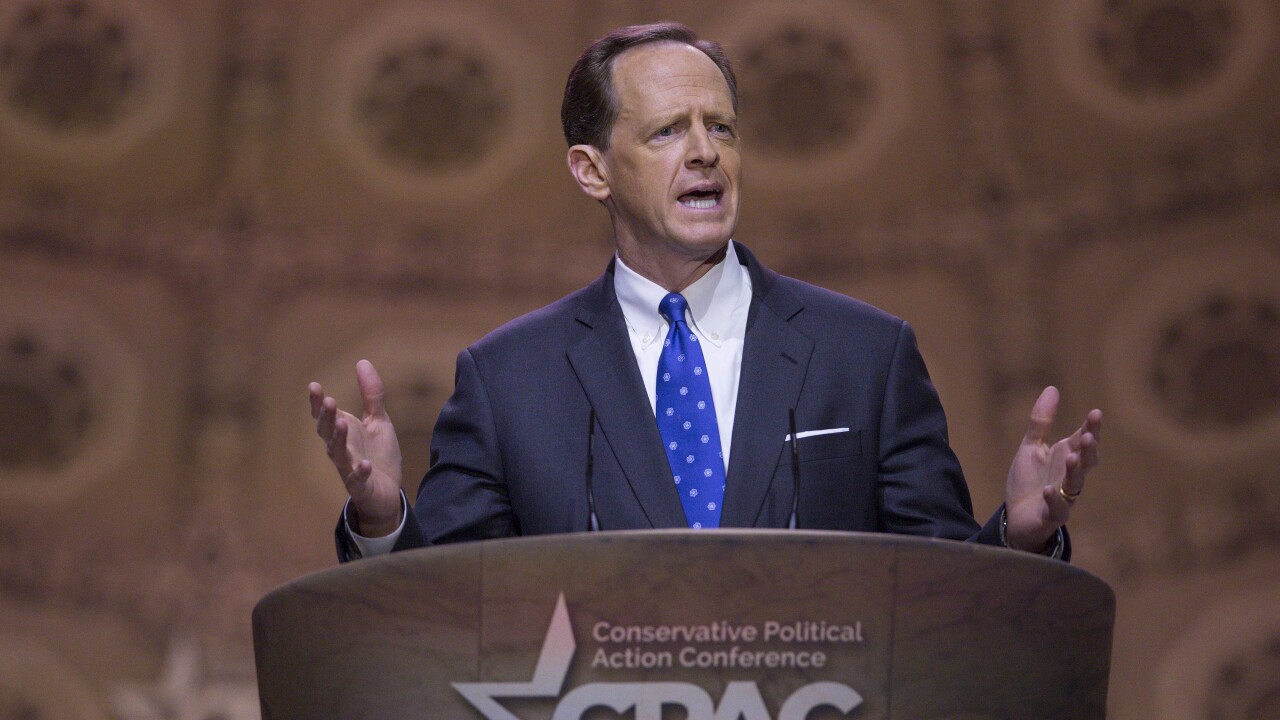

Republican Senator Pat Toomey said he’ll support President Donald Trump’s nomination of Judy Shelton for the Federal Reserve Board.

February 27 -

Attention is focused on the impact COVID-19 may have on economic growth in the United States in the short and long term.

February 26 -

It is “still too soon” to say whether the coronavirus outbreak will cause a material change in the U.S. outlook, said Federal Reserve Vice Chairman Richard Clarida, signaling officials won’t be rushed to judgment on the need to cut interest rates.

February 26 -

Three key Republicans on the Senate Banking Committee said Monday that they remain undecided on President Donald Trump’s nomination of Judy Shelton to the Federal Reserve Board.

February 25 -

Federal Reserve Vice Chairman Richard Clarida disputed suggestions that the central bank suffers from a “hall of mirrors” problem under which it slavishly follows financial-market expectations for monetary policy.

February 21 -

The suite of new monetary policy tools under consideration by the Federal Reserve are likely to have limited effectiveness in the next downturn.

February 21 -

Federal Reserve Governor Lael Brainard on Friday called for the adoption of new strategies by the central bank to achieve its 2% inflation goal and fight off future recessions.

February 21 -

Federal Reserve Vice Chairman Richard Clarida took issue with suggestions that investors expect the central bank to cut interest rates in the middle of this year as he called the economy fundamentally sound.

February 20 -

Little hint as to direction of future monetary policy moves.

February 19 -

Federal Reserve Bank of Cleveland President Loretta Mester said the impact of the coronavirus and the risk it poses to the global economy haven’t changed her forecast.

February 14 -

It’s unlikely Judy Shelton changed anyone’s mind but she appeared poised, confident and unshaken in defending herself and her previous statements and writings.

February 13 -

The temporary inversion of parts of the yield curve “are concerning” but since they’re based on coronavirus fears, the economy should keep growing and will not necessitate cuts to the fed funds rate target, analysts say.

February 12 -

Stifel Chief Economist Lindsey Piegza discusses why she thinks the Fed’s job is far from done, why inflation remains stubbornly below its 2% target, the inverting yield curve, consumer spending and economic growth. Gary Siegel hosts.

February 12 -

Federal Reserve Board Chairman Jerome Powell stuck to his message in questioning before members of the House Financial Services Committee: the economy is doing well and the Fed will stay on the sidelines unless there is a “material change” to its forecast.

February 11 -

The early dot plots were characterized by overly optimistic projections for gross domestic product, which were later revised down, while the projections made after 2017 have been somewhat pessimistic, but more accurate, according to research by the Federal Reserve Bank of San Francisco.

February 10 -

Fed chair calls the illness a downside risk that arose while others are receding.

February 7