-

The Federal Reserve’s tapering of its asset purchases, which he hopes will start “soon,” will run smoother this time around because investors already know that a move is being discussed, said Federal Reserve Bank of Dallas President Robert Kaplan.

June 30 -

Federal Reserve Gov. Christopher Waller said the better-than-expected performance of the U.S. economy warrants scaling back asset purchases sooner than expected and he favors starting with mortgage-backed securities.

June 30 -

The Federal Reserve might consider an interest-rate hike from near zero as soon as late 2022 as the labor market reaches full employment and inflation is at the central bank’s goal, Federal Reserve Bank of Boston President Eric Rosengren said.

June 25 -

The U.S. economy will likely meet the Federal Reserve’s threshold for tapering its asset purchases sooner than people think, said Dallas Fed President Robert Kaplan, who has penciled in an interest-rate increase next year.

June 23 -

Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank could decide to slow its asset purchases in the next few months and he favored lifting interest rates in 2022 in response to a faster-than expected recovery from COVID-19 pandemic.

June 23 -

Federal Reserve Chair Jerome Powell said the price increases seen in the economy recently are bigger than expected but reiterated that they will likely wane.

June 22 -

A discussion about raising interest rates is still quite a ways off as the Federal Reserve begins debating tapering its bond-buying program, New York Fed President John Williams said.

June 22 -

John Hallacy, founder of John Hallacy Consulting LLC, talks with Chip Barnett about the pandemic’s lingering credit impacts on state finances in a wide-ranging discussion of the many issues affecting the municipal market today. (17 minutes)

June 22 -

Federal Reserve Chair Jerome Powell said inflation had picked up but should move back toward the U.S. central bank’s 2% target once supply imbalances resolve.

June 21 -

The short end of the yield curve faced pressure from a cheaper UST five-year. As the flattening trend in UST takes hold, demand for duration will also spill over into the tax-exempt space, with long-dated munis continuing to outperform, analysts say.

June 18 -

The Investment Company Institute on Wednesday reported $2.533 billion of inflows into municipal bond mutual funds, the highest since February.

June 16 -

Most analysts expect the Federal Open Market Committee will alter its Summary of Economic Projections and perhaps begin to talk about tapering, without offering clues when they'll begin cutting back on asset purchases.

June 14 -

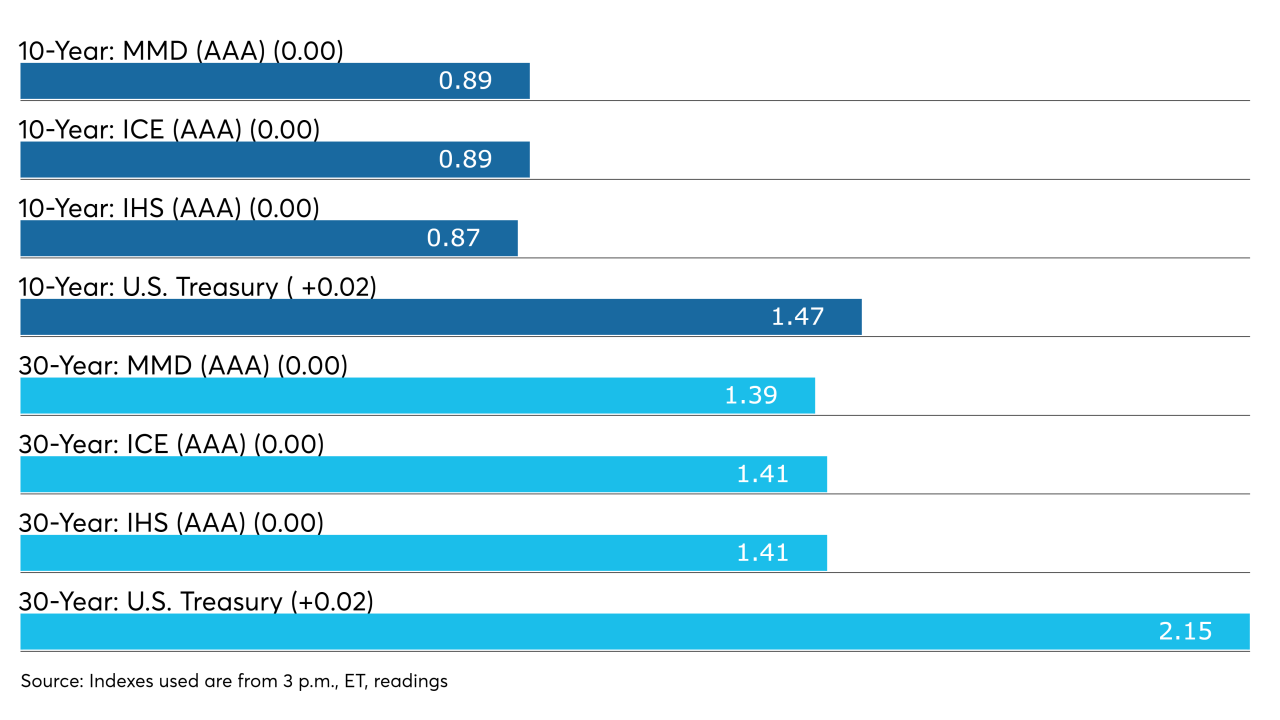

Yields on top-quality munis were flat on the AAA scales Friday; yields were seven to nine basis points lower on the week.

June 11 -

“We have to be careful in removing accommodation so that we don’t create any kind of ‘taper tantrum,’ ” Philadelphia Fed President Patrick Harker said.

June 2 -

Randal Quarles left open the possibility that he might remain in his role as a Federal Reserve governor after his tenure as vice chair for supervision expires on Oct. 13 — a move that would reduce the openings for the Biden administration to fill.

June 1 -

Municipal yields will likely stay in a narrow range with trading activity subdued unless larger interest rate volatility unexpectedly sets in, analysts say.

May 28 -

The Federal Reserve’s prestigious annual Jackson Hole policy symposium will be held in person this year, albeit in a modified form.

May 27 -

U.S. central bank officials may be able to begin discussing the appropriate timing of scaling back their bond-buying program at upcoming policy meetings, Federal Reserve Vice Chair Richard Clarida said.

May 25 -

Raphael Bostic, Federal Reserve Bank of Atlanta president, says he hears frequent speculation that he could be nominated to lead the central bank.

May 24 -

Factors pushing U.S. inflation higher are likely to ebb at the start of 2022, said Federal Reserve Bank of San Francisco President Mary Daly.

May 21